QR Code Payments: What They Are, How They Work, and How to Accept Them

QR code payments are performed by scanning a quick response code from a mobile app or QR code sticker. They let you accept touch-free payments on the go and are an increasingly popular contactless option.

In fact, according to a recent Future Market Insights study, the QR code payment market is expected to experience significant growth through 2033. It’s likely to exceed $11.67 billion in 2023 and grow by 4.8X, surpassing $55.60 billion by 2033, indicating a CAGR of 16.9% from 2023 to 2033.

This speaks to how, now more than ever, consumers worldwide are shifting to mobile methods of payment.

As a retail business owner, there’s no better time than the present to make the shift to QR code payments. If you’re unfamiliar with the concept (or looking to learn more before adopting it for your business), read on for a comprehensive overview of what QR code payments are, how QR codes work, and how they can benefit your store.

Table of contents

- What are QR code payments?

- How do QR code payments work?

- How do I accept QR code payments?

- What’s the difference between static and dynamic QR codes?

- What’s the difference between merchant-presented mode (MPM) and customer-presented mode (CPM)?

- Types of businesses that use QR codes to receive money

- The benefits of QR code payments (for both merchants and consumers)

- Questions to ask yourself before adding QR code payments to your business

What are QR code payments?

To understand what QR code payments are, we first have to take a closer look at the characteristics of QR codes.

QR codes are a kind of two-dimensional code used to store (or directly link to) information. They are made up of a pattern of black squares arranged in a square grid with a plain white background. Devices like smartphones can read and convert them in real time.

While similar to barcodes, QR codes can store a larger amount of information per unit area and can be read both horizontally and vertically, making them part of the future (and present) of digital payments.

So then what are QR code payments exactly? They are payments that can be accepted by scanning a quick response code affiliated with a specific product or business. They’re also referred to as “scan to pay” and act as the equivalent of contactless tap to pay options that require near field communication (NFC).

A brief history of QR codes

Originally invented by the Japanese engineer Masahiro Hara back in 1994 QR codes were initially used to track vehicles during manufacturing processes.

QR codes as payment apps first started in China in 2014 due to a popular self-service QR code reader. From there, QR code mobile payment systems have grown in China (where it has more or less replaced both cash and cards), Europe, Spain, and the US.

How do QR code payments work?

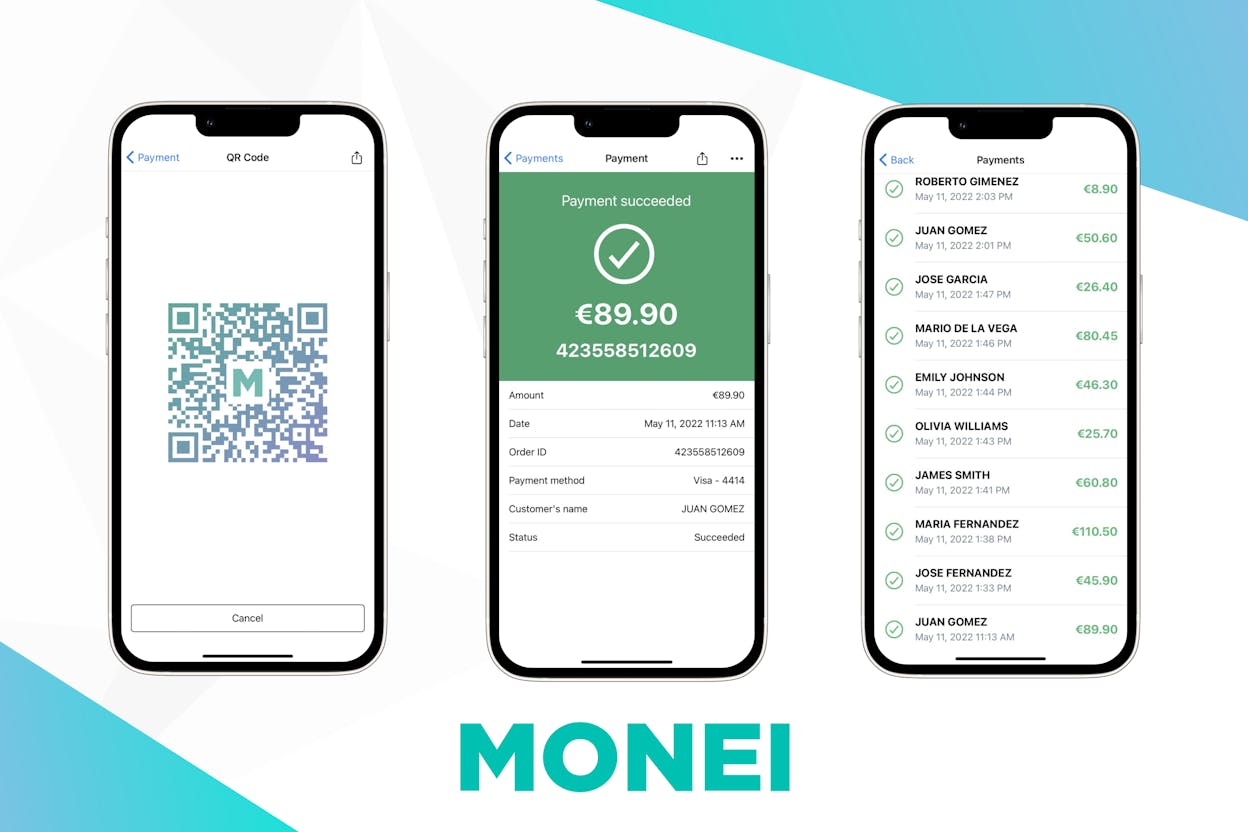

When you’re selling on the go, it can be difficult to carry around heavy POS hardware to accept payments. Thanks to QR code payment apps (like MONEI Pay), you can use your smartphone to collect payments anywhere by letting customers scan to pay, without swiping their card. If you don’t know how QR codes work, don’t worry — we’ll break it down.

- Generate the QR code on your mobile device.

- Have your customers scan the QR code with their smartphone.

- Within moments, a payment screen will appear on their device so they can finish the payment process.

With MONEI’s QR code solution, digital QR codes are bound to a specific payment amount, which you can configure before your customer scans to pay.

📚 Further reading: 8 Important Benefits of Mobile Payments

How do I accept QR code payments?

Our MONEI Pay plan is the fastest way to start accepting payments via QR codes either in your retail store or on the go if you’re experimenting with pop-up events. These types of payments are also great for food trucks, taxi drivers, restaurants, service-based businesses like fitness trainers and lawyers, and even self-serve coffee machines.

“Before MONEI, there was more friction,” says Arnau Cunill, Growth Marketing Lead at Incapto Coffee. “For someone visiting the office, it didn’t make sense to order a coffee. Sometimes it was difficult to connect the app with the coffee maker and customers experienced problems while completing payments.”

Getting started is quick and easy:

- Sign up for MONEI (here’s helpful information for getting started).

- As soon as your account has been approved, you can generate QR codes with any MONEI plan.

- Generate digital QR codes in the MONEI Pay app on the web, Apple, or Android devices. (Note: To set up an e-commerce or API integration, you must select the MONEI X plan.)

- When a customer is ready to complete their purchase, you can use your smartphone or another mobile device to create the payment.

- Then the customer can scan the QR code to complete the payment from their smartphone.

Scan one of the QR codes below to demo MONEI Pay

Accept credit and debit cards and digital wallets like Apple Pay, Google Pay, and Click to Pay. These payment methods will be configured by default, but you can deactivate them if you’d like or set up more options including Bizum, Spain's most popular local payment method.

“For us, having Bizum was essential to reduce payment friction within our solution,” says Christian Campillo Dachs, founder and CEO of Yumminn. “We were also looking for a partnership that goes further, a payment platform that is willing to grow with us and help us develop a solution adapted to our needs.”

What’s the difference between static and dynamic QR codes?

There are two types of QR codes that you can generate to accept payments: static QR codes and dynamic QR codes.

Static QR code

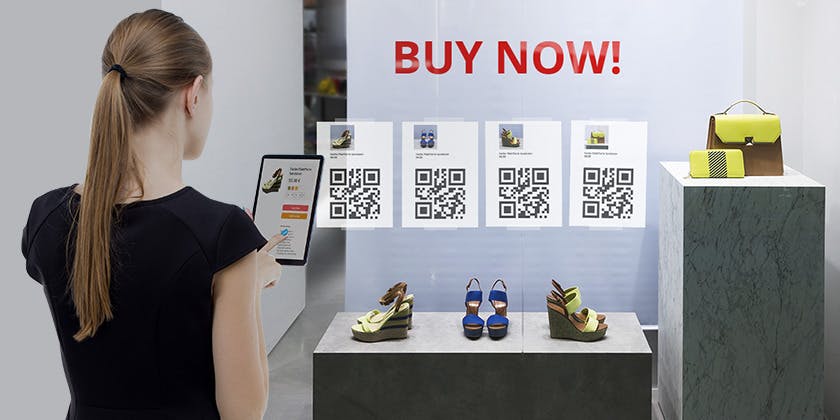

With static QR codes, the URL of the destination website or the product price is embedded into the QR code itself. It’s untraceable and can’t be edited. Static QR codes are best used to facilitate quick and straightforward payments across various industries.

An example of a static QR code is assigning a fixed price to each QR code and sticking it on the product tag. This way, shoppers can scan the QR code to review pricing information and complete payment all at the same time. Static QR codes can also open a specific product page so customers can review the details before purchasing.

Dynamic QR code

Dynamic QR codes, on the other hand, are editable by their creator.

An example of a dynamic QR code is creating a payment from your mobile device each time a customer is ready to pay and then asking them to scan the QR code to review and complete the transaction. Another application of a dynamic QR code is letting customers scan the code and enter the payment amount themselves.

One of the key differences between static and dynamic QR codes is that, while dynamic QR codes offer more flexibility to both you and your customers, static QR codes are more secure.

What’s the difference between merchant-presented mode (MPM) and customer-presented mode (CPM)?

- The MPM (or merchant-presented mode) transaction journey requires a customer to scan the merchant’s static or dynamic QR code to initiate a transaction.

- The CPM (or customer-presented mode) is the reverse, where the merchant must scan the customer’s static or dynamic QR code to initiate the transaction.

Types of businesses that use QR codes to receive money

Does your business fall into a category that frequently uses QR code payment apps?

The answer is likely yes.

Small to medium-sized businesses and enterprises across many industries find QR codes a fast, secure, and convenient way to process customer payments. Here are some of the most popular ways different industries use QR codes to receive money:

QR codes for retail

QR codes in retail are most commonly used to:

- Have mobile POS systems — equip each salesperson with their own mobile device to accept QR code payments.

- Provide click and collect options for busy or safety-conscious shoppers.

- Offer mobile payment options.

- Gift loyalty points to recurring shoppers.

- Give instant digital receipts.

In an age where safe and fast contactless payments are essential to keep up with the competition, retail businesses use QR codes to keep transaction processes running smoothly.

QR codes for restaurants

The ability for restaurant-goers to access paperless menus and book reservations remotely is the tip of the iceberg: restaurants can also use QR codes to receive cashless tips or send curbside pickup instructions.

The most frequently seen example is the paperless menu option, in which restaurant-goers scan a physical QR code (usually attached to the table) to complete a payment.

QR codes for service providers

Taxi drivers, doctors, fitness instructors, lawyers, and other service-based businesses can use QR code payment apps to immediately collect payment for services. This way, you can collect payments faster and skip the time-consuming process of creating and sending invoices.

QR codes can be added to your website, generated digitally on your mobile device, or printed on business cards or brochures.

📚 Further reading: Taxi Card Payments: A Simple Guide to Accepting Cashless Payments in Your Taxi

QR codes for food trucks and street vendors

For mobile businesses like food trucks or street vendors, QR codes are an essential simplification for both customer payments and point-of-sale systems.

Rather than having to set up a POS system, a physical QR code displayed on the counter can mean that customers can scan to view the menu (and pay) in mere moments.

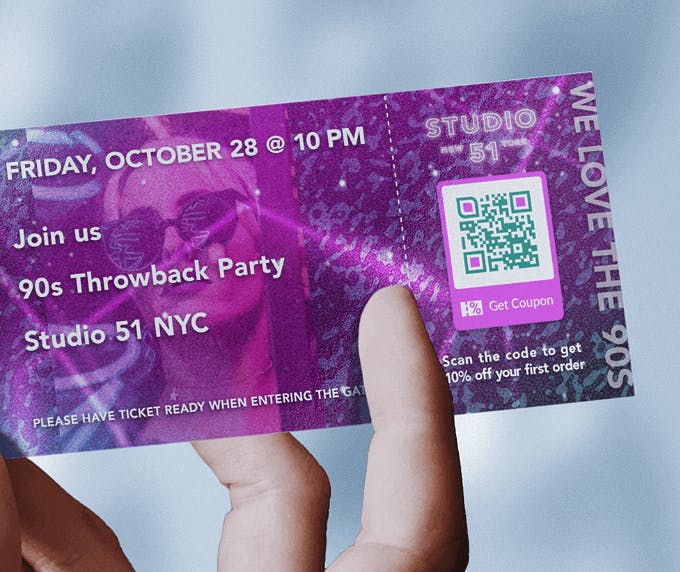

QR codes for the arts, entertainment, and travel

Street artists or art galleries can set up a physical QR code next to each art piece, which buyers can scan to purchase or pull up more information ahead of their purchase.

In terms of both the entertainment and travel industry, QR codes can be paired with e-ticketing to enable customers to streamline booking tickets for flights, buses, movies, concerts, museums, and more online.

In the entertainment or events industry, QR codes can be used in digital and physical forms at the entrance of a museum, concert, or movie theater.

The customer can either scan to buy an entry ticket. Or if customers buy their tickets online, the company can send them a QR code via email or SMS with the confirmation of their purchase. Then when the customer is checking in, the process is faster because they’ve already paid for their ticket and just need to scan their QR code for verification.

📚 Further reading: Incapto Experiences a 66% Uplift in Coffee Cup Orders by Switching to MONEI

The benefits of QR code payments (for both merchants and consumers)

There are many advantages of QR codes, for merchants and consumers alike.

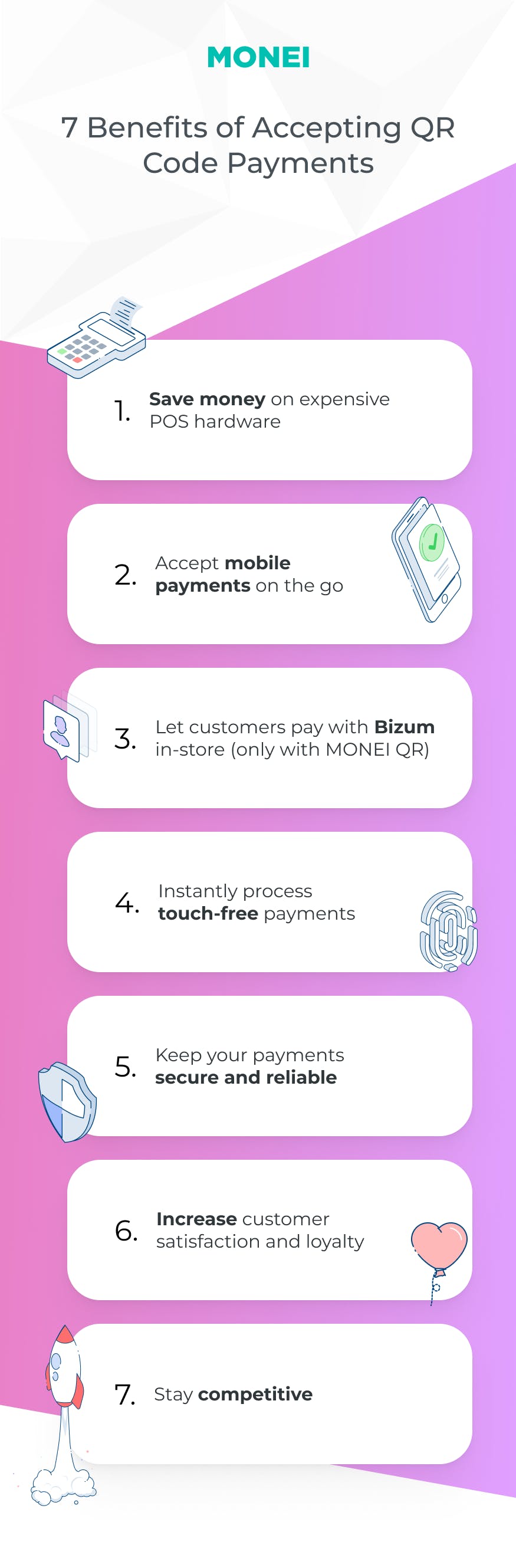

Instantly process touch-free payments

Serve more customers thanks to QR code payments being touch-free and, in most cases, instantaneous.

Accept mobile payments on the go

Equip your store staff with a smartphone (think Apple stores) to start collecting mobile payments anywhere, any time. Just like how QR code payment apps are simple and near-instant for customers, the same can be said for salespeople collecting payment on the go.

Save money on expensive POS hardware

To generate digital QR codes, all you need is a smartphone. There’s no need to purchase a dedicated point-of-sale terminal or POS hardware to start processing digital transactions with QR codes.

Keep your payments secure and reliable

Scanning QR codes to make a purchase lets customers pay via their payment app or digital wallet, where their payment data is tokenized.

This makes it so consumers can pay without sharing personal information like account or credit card numbers, ensuring that payments via QR codes are secure and reliable.

Increase customer loyalty

Making QR code payments available to consumers can increase customer loyalty due to the speed and simplicity associated with QR code transactions.

For some customers, not offering their preferred payment method will result in them not frequenting your business.

Stay competitive

QR codes are becoming more popular globally and are anticipated to soon become mainstream, with worldwide mobile payment adoption estimated to grow by 27% between 2020 and 2025.

Including QR code payments in your payment option lineup right now will ensure you’ll have your payment system refined by the time it becomes the most popular form of payment around the world.

Questions to ask yourself before adding QR code payments to your business

Would you prefer to integrate QR code payments into your existing POS or switch POS systems?

With MONEI you can ditch the expensive POS hardware altogether and use your smartphone or another mobile device to set up and accept QR code payments. We’re here to help you get started.

How quickly do you need to accept payments?

If the answer is “immediately”, then QR code payments are absolutely the solution for you.

Mobile businesses such as taxi drivers, street vendors, or digitally native brands testing physical retail through pop-up shops can benefit from scan to pay options like QR codes due to the need to collect payments quickly and on the go.

How much does your current POS system charge for QR code payments?

Taking your budget into account is vital when making any business-related decision. When evaluating QR code provider pricing, figure out how much your existing POS system charges for them versus fees from other service providers.

If you decide to integrate QR code payments into your business rather than switching to a POS system, how will it work?

With our payment gateway, you can accept a wide range of payment methods and manage it all from a single platform. Setting up QR code payments doesn’t take long and you won’t have to worry about the increased costs and headaches of managing multiple integrations.

Will your customers be interested in paying via QR codes?

While current QR code users will happily pay through this method, even those unfamiliar with the concept will likely get on board after seeing how straightforward and secure QR code payment apps are.

How will you introduce this new payment method to customers?

A short description on your website and storefront window or wall will help give an overview of QR code payments to those who haven’t used them. Depending on your customer base, adding visuals to each step may help the less tech-savvy successfully scan your QR codes for the first time.

How often do you need to be able to collect payments on the go?

Even if your answer is “sometimes”, QR code payments will simplify the process for you, your staff, and your customers.

Are you ready to get started with QR code payments?

Now that you know what QR code payments are and how they can be applied to many types of businesses, it’s time to get started with this increasingly popular payment technology. Sign up for MONEI now.

QR code payments FAQ

Are QR code payments secure?

Yes, QR code payments are secure because they’re encrypted and don't require the customer to physically hand over their credit card or debit card. However, like any other payment method, they’re not completely immune to fraud.

How do I accept QR code payments at my business?

To accept QR code payments, you need to sign up with a payment service provider (PSP) that supports this feature. Try MONEI Pay to accept QR code payments from your smartphone or another mobile device.

What are the fees associated with QR code payments?

Fees for QR code payments vary depending on the PSP and the payment method. Learn more about MONEI Pay pricing here (MONEI’s QR code payment solution).

Do I need any special equipment to accept QR code payments?

It depends on the QR code payment solution you’re using. With MONEI Pay, all you need is your smartphone or tablet to generate digital QR codes that your customers can scan to pay.

What if my customer doesn't have a smartphone or their phone battery is dead?

Unfortunately, if the customer doesn't have a smartphone or their battery is dead, they won't be able to make a QR code payment. But if you find yourself in this situation with MONEI Pay, you can use the app to send a payment request via WhatsApp, SMS, or email to remind your customer to pay and then return to your store to pick up their purchase

How quickly will I receive the funds from a QR code payment?

Payment settlement times vary depending on your PSP. Some providers offer near-instant transfers, while others might take a few business days.

Do all mobile payment apps support QR code payments?

Many, but not all, mobile payment apps support QR code payments. With MONEI Pay, you can offer QR code payments in your business and accept a range of payment methods including cards, Apple Pay, Google Pay, and Click to Pay.

What happens if a QR code payment fails?

If a QR code payment fails, the transaction will not go through, and funds will not be deducted from the customer's account. The customer can try again or use a different payment method. If a payment fails but the funds are still deducted, you should contact your PSP immediately for assistance.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).