Acquiring Bank vs Issuing Bank: 3 Minute Guide

Payment processing involves many players with specific roles to route transactions from the moment a customer enters their payment information on your checkout page to the time the funds get deposited into your business bank account.

Two crucial players in the transaction flow are the acquiring bank and the issuing bank. But what’s the difference between the two? And why do two banks need to be involved in processing card payments?

In this article, you’ll learn what an acquirer and an issuer are, the roles and risks of each, and how to start accepting digital payments today.

Let’s dive in.

Acquiring bank vs issuing bank: what’s the difference?

The payments terminology, acquiring and issuing refer to the roles banks play in payment processing. The acquiring bank is involved in the part of the transaction flow on the merchant’s side, while the customer’s (or cardholder’s) bank is the issuing bank.

Frequently, banks carry out both functions. For example, some large banks issue credit cards to consumers and also provide merchant acquiring services to businesses.

So then what’s the difference between acquiring and issuing banks? Let’s take a look at the responsibilities of each:

Acquiring bank: key functions

- Offer merchant account services — in Spain, this is also referred to as a TPV Virtual

- Allows you to accept and process card payments

- Deposits funds into your business bank account once a transaction has been approved

- Provides a line of credit to balance unforeseen processing costs (for example chargebacks)

- Keeps a record of your account activity (for example fees, deposits, and withdrawals)

📚Further reading: What’s the Difference Between a Payment Gateway and Virtual POS?

Issuing bank: key functions

- Manages consumer credit card applications

- Offers payment cards to consumers so they can complete purchases through card networks like Visa and Mastercard

- Approves or declines customer payments

- Sends funds to the acquirer once the transaction is approved

- Starts and reviews the chargeback process for cardholders

📚 Further reading: How to Accept Payments Online: 6 Step Guide

The issuer and acquirer are both involved in payment transactions

To make it clearer, we’ll review the payment transaction flow.

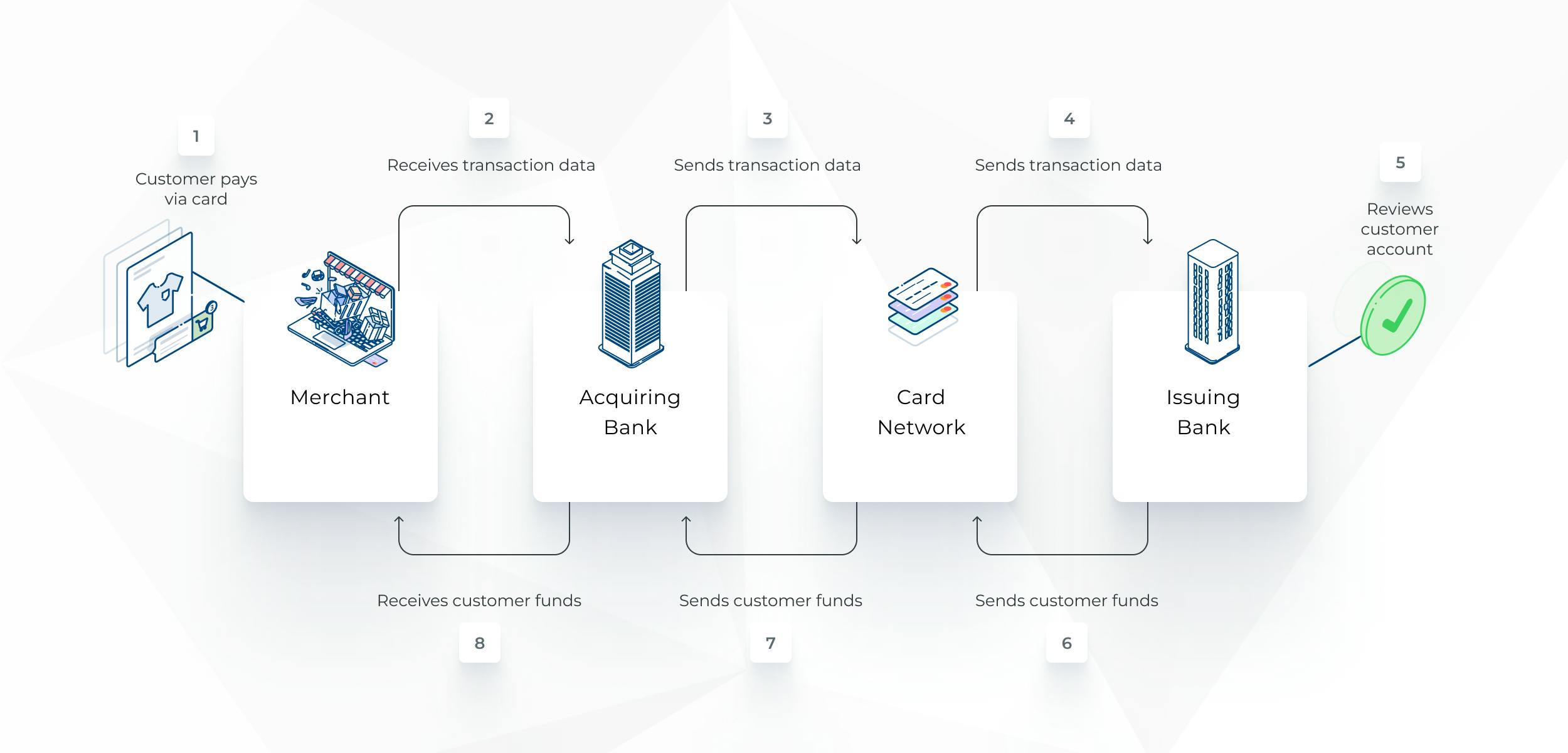

When your customer chooses to pay via credit card or another digital payment option, during the first step of the transaction, data is sent to the acquiring bank. Some larger commerce businesses have direct relationships with acquirers in order to enable payments orchestration, but using a payment service provider (PSP) that offers merchant account services (so you can accept credit card payments without opening a merchant account) is another great option, no matter the size of your business.

Regardless, the acquiring bank offers services that let you accept digital payments. Once the acquirer receives a transaction, it sends it through the card network (Visa or Mastercard, for example) to the issuing bank on the cardholder side of the payment process.

The card issuing bank supplies cards to consumers and is the holder of the account that the cardholder takes funds from to complete payment. When the issuer receives a transaction, the customer’s account is reviewed to make sure they have sufficient funds or available credit. Only then is the transaction authorized.

Next, the issuing bank routes the transaction back to the card network, and then it’s sent back to the acquiring bank.

During the transaction settlement phase, the acquiring bank approves sending funds from the cardholder’s account at the issuing bank into your business bank account.

Use the illustration below to visualize how payment transactions flow from the acquirer to the issuer and back again.

Roles acquirers and issuers play in payment processing and the risks

As you’ve learned, card payments go through many steps before the funds are deposited into your business bank account. It may seem unnecessary to involve two banks in the process, but both the card issuer and acquirer serve essential roles in payment processing.

Acquiring banks

- Who they work for. Businesses use an acquirer to accept digital payments.

- What they do. Acquiring banks process card payments for your business by routing transactions to the card network and eventually depositing funds into your business bank account (usually in partnership with a payment processor).

- The risk they take. Acquirers assume the financial risk associated with payments, are liable for payment security, and are also sometimes responsible for pending chargebacks or refunds if your business fails.

Before approving merchants, acquiring banks review bankruptcy potential to compare likely gains against possible losses in the future. If the risk is too high, merchant account services are denied or you may be identified as a high-risk merchant and incur additional fees for acquiring.

Issuing banks

- Who they work for. Issuers give credit cards to consumers.

- What they do. Issuing banks approve or deny consumer credit card applications for a line of credit and collect monthly interest fees until the debt is paid.

- The risk they take. Issuers must make sure the cardholder has enough funds to cover transaction costs — unpaid debts become a liability.

How can I start accepting digital payments today?

Now that you know the difference between acquiring banks vs issuing banks and how payment processing works, you’re in a better position to set up your business to accept payments. The easiest way to do this is to work with a payment service provider that has built-in merchant acquiring services.

With MONEI, you don’t have to worry about going through the lengthy process of setting up merchant acquiring. Once your account has been approved, card payments are configured in your dashboard by default and you can immediately start accepting card transactions as well as Apple Pay and Google Pay payments. You can then also configure alternative payment methods like Bizum, Click to Pay, and Multibanco in your account.

🎓Find more definitions in our payment industry glossary.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as their payments partner, of course).