Fintech vs Traditional Banks: Competition or Collaboration?

Image source: Fintech Magazine

For a long time, consumers have tolerated the lack of technology found at traditional banks. But with fintech on the rise, banks are struggling to keep up and offer customers the innovation they crave. The question is, will it be fintech vs traditional banks? Or can they join forces to build the financial services that modern consumers are looking for?

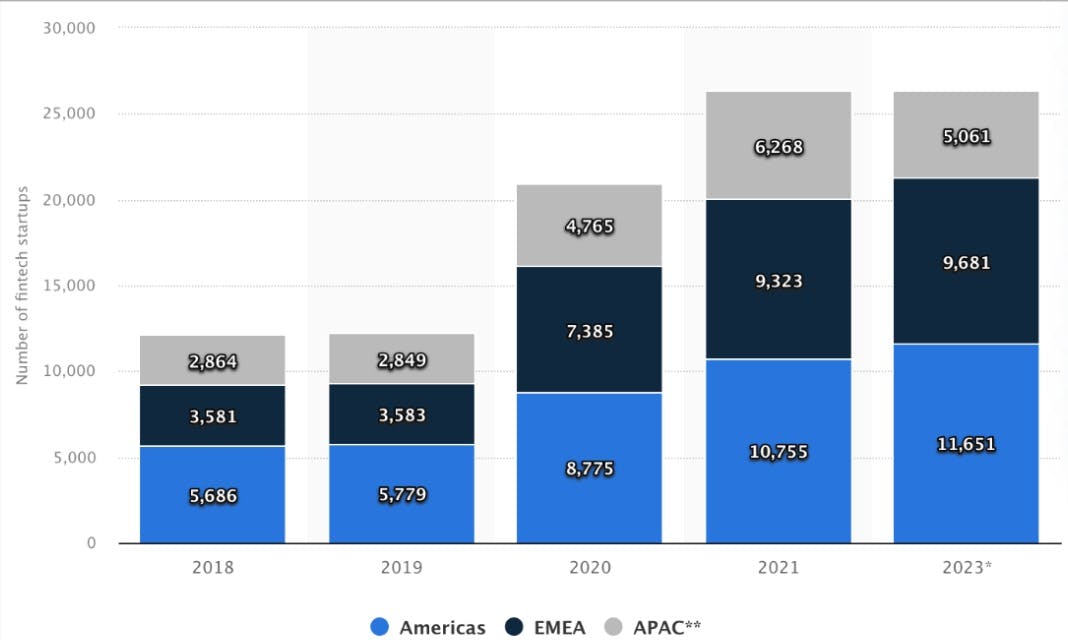

According to Statista, from 2018 to 2023, the number of fintech companies in the EMEA region more than tripled.

Fintech is an important source of potential growth for the overall economy, according to McKinsey. Across Europe, fintech companies have created roughly 134,000 jobs. European fintechs have significantly scaled up their hiring at a time when traditional banks in Europe have been reducing their workforces. According to Statista, the digital payments market is expected to amount to 601.30m users by 2027.

The data shows that fintech is a booming industry that combines financial services and technology to help people and businesses manage payments and financing. But will it last?

In this article, we’ll take a closer look at what fintech is, the differences between fintech and traditional banks, and the growth potential of financial technology.

Let’s dive in.

Table of contents

- What is Fintech?

- What are banks?

- Why is fintech growing?

- Will fintech last?

- Fintech use cases

- Fintech vs traditional banks: what’s the difference?

- Will fintech companies and traditional banks work together?

What is Fintech?

Fintech is a combination of the words “financial” and “technology”. It’s a term used to describe new technology that aims to automate and improve the use and delivery of financial services and products.

Fintech is used to help business owners, companies, and consumers easily manage their finances and business processes using software. The technology is usually accessible via their computer or other devices such as a smartphone or tablet.

Fintech began in the late 1990s when the Internet and e-commerce businesses emerged. By the 21st Century, the technology was used at the backend systems of financial institutions to digitize banking.

Since then, fintech has shifted its focus to consumer-oriented services. It's now used in various industries including retail banking, investment management, fundraising and nonprofit, education, and financial services for individuals. Cryptocurrencies like Bitcoin are also part of fintech development.

💡 Read also: QR Code Payments: What They Are, How They Work, and How to Accept Them

🎓Find more definitions in our payment industry glossary.

What are banks?

Traditional banks are financial institutions that are licensed to receive deposits from and make loans to individuals and businesses. Some banks also offer other financial services including wealth management, safe deposit boxes, and currency exchange.

There are various types of banks such as corporate banks, retail banks, and investment banks. And, in most countries, they’re usually regulated by a central bank or the national government.

Why is fintech growing?

McKinsey reports that when it comes to digital banking, consumers are demanding a more flexible journey. 71% prefer multi-channel interactions and 25% want a fully digitally-enabled private banking journey with remote human assistance available when needed. Consumer payment trends are also evolving.

To meet customers’ demand for speed, efficiency, and a better user experience, financial providers need to integrate technology into their services. This will enable them to offer the frictionless experience consumers have come to expect. If retail giants like Amazon let customers complete a purchase in seconds, it shouldn’t require a face-to-face meeting to open a new bank account.

Fintech is bridging the gap between what traditional banks offer and what the modern consumer has grown to expect. The industry has experienced massive growth.

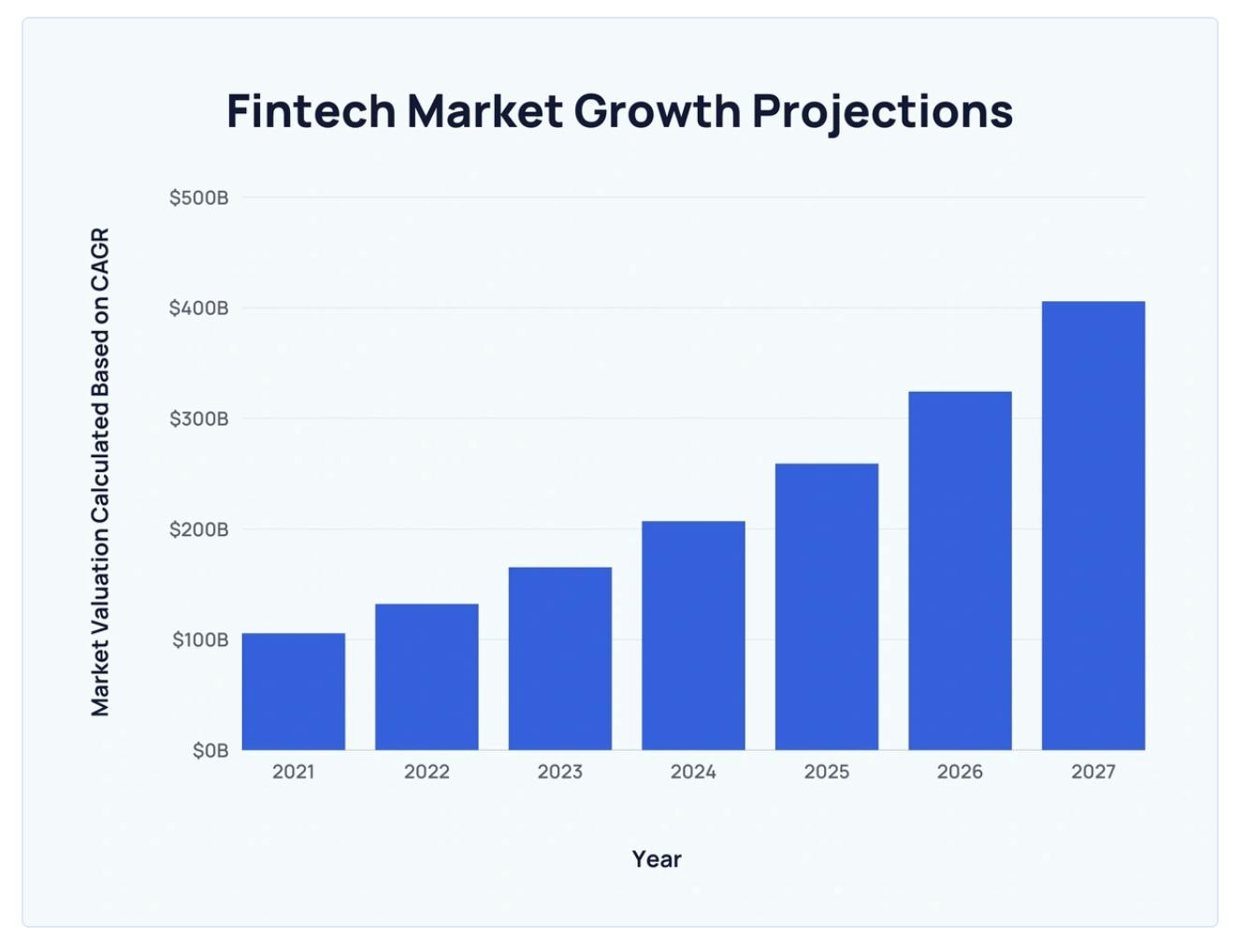

The global fintech market was valued at $127.66 billion in 2018, and today, in 2023, it's valued at about $165.17 billion.

The fintech market is expected to surpass $400 billion by 2027, at an annual growth rate of 25.18%.

Will fintech last?

Fintech is considered the future of banking and financial institutions.

Traditional banks have evolved drastically in the way they function thanks to new-age technologies including machine learning, AI, and analytics. Banks have also begun to acquire fintech startups to add to their services. In addition, fintech startup accelerator programs are gaining popularity, some of which are managed by banks including ING and JPMorgan.

The competition is intense, so some fintech businesses will thrive while others could struggle to stay afloat. But this presents an opportunity for fintech startups and traditional banks to team up and adapt quickly to the new digital world.

Fintech use cases

Mobile applications, software, and other financial technologies help automate and improve conventional forms of finance for businesses and consumers.

Let’s look at a few fintech use cases:

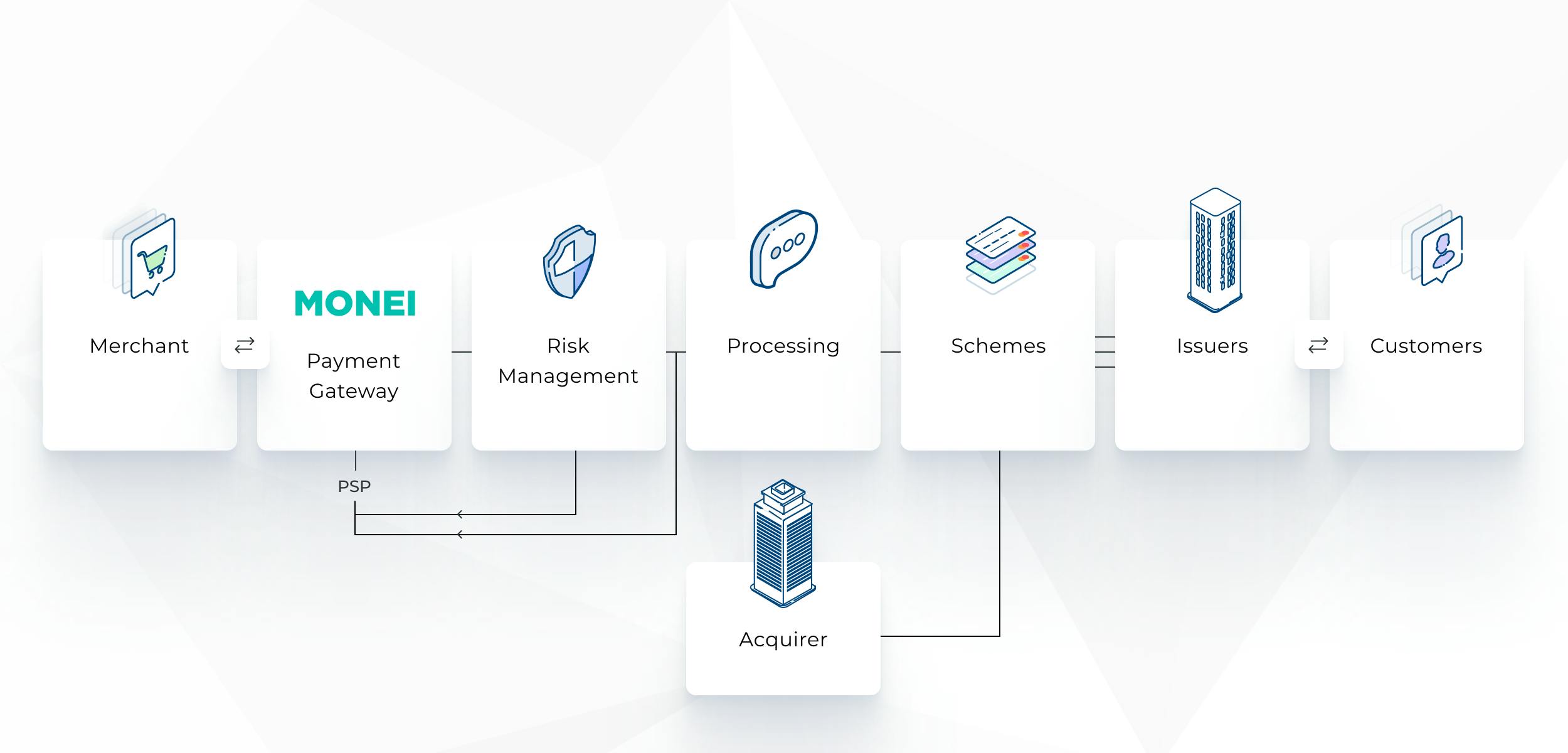

Online payment gateway

Online payment gateways are a type of payment service provider (PSP) that helps e-commerce businesses accept payments through their online store. They integrate with e-commerce platforms or custom-built websites using a payments API.

Not to be confused with a payment processor, payment gateways work with processors and other key players involved in online transactions like the card network, issuer, and acquirer.

Simply put, an online payment gateway is a safe and secure infrastructure that helps merchants accept payments from customers online.

And depending on the payment gateway, features like managing many online payment methods from one platform, checkout page customization, emailing payment links, setting up payment routing rules (also known as payments orchestration), and more may also be available.

💡PRO TIP: Use MONEI to manage your omnichannel payment stack from a single platform. Reach more people, improve the payment process, and increase sales by accepting more alternative and local payment methods online and in person.

Mobile payment app

Mobile payment apps make it easy for merchants to accept payments from any location and any mobile device making them a perfect solution for physical retailers, e-commerce businesses experimenting with omnichannel sales, restaurants, or service providers.

- Physical retailers can use a mobile payment app to easily equip all store staff with a mobile point of sale (mPOS) — without investing in POS hardware — to help customers checkout anywhere in-store.

- Online sellers participating in events or pop-up shops can download a mobile payment app to accept physical payments from their smartphones.

- Restaurants can quickly and securely charge customers from any mobile phone or tablet and avoid issues like high costs, regular network outages, and short battery life that come with traditional POS systems for restaurants and bars.

- Service providers or freelancers can skip the process of creating and emailing invoices by using a mobile payment app or credit card payment app to collect payments in person as soon as services have been rendered.

Mobile payment apps and other mobile POS devices offer the same functionalities as an electronic point of sale or cash register, but they’re portable and wireless.

💡PRO TIP: MONEI Pay lets you accept payments and manage your business from anywhere. All you need is a smartphone or other mobile device to generate digital QR codes so you can take card, Google Pay, Apple Pay, and Bizum payments on the go.

Crypto exchange payments platform

Crypto exchanges also need a secure and scalable way to process payments and help their customers maximize trading opportunities. Integrating with a crypto exchange payments platform can help crypto businesses process large volumes of fiat payments for cryptocurrency purchases. This type of payments platform also helps crypto exchanges improve the user experience by accepting deposits of funds from a wide range of customer-preferred local fiat payment methods.

📌 Looking to improve payments in your crypto business? Get in touch to learn how MONEI can help.

Fintech vs traditional banks: what’s the difference?

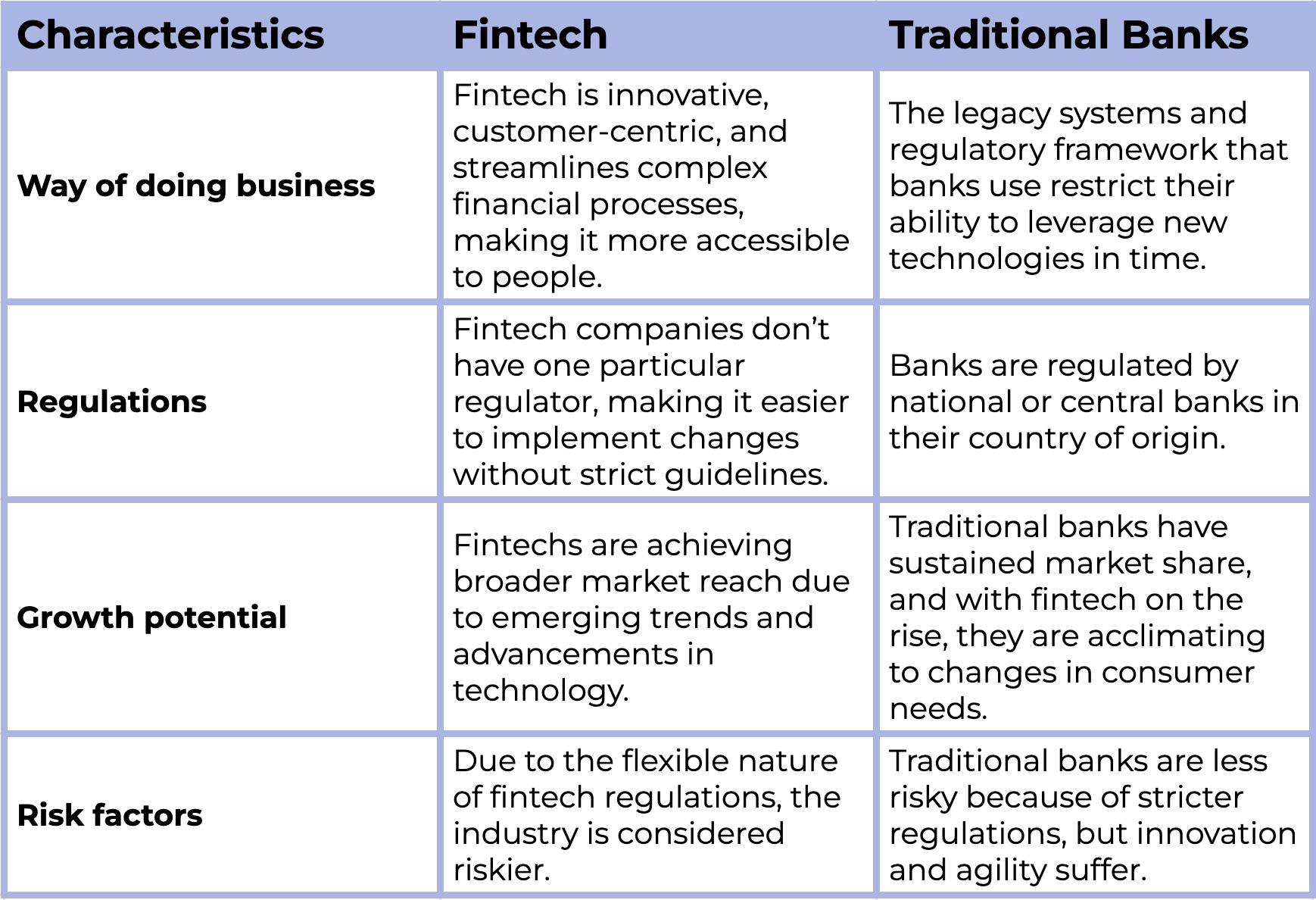

While fintech and traditional banks both aim to provide seamless financial services to consumers, that’s the only similarity.

Fintech companies are considered the bank’s biggest competitors. The financial system banks use today is made up of some very traditional and antiquated practices and procedures. It’s more often time-consuming and glitchy than it is frictionless. As consumer demands continue to shift to wanting things faster and easier, people are looking for a financial solution that meets their needs.

When it comes to innovation and advancement, traditional banks are falling behind and fintech is stepping up to the plate. Fintech may have a small share in the world banking system, but consumers are increasingly opting to use it as a substitute to banks.

We can break down the differences between fintech and traditional banks into four categories.

- The way of doing business

- Regulations

- Growth potential

- Risk factors

1. The way of doing business

Traditional banks and fintech companies both operate as financial service providers- but have different ways of doing business.

Structure and function

Fintech

Fintech is innovative, customer-centric, and streamlines complex financial processes, making it more accessible to people. These types of companies use lean operating models that are free of legacy system issues and can circumvent unfavorable regulations. Because of the flatter organizational structures in fintech, it’s easier to change, innovate, and rebuild systems that aren’t working.

Fintech leverages new technologies like artificial intelligence (AI), big data, and cloud computing to give customers a unique experience. It’s focused on seamless delivery, personalization, speed, and relevance.

By streamlining complex financial processes, fintech companies are more accessible to people, particularly millennials and younger generations.

Also, due to a more optimized business structure, fintech companies can offer products and services that are up to 10 times less expensive than traditional banks. A traditional bank needs real estate and thousands of employees while many fintech companies need very little real estate and a smaller team. The savings are then passed on to consumers.

Traditional banks

The legacy systems and regulatory framework that banks use restrict their ability to leverage new technologies in time. For this reason, banks can’t introduce new services or products that address customer needs or issues at the same speed as fintech companies. Overall, banks are more process-oriented when compared to fintech.

Customer experience

Fintech

Fintech companies are agile and accessible. They work virtually, so consumers don’t need to physically be present to transact or partake in financial services. This makes fintech a convenient option. Users can register on their computer, or in most cases, via an app on their mobile device. Fintechs offer 24/7 access, remote account opening, quick consultations, and better communication with customers overall. They have grown due to their focus on user experience, which is where banks have fallen behind.

💡Further reading: 8 Trends Shaping the Future of Payments & E-commerce

Traditional banks

In most cases, banks require you to be physically present to open an account or to apply for financial services. Not all banks have the technology to verify your identity online. This makes traditional banking less convenient for consumers, leading to an unsatisfactory experience.

Technology

Fintech

Fintech companies build on technologies like machine learning, artificial intelligence, and automation to function faster. Using technology also leads to fewer mistakes, higher quality service, and faster service in a shorter amount of time.

Traditional banks

When it comes to technology, banks are still struggling with legacy infrastructure. These banking systems are usually decades old, and support the bank's operations and backend across its main functions. This includes opening an account, setting up an account, processing transactions, deposits, loans, and more. Legacy systems limit the ability to interface with other systems and restrict banks from improving their infrastructure to quickly deliver new services, products, or experiences to customers. For this reason, banks are lagging behind.

💡Read also: What is a Payfac? A Guide for E-commerce and Retail Businesses

2. Regulations

Every financial institution is regulated in some way or another to make it safe for people to use. But fintech is generally more lenient and flexible and banks are stricter.

Fintech

Fintech companies don’t have one particular regulator. This is one reason why so many fintech startups have appeared. Without strict regulation, these companies can make changes to their business and do what they want without strict guidelines. While this makes it easier for fintech startups to work faster and adapt to their users’ needs, some consider it a risky industry. Depending on the country, authorities do regulate fintech businesses. And some companies choose to be more regulated or compliant, so their customers feel safer.

Traditional banks

Banks are regulated by national or central banks in their country of origin. The regulating bodies require banks to adhere to legal requirements, restrictions, and guidelines that are put in place to safeguard their people’s money. Banking regulations are used to ensure transparency between financial institutions and their customers.

3. Growth potential

When comparing two industries, growth is a key factor. Both traditional banks and fintech companies have growth potential depending on different aspects.

Fintech

The pandemic may be a big reason for the digital transformation we saw in 2020, but this trend is here to stay. As we mentioned above, the fintech market is expected to grow more than 25% each year, surpassing $400 billion by 2027.

Traditional banks

This doesn’t mean banks will slip away. Traditional banks have sustained market share, and with fintech on the rise, they are acclimating to changes in consumer needs. This includes adopting fintech features like digital security, mobile payments, and peer-to-peer lending, which lets customers borrow from an individual or group of individuals.

4. Risk factors

While fintech may be riskier, its benefits outweigh the risks.

Fintech

Due to the flexible nature of fintech regulations, the industry is considered riskier. But people still use it because it offers a faster, less expensive, more innovative, and highly user-friendly experience. As well as added features that can’t be found at traditional banks.

Traditional banks

Stricter regulations, of course, lead to lower risk, which makes traditional banks the less risky option. But if you want to stay competitive, reach more people, and provide a better customer experience using financial technology is essential. Just make sure you’re using an app or service that is well-known and if necessary, is compliant. For example, our payment gateway must be PCI DSS compliant to ensure both merchant and consumer data is securely handled in processing credit card transactions.

Compliance regulations vary depending on the sector each fintech is operating in.

Will fintech companies and traditional banks work together?

Fintech companies and traditional banks both work as financial intermediaries. Banks have been in business for hundreds of years, but they still need to make radical changes to meet the needs of modern-day customers.

Technologically speaking, fintech gives users more advanced features, and almost all the same services traditional banks provide. So, what does their relationship look like now? And how will it evolve in the future?

We can’t expect people to switch completely away from banks to fintech. But if fintech and banks can cooperate and collaborate, they’ll both make a bigger impact. There are immediate advantages to both parties if the two can partner.

Traditional banks benefit from the innovation and agility of fintech. And they boost confidence in financial technology due to decades of customer loyalty, business size, and an established network.

Here are a few advantages to fintech and traditional banks collaborating:

- When compared to fintech, banks have huge deposits. If they partner, building better financial systems will be easier for banks.

- If fintech collaborates with banks, they will be regulated under the same government institutes which can help build trust.

- The overall financial system will improve because of the advanced technology fintech can bring to banking.

To meet the technological demands that consumers have today, banks are embracing fintech features to improve user experience. As the whole finance system continues to evolve, allocating resources for digital agility is increasingly a priority for banks. A win-win situation for both is long-term partnerships that combine innovation (fintech) and support and trust (banks) to build the sector for the digital future.

You may also like to read:

- Omnichannel Commerce: Benefits, Tips, and Real-Life Examples of Brands Succeeding

- 8 Important Benefits of Mobile Payments

- The Top 4 Digital Wallets to Add to Your Online Store + Benefits for E-commerce

- What are Alternative Payment Methods? [Quickstart Guide]

- Your Guide to Payments Terminology

Fintech vs traditional banks FAQ

Which is more cost-effective for a merchant: fintech or traditional banks?

Generally, fintech companies tend to be more cost-effective. They have lower overhead costs due to their lack of physical infrastructure, which can translate into lower fees for their services. However, the cost can vary depending on the specific services you're using and the terms of your agreement.

How do the speed and efficiency of services compare between fintech and traditional banks?

Fintechs are often faster and more efficient. Their services are technology-driven and automated, which usually results in faster transaction times, instant payments, and real-time reporting. Traditional banks, while also offering online services, may have slower processing times due to their larger scale and reliance on legacy systems.

Which offers better customer service: fintech or traditional banks?

This can be subjective and varies from one company to another. Fintechs often have more user-friendly interfaces and 24/7 customer support. Traditional banks, on the other hand, may offer personalized service through relationship managers, especially for high-value customers.

Do fintechs or traditional banks provide better security?

Both types of financial institutions prioritize security but may approach it differently. Traditional banks have years of experience handling financial data and comply with established regulations, while fintechs often leverage advanced technologies like encryption and tokenization for secure payments. The level of security can greatly depend on the specific company.

Are fintech services as widely accepted as those from traditional banks?

While fintech companies are growing rapidly, traditional banks still have wider acceptance due to their long-standing reputation and trust. However, fintech solutions are gaining popularity, especially among the younger demographic and in regions with less banking infrastructure.

Can fintechs offer all the services that a traditional bank can for a merchant?

Fintechs offer many, but not all, of the services a traditional bank can. For example, they can handle online transactions, provide loans, or offer payment solutions for business platforms. For more complex services, such as international trade finance or complex wealth management, traditional banks are still the go-to institutions, but they often lean on fintech companies to make these services more efficient.

How do fintechs and traditional banks differ in terms of innovation?

Fintechs are generally more agile and innovative. They leverage technology to provide unique solutions that traditional banks don't offer, like mobile wallets, QR-code payments, or cryptocurrency transactions. Traditional banks, due to their size and regulatory constraints, may be slower to innovate.

How does integration with my business operations compare between fintechs and traditional banks?

Fintech solutions are usually more adaptable and can be more easily integrated into your existing business operations. Many offer APIs that let you integrate their services into your own systems.

Which should I choose as a merchant: a fintech or a traditional bank?

It depends on your specific needs. If you value speed, innovation, and cost-effectiveness, a fintech could be a great choice. If you value a long-standing reputation, personalized service, and a wide range of services, then a traditional bank might be better. Many businesses use a mix of both to get the best of each, and many banks and fintechs partner to offer a holistic solution.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).