What is Tokenization? And its Benefits for E-commerce

Tokenization isn’t just a buzzword in the payments industry. With an increase in the types of online payment methods available to customers, it's vital to add an extra layer of security to ensure sensitive credit card data isn’t compromised.

But what is payment tokenization and how does it work? As a busy e-commerce business owner, it’s probably overwhelming to think about how to implement this technology in your business. That’s why we’re breaking it down for you in this digestible guide.

In this article, you’ll learn:

- What is payment tokenization?

- How does it work?

- What is the difference between tokenization and encryption?

- Examples of tokenization

- The benefits of payment tokenization in e-commerce

- Get payment tokenization with MONEI

What is payment tokenization?

This technology protects sensitive data through a process of replacing the data with a non-sensitive equivalent, known as a token. The token has no external significance or value. It’s a reference — or identifier — that through a system, maps back to the sensitive data. This process securely collects sensitive credit card information and prevents data theft.

When it's used for credit cards, an algorithm generates a unique random value to replace the customer’s primary account number or PAN. The randomly-generated value is called a token. The tokens safely pass through the Internet or wireless networks to process the payment without exposing credit card details. The credit card number stays safe within a secure token vault.

Chip cards were created to protect your bank information at in-person points of sale. Like chip cards, payment tokenization is designed to provide the same added security to your online purchases, preventing thieves from getting your credit card information.

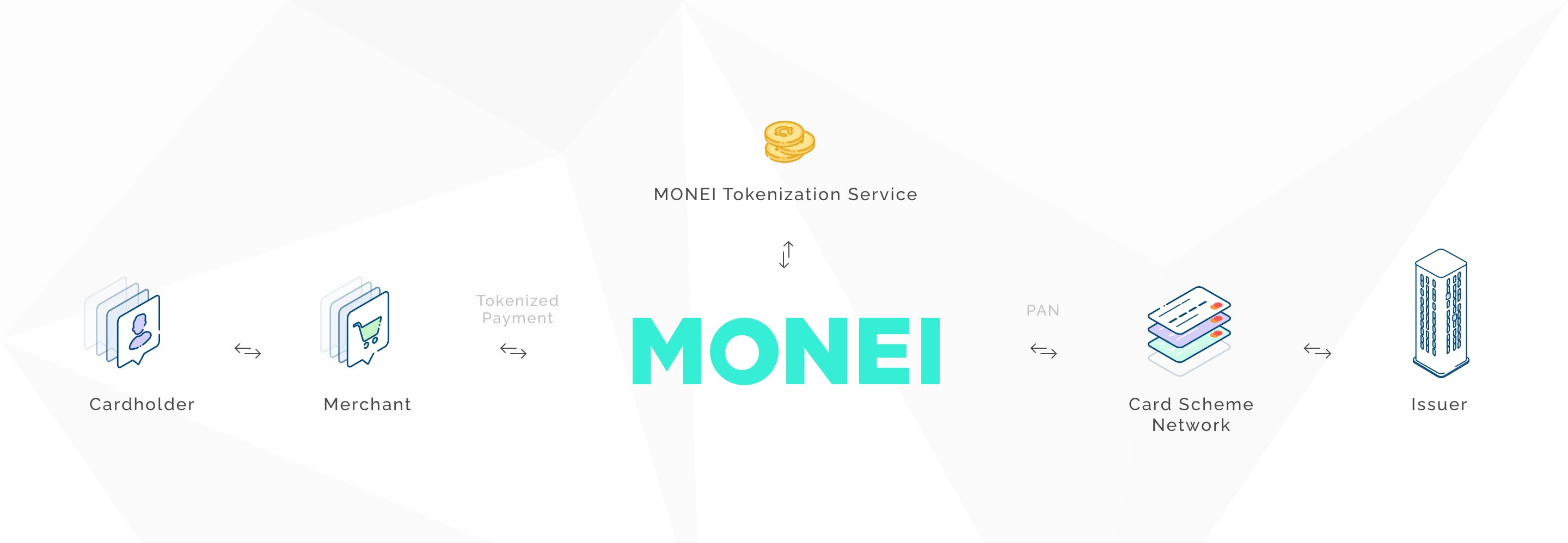

Payment tokenization vs network tokenization

Payment tokenization involves a payment service provider (like MONEI) retaining a customer's card details, like the Primary Account Number (PAN), and creating tokens. These tokens are then used by merchants for processing payment transactions.

Network tokenization, on the other hand, is handled by card networks such as Mastercard, Visa, and American Express. In this scenario, these networks store the PAN and are responsible for token generation. A key advantage is that the tokens remain current and valid, even if the original card details change or expire, thanks to the card networks managing the entire process from start to finish.

How does it work?

Payment tokenization works by creating a secure and unique random ID that has no meaning. There is no correlation between the token and the data. If you send the same card information again, you'll get a different token each time. Tokens are usually issued in real-time and used in predefined environments or domains. For instance, the same card will generate one token for use in a specific payment environment, and another token for e-commerce transactions. It doesn’t slow down the payment process because the tokens are issued in real-time.

Using a token to complete the payment, instead of a PAN, makes the payment more secure. Only the token in your database for future transactions. Even with a data breach where payment tokens fall into the wrong hands, the PAN stays secure and the tokens are useless to the thieves.

📚 Further reading: How to Accept Payments Online: 6 Step Guide

The basic process for payment tokenization looks like this

- At checkout, a customer enters their card information into the secure payment form that is provided by the payment gateway.

- The payment gateway securely collects credit card information, sends it to the server inside the iframe, and returns a token to the client. An iframe allows you to embed a web page that belongs to a provider and is guaranteed to be secure. This way, your customers can safely enter their credit card information.

- The token server sends a response and the token goes into your payment system.

- Your store safely processes the payment with the token that represents the customer’s card data.

At MONEI, we include tokenization with both our MONEI X and MONEI PLUS plans. We have two types of tokens:

1. One-time token. Is a token that's used to complete the payment. The user enters credit card details into our card input and we convert the data into a short-lived token that is only valid for one transaction and lasts only five days.

2. Permanent token. Is a token that’s used to save your customer’s payment method. Using our API, you can request a permanent token. When the transaction is processed you will receive a permanent token in the callback. It represents the user’s credit card details, but never expires and is not bound to a specific transaction. Using this token will allow your customers to make subsequent payments without entering their credit card information again.

Tokenization and PCI compliance

Because this process replaces sensitive credit card data with a token (and the card data never touches a business's servers), it can help streamline PCI compliance for e-commerce businesses.

But it doesn’t eliminate the need to be PCI compliant. That’s why it’s crucial to find a payment service provider (like MONEI) that’s PCI compliant and tokenizes payments.

💡 Conversion Rate Optimization Tip: Payment methods like Apple Pay, Google Pay, and Click to Pay all use tokenization to securely store customers’ sensitive payment information. This way, they can quickly check out without ever sharing their card details with a business. Sign up for MONEI to accept these popular digital wallets and increase conversions.

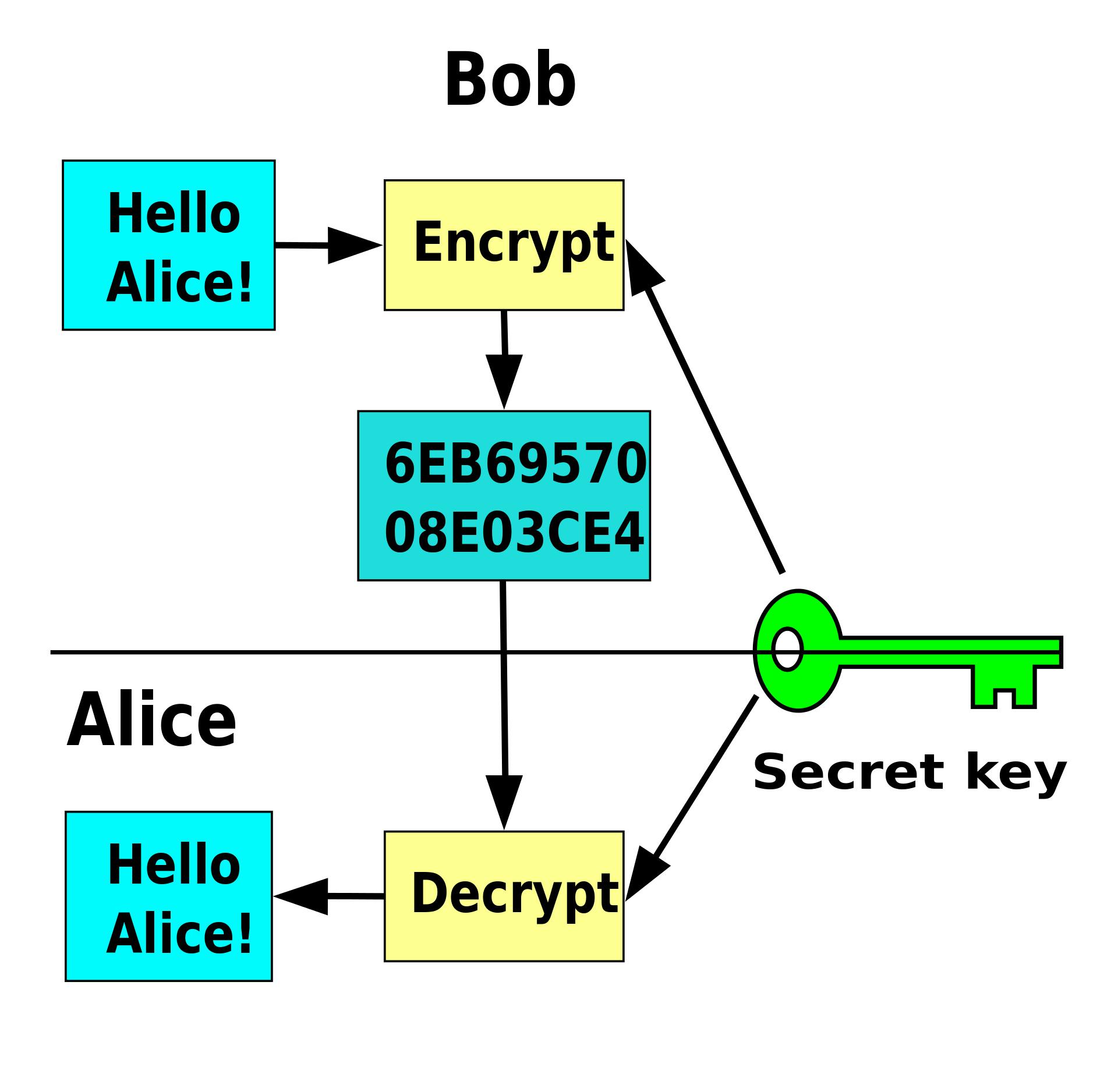

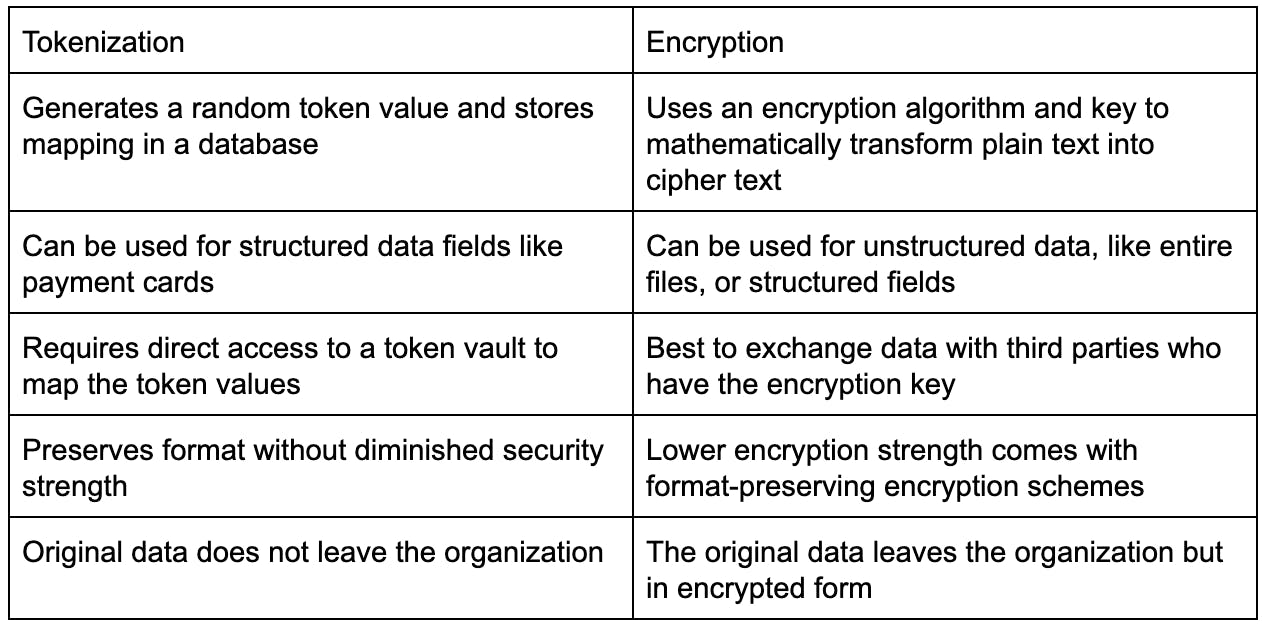

What is the difference between tokenization and encryption?

Both help protect data online, but they are two different technologies that are not interchangeable.

Encryption involves rearranging or altering data in a random way. It uses a cryptographic key (a set of mathematical values) that’s agreed on by both the sender and receiver.

While it usually appears random, the process of encrypting data is logical and predictable so the recipient of the encrypted data can decrypt it back to its beginning value. Fully secure encryption involves using complex keys that are difficult to decode, but it is possible to decipher information with the right key.

These technologies are always used together in an e-commerce transaction to secure the end-to-end payment process. Data is mapped (i.e. fields from one database to another are matched) in a database using tokens but the data is also encrypted when you store it. This is a PCI DSS requirement.

Examples of tokenization

Subscription for billing and recurring payments

If your business thrives on subscriptions or other recurring payments, tokenization lets you save your customers’ billing information for their next automatic payment without the liability of keeping all their data on file.

You can save tokens for your customers and bill them on a recurring basis, giving them uninterrupted service while protecting your business.

E-commerce sites that offer “one-click” checkouts

One-click checkouts help retain customers by giving them instant gratification and a smooth checkout experience. One-click checkout has been very popular in online gaming, entertainment, and social networks.

Amazon pioneered one-click checkout using tokenization and patented the process in 1999. The patent on a business process was controversial and has since expired. Many businesses have adopted the practice of one-click checkouts to improve user experiences and retain customers.

According to Baymard, 70.19% of e-commerce customers abandoned their carts in 2023. One-click checkout vastly improves the chances of customers going through with the checkout process by eliminating obstacles to completing the transaction.

Mobile wallet

Mobile wallets (also known as digital wallets or e-wallets) are increasing in popularity and are made possible by payment tokenization. The technology lets customers save credit and debit cards for online purchases in a secure environment, making checkout fast and frictionless.

Some popular mobile wallets are Apple Pay, Google Pay, Click to Pay, PayPal, and MB WAY.

📚 Further reading: Online Payment Methods for Your E-commerce Business

The benefits of payment tokenization in e-commerce

- Compliance. If you’re storing credit card information, it’s crucial to be PCI DSS compliant and as we mentioned before, tokenization can help keep data secure.

- Reduced risk.Store customer data in a way that’s safe for you and your customers. If your business suffers a data breach and is holding customer financial data, you could be found responsible and open yourself up to lawsuits.

- Added security from mobile wallets. Tokenization that takes place through third-party apps like Apple Pay or Google Pay adds an extra layer of security to the mobile devices your customers use. They have to use an added layer of biometric data or a password to access their mobile wallet before moving forward to your site.

- Build trust with your customers.In the UK, 41% of consumers say they would never return to a business after a security breach, and in the US, 83% say they wouldn’t buy from a business for several months after a breach. Safeguard customer data and build trust by not storing any of their actual financial information.

- Ability to accept recurring or subscription payments. Securely accept subscription or recurring payments in your e-commerce business. Sensitive card data is converted into random values that can’t be decoded outside the tokenization systems. This way you can store credit card data for future purchases and streamline subscription payments for you and your customers.

Get payment tokenization with MONEI

You’ve learned what this system is, how it works, and why it’s important. You understand how it differs from encryption, you’ve seen examples and you’re aware of the benefits. Now all that’s left to do is find a payment service provider.

Follow these steps to get started with MONEI:

- Sign up for MONEI

- Complete the account activation process

- Configure payment methods

- If you bill customers on a recurring basis, use MONEI’s recurring payments feature

You may also like to read:

- What is a Payment Gateway? Why You Need One & How it Works

- PSD2: What is It? Why it’s Important + How to Be Compliant

- What is SCA? (+ How it Benefits Consumers)

- The Top 4 Digital Wallets to Add to Your Online Store + Benefits for E-commerce

- AI in Payments: How It’s Transforming the Industry

🎓Find more definitions in our payment industry glossary.

Tokenization FAQ

What is tokenization in the context of e-commerce?

Tokenization in e-commerce refers to the process of replacing sensitive payment card data, like credit card numbers, with a unique identifier called a token. This token can be used for transaction processing, while the actual card details are securely stored by a payment service provider or a tokenization service.

Is tokenization compliant with PCI DSS?

Yes, it helps you achieve PCI DSS compliance. By eliminating the storage of sensitive card data, you can significantly reduce the scope of your PCI audit, as the tokenization service provider bears the responsibility of safeguarding the actual card information.

Can tokens be reversed to retrieve the original payment card details?

No, they are irreversible. They are generated using mathematical algorithms that cannot be reversed to retrieve the original card information. Tokens are designed to be used as substitutes for card data without exposing sensitive details.

Are tokens unique to each merchant or shared across multiple merchants?

Tokens are unique to each merchant. The tokenization process generates a token specific to your environment and system, so nobody else can use it.

Can tokens be used for multiple transactions?

Yes, tokens can be used for multiple transactions within the same system. Once a payment card is tokenized, the token can be securely stored for future use, such as processing recurring payments or facilitating a seamless checkout experience for returning customers.

What happens if a tokenized transaction needs to be refunded?

When a refund is requested, you need to use the token to identify the original transaction and initiate the refund process. The payment service provider matches the token with the actual card details in their secure storage, processes the refund, and communicates the outcome back to you.

How secure is tokenization compared to other payment security methods?

Tokenization is considered a highly secure payment method for protecting cardholder data. It minimizes the risk of data breaches, as tokens hold no value for attackers without the associated card details. Compared to other methods like data encryption, it offers an added layer of security.

Does tokenization affect the customer's payment experience?

It generally improves the customer's payment experience. Once the card is tokenized, customers can make future purchases without repeatedly entering their card details. This convenience speeds up the checkout process and reduces friction for returning customers.

How can I implement tokenization in my e-commerce store

To implement tokenization, you can integrate with a payment service provider (like MONEI) that supports your e-commerce platform. It will provide you with the necessary APIs and documentation to securely tokenize and store payment card data.

Is tokenization applicable to all types of payment methods, such as debit cards and digital wallets?

Yes, it can be used for various payment methods, including credit cards, debit cards, and digital wallets. The process replaces the sensitive card data with tokens, regardless of the payment method used by the customer.

Is tokenization used for in-store transactions as well, or is it limited to online payments?

It can be used for both online and in-store transactions. Many payment service providers offer solutions that support tokenization across various sales channels, including online, in store, and mobile payments.

Are there any additional costs associated with implementing tokenization?

There may be costs associated with implementing tokenization depending on the PSP you use, but not with MONEI. We charge transaction fees, but you won’t incur additional fees for using this technology.

Can tokens expire or become invalid over time?

Tokens can be configured with an expiration period if required. However, the expiration of tokens is typically managed by the payment service provider, and you would need to check their specific tokenization guidelines to understand the lifespan of tokens in your system.

What happens if there is a breach in the tokenized data?

In the event of a breach, tokenized data alone is useless to attackers since it does not contain the original card details. However, it’s still essential to follow payment security best practices and to regularly monitor for any signs of unauthorized access or suspicious activity

Are there any legal or regulatory considerations when implementing tokenization?

While tokenization can enhance security and compliance, it's important to consult with legal experts and understand the specific laws and regulations governing your industry and jurisdiction. Compliance requirements such as GDPR or data privacy laws may have implications for how tokenization should be implemented and managed.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).