Understanding payment limits with Bizum: what merchants should know

As a provider that accepts payments through Bizum, it is important to understand how its limits and regulations can affect your business operations. In this article, you will gain clarity on what the limits are, why they are important, and how to plan accordingly.

Bizum limits for businesses (vendors)

For businesses accepting payments via Bizum for Businesses, the platform itself generally removes the strict limits on the number of transactions and daily/monthly amounts received that apply to personal accounts (60 transactions per month, with a limit of €2,000 received per day).

Bizum limits for merchants:

● Number of transactions received: Unlimited

● Maximum amount per transaction: Set by the customer's bank. (Ranges vary widely, Bizum does not impose any maximum; see below)

● Minimum amount per transaction: None

● Daily/monthly limit received: No platform limit (for the seller's business account)

Maximum amount per transaction with Bizum for the top Spanish banks

Maximum amount per transaction with Bizum for major Spanish banks

The most important limit for merchants is the maximum amount a customer can pay them in a single transaction. This limit is set by the customer's bank.

Although the general limit for Bizum P2P is €1,000 per transaction, major banks set much higher limits for merchant payments.

Maximum amount per transaction with Bizum according to the customer's bank:

- Banco Santander: Up to €15,000

- CaixaBank: Up to €1,500

- BBVA: Up to €3,000 (Reported for daily online purchases)

- Banc Sabadell: Varies; typically high for e-commerce/business

Disclaimer: These limits are subject to change, so you should always check with your payment service provider and your bank for the most up-to-date and specific figures.

Note: These limits are set by default: at most major Spanish banks, customers can request to have them changed, especially for online purchases, in a similar way to how they can change their bank card limits.

Pro tips:

Pro tips:

● To avoid a customer's payment being declined, you can disable Bizum as a payment option for transactions that exceed the minimum limit common among major banks or the limit of most of your customers' banks.

● If a customer contacts you to say that their Bizum payment has been declined due to a limit, it is best to advise them to check their bank's app in the security, cards, or Bizum settings to increase their online purchase limit.

Bizum limits for freelancers in Spain

Bizum for freelancers

For Spanish freelancers who use Bizum, the situation often falls into a gray area between strict personal limits and unlimited limits for businesses.

In general, if a freelancer simply uses their personal bank account to receive payments from clients through Bizum's standard P2P feature, they are usually subject to the limits set for individuals.

This is why Bizum recommends using its solution for freelancers: if you rely on Bizum to collect payments from your clients and anticipate more than 60 transactions per month or payments exceeding €1,000, find out about the Bizum for Freelancers option.

📌 Read our full guide on How to charge your customers as a freelancer in Spain →

Conclusion

Bizum is already one of the most popular payment methods in Spain.

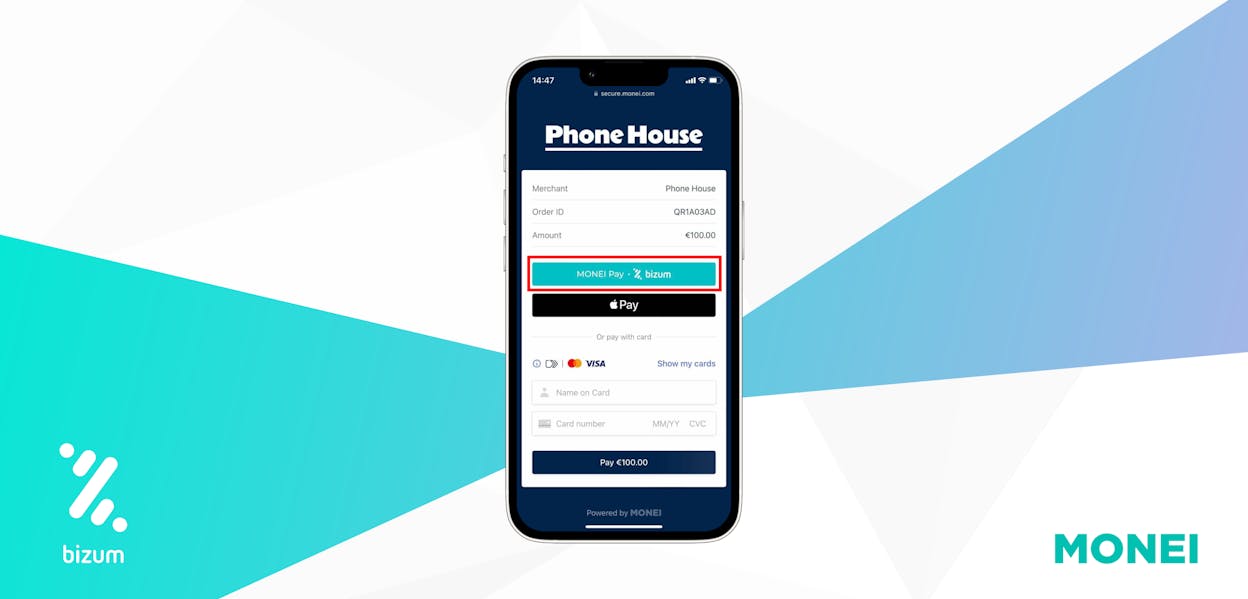

Seize the opportunity to satisfy your clients and improve your payments conversion rate by adding Bizum to your payments stack, both off and online with MONEI.

MONEI

MONEI is the leading omnichannel payments platform in Southern Europe.