8 Important Benefits of Mobile Payments

Mobile payments make it easier to accept payments anywhere for goods or services either through a mobile POS or mobile devices like a smartphone or tablet.

Peer-to-peer (P2P) payment apps like Bizum also use mobile payment technology to let users send money to friends or family members and pay for purchases in-store and online.

Whether you need to collect contactless payments on the go, offer a wider variety of payment options, or cut down on in-store queues, mobile payments can help solve these problems.

Keep reading to learn more about what mobile payments are, the stats behind them, and the advantages (and disadvantages) of using them.

What are mobile payments?

Mobile payments are a popular way to accept in-person customer payments thanks to their security, speed, and level of convenience.

With mobile payments, you can accept card and mobile wallet payments from virtually any location as long as you have a mobile POS, smartphone, or other mobile device configured with a credit card payment app to collect scan to pay or tap to pay NFC mobile payments.

Then shoppers can use an EMV chip card or mobile wallets like Google Pay or Apple Pay (that have contactless NFC technology) to pay in-store or at a restaurant without having to present their credit card.

💡Did you know? The terms mobile wallet and digital wallet are interchangeable, but there’s an important difference. Mobile wallets like Google Pay and Apple Pay work for online and in-person mobile payments while digital wallets like PayPal only work for online mobile payments.

Mobile payment statistics and trends

The usage of mobile payments is increasing rapidly. In fact, studies show that:

- According to one survey in Spain, of the 34% of respondents who currently pay with their mobile device, almost seven out of 10 (67%) say they have increased their use since the beginning of the pandemic

- It's estimated that there will be 1.31 billion mobile payment transaction users worldwide in 2023, up from 950 million users in 2019

- By 2024, the global mobile payment market size is estimated to be 3 trillion USD

- 70% of millennials around the globe enjoy discounts and reward offers as incentives for using mobile payment methods

- 46% of consumers globally say they believe using contactless payment methods like mobile wallets is one of the most important safety measures for stores to follow

- Mobile purchases are also gaining popularity online — according to our recent payment trends report, 60.2% of online purchases from April to August 2022 were mobile

Thanks to stats and trends like these, we can see that mobile payment adoption will continue to increase in the coming years.

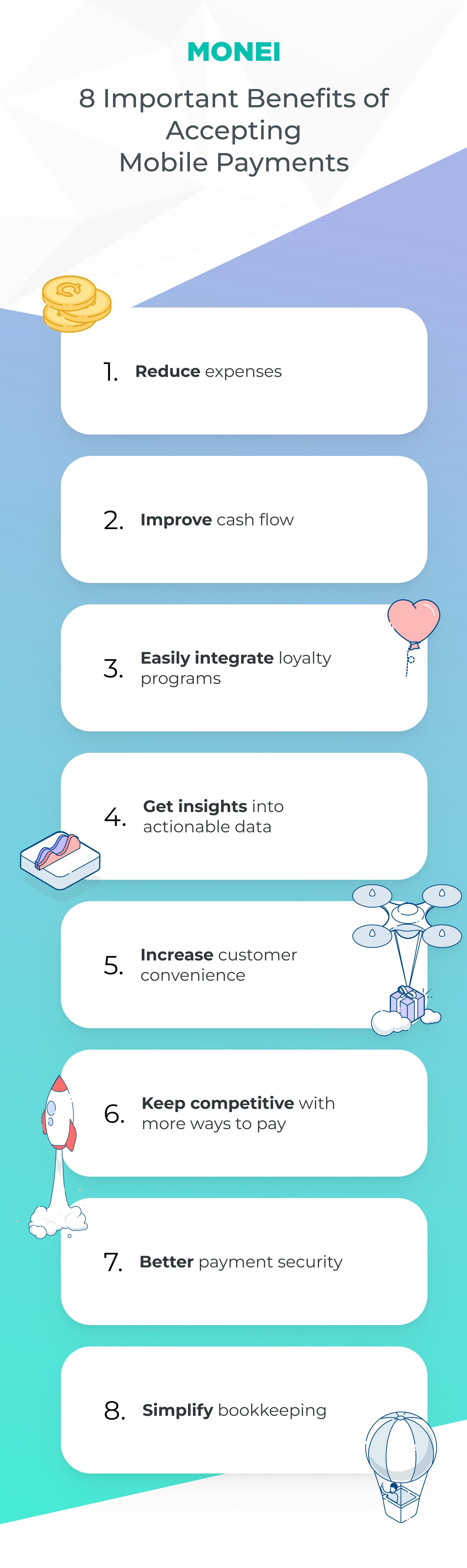

8 Benefits of mobile payments

There are numerous benefits that lend themselves to the global widespread adoption of mobile payments.

1. Reduce expenses

Opting for mobile payments can help you reduce expenses in a few ways. You don’t need to buy expensive point of sale (POS) equipment or paper and ink due to the ability to email receipts. And because you can use a tablet or smartphone as your mobile point of sale terminal, the only external cost you’ll need to set it up is a card reader.

The cloud-based subscription models that mPOS systems have also generally mean low sign up and monthly maintenance expenses.

📌Or you could opt for QR code payments and then you don’t need a card reader or mobile POS system. All you need is a smartphone or mobile device to get started.

2. Improve cash flow

When using mobile payments, customer funds are transferred to your account either instantly or within a few days.

This means you get money faster and, because customers can pay as long as they have their personal mobile device on hand, you’re more likely to receive payments from customers who prefer paying with their mobile wallets.

And considering over one-third of mobile wallet users now have three or more mobile wallets like Google Pay and Apple Pay installed on their smartphones, accepting these alternative payment methods is crucial in today's retail landscape.

In short, with mobile payments, you increase your chances of getting more money from more customers faster than you would with traditional payment methods.

3. Easily integrate loyalty programs

Since customer information is stored in mobile payment apps, coupons or discounts can quickly and easily be sent out to specific customers to reward repeat purchases.

These loyalty programs can include:

- Points loyalty programs. Customers get points for each transaction and can put them toward discounts or free products.

- Tiered loyalty programs. A certain amount of purchases unlocks a new tier of reward points or discounts once the specified number of purchases has been made.

- Hybrid loyalty programs. Combine two types of loyalty programs for greater incentives.

4. Get insights into actionable data

Using a mobile point of sale system means you have instant and secure access to key customer data.

This data can help inform you of your current customers’ purchasing behavior and give you the opportunity to further tailor your products, services, or overall customer journey funnel.

Data types include how frequently customers shop at your business, their average spend, preferred payment methods, and the products they buy the most.

5. Increase customer convenience

By adopting mobile payments for your business, customers can leave their wallets at home and still complete purchases.

Alongside this, adding a minimum of one mPOS to your store can improve the customer experience by making it faster and more flexible. And depending on the mobile POS system, you’ll be able to accept the most popular (and customer-preferred) payment options anywhere in your store or on the go.

📌 Get started today with mobile QR code payments to accept a wider range of payment methods including credit cards, and mobile wallets like Apple Pay, Google Pay, Click to Pay, and Bizum from your smartphone.

Accepting a wide range of payment options will help you reach more people and see an uptick in customer loyalty long-term.

6. Keep competitive with more ways to pay

How likely are you to frequent a business if you can’t pay with your go-to payment method?

By offering multiple ways for customers to pay via mobile payments, you’re staying ahead of the competition.

When investing in an mPOS system, choose one that can process the following types of frictionless payments:

- Contactless (or EMV chip) credit cards

- Digital wallets like Apple Pay, Google Pay, and Click to Pay

- QR code payments

Remember: every payment option you offer that a competitor doesn’t, means you’ll have an advantage when it comes to convenience and flexibility.

📚 Further reading: 11 Important Reasons to Accept Bizum in Your Physical or Online Business

7. Better payment security

Mobile payment apps use an encrypted or protected code to shield customers’ personal data.

This means that customers’ real card numbers are never stored on either their personal device or your mobile payment equipment or software.

Because of this, payment security is increased and your liability is significantly lower.

8. Simplify bookkeeping

Alongside actionable customer data, using an mPOS system also works to collect the following kinds of information for your business:

- Sales information

- Payment records

- Inventory updates

All of these benefits act as a bonus to mobile payments’ main upside, which is improving the customer experience and making it easier to accept payments on the go.

5 Downsides of mobile payments

Despite the many benefits of mobile payments, no technology is without its downsides.

1. Slow user adoption

Some customers might be reluctant to switch from traditional payments like cash to mobile payments.

But in reality, this applies to only a small number of consumers. One-third of customers who prefer paying through mobile QR code payments have stated they would not complete a purchase at a business where that option was not available.

2. Some security concerns

While tokenization and biometrics keep the majority of customer information safe, the potential for hacking or data leaks exists for all types of payment methods.

You can add further protection by investing in an mPOS or mobile payment software that has an emphasis on security and responsive customer support should any hacking or data leaks occur.

3. Lack of technology and infrastructure in developing countries

Although the United States, Europe, Spain, and other developed areas see little-to-no difficulty onboarding mobile payments thanks to their strong WiFi connectivity and technology resources, developing countries may find the necessary near field technology too costly and unreliable to integrate.

4. No one-size-fits-all option

When you’re looking for mobile payment processing services, you’ll need to comb through the available options to see which best fits your specific business needs and payment goals.

Features you should look for include:

- A high level of security

- Fast transaction times

- Both online and offline compatibility

- An intuitive interface

- Responsive support options

- Low monthly maintenance or subscription fees

- Dynamic pricing

5. Understanding the terms and conditions

Pages upon pages of terms and conditions can be difficult to fully comprehend, especially if you’re new to the world of mobile payments.

You’ll want to pay close attention to the fine print when it comes to transaction and platform usage fees. For example, some processors charge one fee for swipe or scan transactions and a different fee for transactions entered manually.

Types of businesses that should accept mobile payments

Whether you have a retail store, a restaurant, work at a hair salon, or offer another service, taking in-person mobile payments from your phone is easy with MONEI Pay. Here are a few use cases:

- E-commerce and brick-and-mortar shops. Do you want to take your online business offline? Do you have a boutique or run a multi-location brick-and-mortar business? Speed up your mobile retail payments, boost the customer experience, and track your omnichannel sales with MONEI Pay.

- Hospitality. Mobile payments for restaurants offer more flexibility than traditional POS systems, even for events and food trucks.

- Freelancers. Whether you’re a web designer, accountant, online marketer, nanny, or artist, MONEI Pay is the most flexible mobile payment option for freelancers.

- Taxis. Accepting taxi card payments is now required in most cities. Replace your old dataphone and save time and money by using your smartphone as a taxi POS system.

- Hair and beauty salons. Simplify your daily work by using the best alternative to a POS system for hair salons. Choose a more convenient, affordable, and reliable option — try MONEI Pay.

💡 Have questions about MONEI Pay? Contact us today!

Start enjoying the benefits of mobile payments today

Now that you’re familiar with what mobile payments are and how they can benefit your business, it’s time to start enjoying their many advantages.

🚀 Join MONEI today to get started with mobile QR code payments. All you need is your smartphone to experience the convenience, security, and speed that come with accepting mobile payments anywhere.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).