Cross-Border Payments: Make Them Work for Your Business

Where there’s cross-border commerce, there are cross-border payments. Once you’ve established a business and defined your ideal client, you might notice that lots of potential customers are based abroad.

You don’t want to miss out on international sales, but accepting payments from shoppers in other countries has historically been quite a challenge. There are cross-border fees to think about for a start. Then there’s a question of transparency, speed, and access.

For a long time, cross-border payments have been more difficult to accept than they should be. But things are changing. In this article, you’ll learn what cross-border payments are, why they’re important, and how they work. You’ll also discover the trends, advantages, and challenges involved.

Table of contents

- What are cross-border payments?

- The importance of cross-border payments

- How do cross-border payments work?

- Cross-border payment trends

- Cross-border payment types

- Advantages of accepting cross-border payments

- Challenges of cross-border payments

- Cross-border payments are improving

- ISO 20022 and cross-border payments

What are cross-border payments?

Cross-border payments take place when a payer and a recipient are based in separate countries. These transactions can involve individuals, companies, banks, or financial institutions. Payments are made in several ways including bank transfers, credit card payments, and alternative payment methods like mobile payments and digital wallets. Let’s split them into two main categories:

- Wholesale cross-border payments. These are commonly used by financial institutions to support their customers and their own cross-border activities. Governments also make use of wholesale cross-border payments to trade in financial markets and to deal with large transactions.

- Retail cross-border payments. If you sell to another business (B2B) or direct-to-consumer (DTC) in another country, you’ll be affected by retail cross-border payments, as will individuals transferring funds between themselves which is called customer-to-customer (C2C) or peer-to-peer (P2P) payments.

The importance of cross-border payments

The total value of B2B cross-border payments is expected to reach $35 trillion by 2022, according to Juniper Research. It’s easier than ever to move goods, services, capital, and people around internationally, so many businesses are broadening their reach.

Businesses and individual consumers alike are increasingly demanding cross-border payment services that are as efficient and as safe as their domestic counterparts. As it becomes easier, faster, more transparent, and cheaper to execute cross-border transactions, more and more businesses are selling globally. It’s just one reason cross-border e-commerce is booming.

How do cross-border payments work?

With cross-border payments, the currency isn’t physically transferred overseas. Domestic payment systems aren’t usually connected with the systems of other countries. Instead, international banks set up accounts with their foreign counterparts.

There are a few ways to make a cross-border payment. Here are some of the more common methods:

Credit card payments

For your customer, the process of paying by credit card is easy. They enter their credit card details and wait for verification. For credit card companies, there’s a lot more to consider. They sometimes need to convert between two different currencies and always need to communicate with the local acquiring banks involved. As you’ll see from the bank transfer explanation below, that’s not so simple. The fees involved are always passed down the chain.

Bank transfers

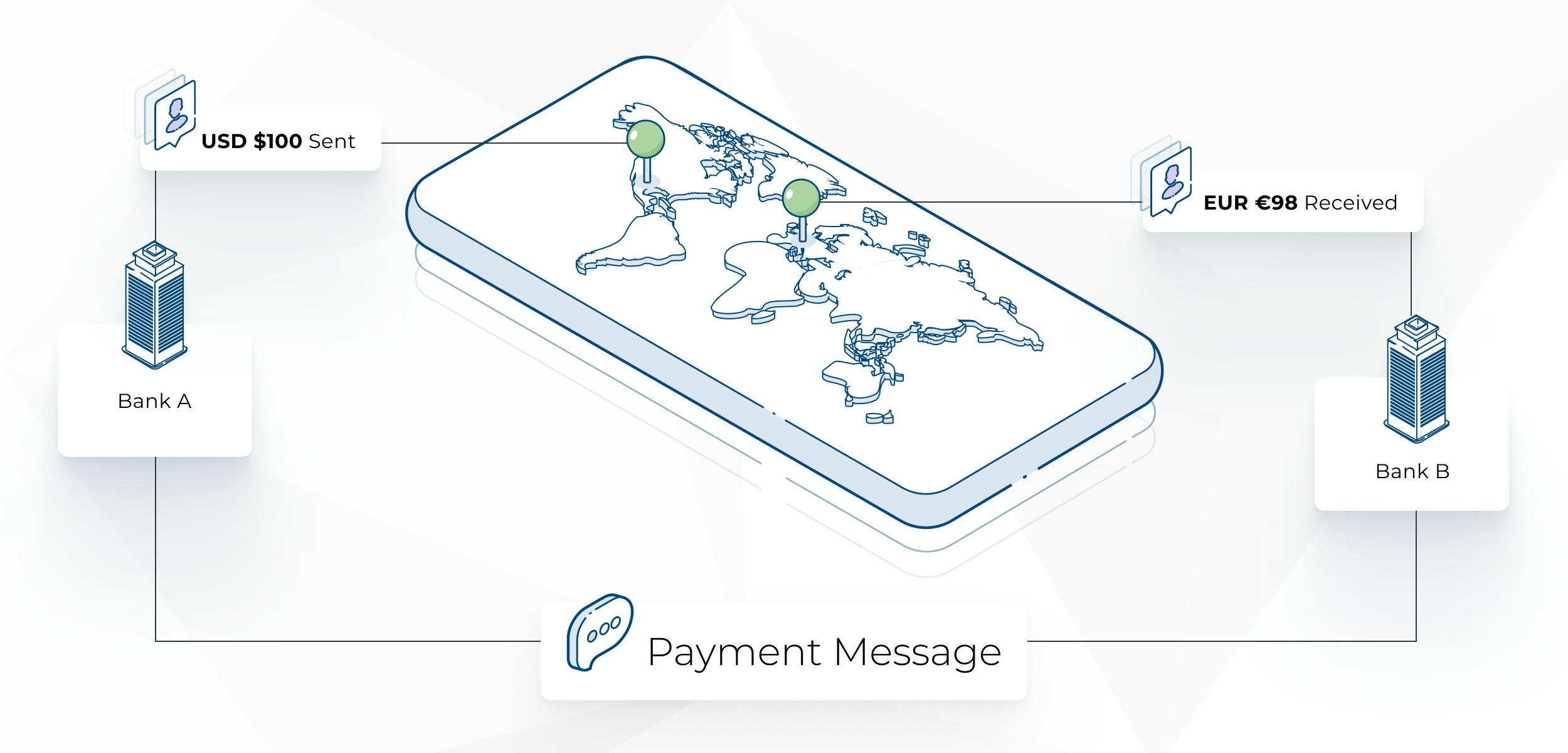

Let’s take an international bank in Spain and an international bank in the US. When a transfer is made from Spain to the US, no physical funds will be sent. Instead, the account in the US will be credited in US dollars and the account in Spain will be debited with the corresponding amount in euros. Money transfer agents and fintechs will use these banks’ services for the same purpose.

Take a look at the example below to see how a simple cross-border payment works:

However, it’s not always that simple. Not every bank has a direct relationship with its international counterparts. An account in Spain and an account in the US might not be directly connected but they could, for example, both have accounts with a bank in Switzerland. The Swiss bank can act as an intermediary or a correspondent bank. The Swiss bank will charge a fee and because another step is involved, the whole transaction will take longer.

Take a look at the example below:

Exchanges between euros and US dollars are frequent. This means banks are likely to have direct communication. When cross-border payments are made in these currencies, there will usually only be one intermediary at most.

Currencies like the Polish Zloty and the Romanian Leu are exchanged less often. This means banks might not be able to communicate directly. When this happens, cross-border payments will pass through more correspondent banks. Every correspondent bank will have its own procedures that take time and cost money. That means the total cost of a transaction will increase. This eventually gets passed down to you and the consumer.

Take a look at the example below. There are three correspondent banks involved — each one charging a fee and each one causing an extra delay:

Each bank will charge processing and foreign exchange fees. There will also be legal checks, such as financial crime requirements and updates to the balances of every account. Considering each bank will be processing during their normal domestic business hours, this can make the whole process last an exceptionally long time.

Digital wallets

Digital wallets such as PayPal, Apple Pay, and Google Pay allow users to safely store payment cards of their choice, so they can pay for goods and services.

Some digital wallets allow multiple currencies and cross-border orders meaning a customer in the Netherlands can buy from your e-commerce business in Spain using their Apple Pay account. Once the payment has been processed, the funds will be transferred to your business bank account, the process is classified as a cross-border payment.

Cross-border payment trends

In recent years, the changes in cross-border payments have become wider and more frequent. From consumer demand to increasing trade with emerging markets, and the rise of cross-border payment specialists, there’s a lot to consider.

Trend 1: Evolution of consumer demand

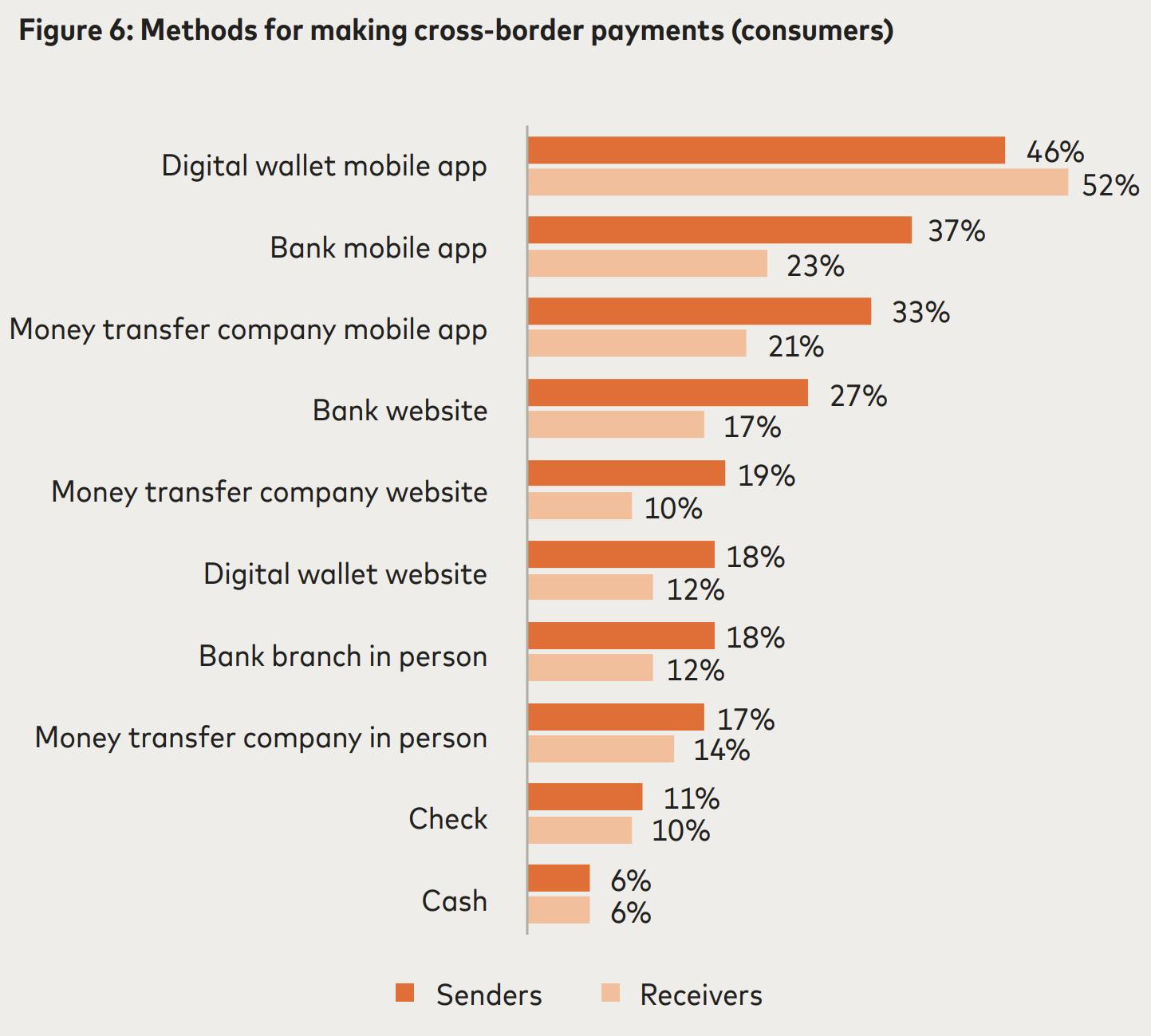

Cross-border payments are occurring more frequently. The increase in demand has been a catalyst for a growing number of choices in the cross-border payments market. Consumers are less willing to pay for costly banking services and they expect international payments to be fast, secure, and intuitive.

Alternative payment service providers are meeting demand by offering cross-border payment solutions that feel much closer to a domestic transaction. Many traditional banks are struggling to keep up.

📚Further reading: Fintech vs Traditional Banks: Competition or Collaboration?

Trend 2: Increasing trade with developing markets

Although Brexit and US trade tensions could restrict the growth of cross-border payments, developing markets in Africa, Latin America, and Asia will have the opposite effect. Initiatives such as the African Free Continental Trade Area and China’s Belt and Road are likely to further stimulate the market.

Trend 3: Availability of cell phones and ePayments

“Imagine being able to look after all your financial needs through your phone.” If somebody had said that just a few years ago, they would have been laughed out of the room, but these days, banking services and ePayments (electronic payments) are available on most smartphones.

According to Bloomberg, the mobile wallet market is expected to be worth $16.2 trillion by 2031. The inclusivity of foreign currencies in digital wallets means that this trend is likely to affect cross-border payments too.

📚Further reading: 10 Trends Shaping the Future of Payments & E-commerce

Trend 4: A rise in specialists

Delays, high costs, and a lack of transparency were clear problems in cross-border payments. To counter these problems and to make the most of the above trends, two groups of cross-border specialists challenged incumbents with innovative business models.

These specialists are called digitally-enabled money transfer operators and back-end networks.

- Digitally-enabled money transfer operators. Dealing directly with your business or a consumer, these specialists offer digital cross-border payments. For currencies that have a lot of buyers and sellers such as EUR or USD, these providers would normally set up direct banking relationships. In emerging markets, setting up an international bank account can be challenging. Instead, digitally-enabled money transfer operators often rely on partners, such as back-end networks.

- Back-end networks. Instead of establishing a direct relationship with the sending or receiving party, these specialists partner with local banks and alternative payment methods. This makes exchanging information quicker, easier, and more transparent for cross-border payments.

Cross-border payment types

There are four transaction areas that make up cross-border payments:

- Business-to-consumer (B2C). These include salaries or interest payments.

- Consumer-to-business (C2B). Such as tourism spending and customers paying you through your e-commerce site.

- Business-to-business (B2B). As the title suggests, any transaction from one business to another. These make up the largest share of the cross-border payments market.

- Consumer-to-consumer (C2C). Includes supporting children or family in another country, paying loans, etc.

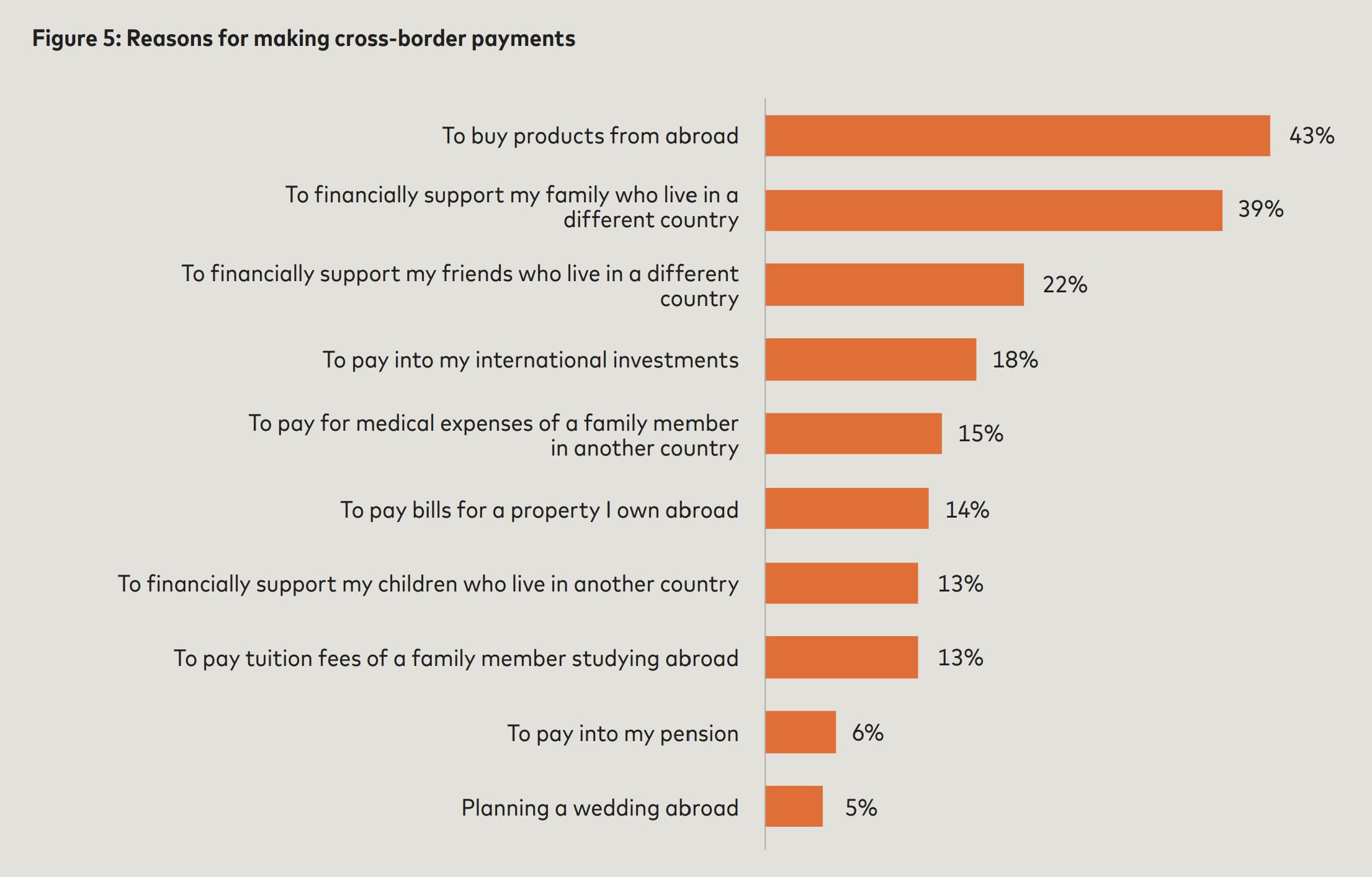

Mastercard’s 2022 Borderless Payments Report gives us better insight into what consumers are using cross-border payments for.

Advantages of accepting cross-border payments

Buying products from abroad is the main reason consumers make cross-border payments. The market is growing, but there are still challenges. Let’s take a closer look at why those challenges are worth overcoming.

Grow your business internationally

Accepting cross-border payments lets you reach more customers in more regions. If you accept multiple currencies and let customers pay with their preferred local payment methods, such as iDEAL a popular bank transfer method in the Netherlands, you’ll attract a larger, international customer base.

In fact, if we look at the example of selling products from your Spanish e-commerce business to consumers in the Netherlands, accepting cross-border payments will help you reach customers in a country that’s ranked fifth in Europe in terms of using online retail, according to Statista. And over 80% of Dutch consumers from 16 to 75 years old said they used e-commerce in 2019.

Improve customer experience

The more options a customer has, the more likely they are to convert. Offering more payment types will improve the customer experience. This is especially true if you offer the possibility to pay using more local payment methods.

Another benefit is removing the burden of FX (foreign exchange) fees from your customer. If managed well, you can save both you and your customer money. Using a multi-currency account will give you the ability to make conversions when FX rates are optimal.

Better payment security

One security glitch can be all it takes to destroy your reputation. PSPs (payment service providers) that include built-in PCI DSS Level 1 security and payments compliance keep cross-border payments secure for you and your customers.

Work with international employees and freelancers

Cross-border payments make paying international employees far easier. Some employees need to be physically located in the same place as you, but many jobs can be done remotely. As cross-border payments become easier, more transparent, and cheaper, the barriers to hiring internationally decrease substantially.

Challenges of cross-border payments

As mentioned earlier, there are still challenges when it comes to cross-border payments. We’ve briefly talked about them above but let’s have a closer look:

Cost

Using traditional methods (like bank wire transfers), cross-border payments can cost up to 10 times more than a domestic payment. For some businesses and consumers, that could be the difference between doing business in a particular country or not.

Having said that, PSPs and alternative providers are finding ways to reduce costs.

Speed

You’ve seen how some transactions have to go through multiple intermediaries before they are finalized. This causes delays in the transaction. With complex processing of compliance checks and fragmented data formats, automated processes are difficult to set up.

Again, PSPs and back-end networks are reducing that burden and making sure that you and your customers are not faced with these challenges.

Access

There are more and more disruptors making changes to help businesses like yours accept cross-border payments, but there are significant barriers to entry for new firms entering the market. The more competition there is, the better it will be for you.

Transparency

Old technology, varying compliance standards, long transaction chains, and many of the other challenges we mentioned above also affect transparency. It’s hard to know what’s happening at every stage of the process, which can mean something might get missed.

Payment fraud

Cross-border payment fraud is on the rise. According to the latest issue of PYMNTS and Worldpay’s Global B2B Payments Playbook, with more people working remotely, businesses have struggled to keep up with protection against cyber security threats. Fraudsters have taken advantage and up to 60% of US and UK businesses have been the targets of cross-border fraud.

Here are three common fraud types that are becoming more prevalent:

- Reshipping fraud. Criminals purchase real items with stolen money. They send them to employees or freelancers who think they’re doing legitimate work by rebranding the products and shipping them on. Often, the people reshipping products are completely unaware they’re doing something illegal.

- Invoice fraud. Cybercriminals pretend to be vendors and bill for work that was never performed. Victims often don’t realize what’s going on until the real vendor sends an invoice for the same work. By this point, their money has been laundered into an overseas account.

- Capital scam. Fraudsters impersonate insurance or investment companies to trick business leaders into sending funds as part of a non-existent investment commitment.

Cross-border payments are improving

Cross-border payment challenges aren’t going unnoticed. The G20 (19 of the richest countries in the world plus the EU) made improving cross-border payments a priority in 2020. They set up a three-stage process to improve cost, speed, transparency, and access. Put simply, the three stages are:

- Stage 1. Assessment of existing cross-border payment arrangements and identified frictions and challenges

- Stage 2. Development of 19 building blocks to address frictions identified in stage one

- Stage 3. Development of a roadmap to deliver on the building block created in stage two

ISO 20022 and cross-border payments

ISO 20022 is a highly structured, data-rich financial messaging standard. It will support 80% of transaction volumes and 87% of transaction value globally by 2025. SWIFT and the European Central Bank are going live with ISO 20022 by November 2022.

Why does this matter?

A common language and model for payment data means faster and higher quality payments for everyone. It’s also more transparent and with so many institutions signing up, it’ll create a more accurate compliance process, improved security, and fraud prevention.

Considering the biggest challenges in cross-border payments are cost, speed, access, transparency, and payment fraud, ISO 20022 will be a major part of the solution.

What does this mean for you? Now is a good time to think about cross-border payments. You can take advantage of all of the benefits and look forward to a time in the near future when the challenges are far easier to overcome.

Cross-border payments, what now?

If you have an international audience, it’s important to accept cross-border payments. Now you know what they are, the current trends, the advantages, the challenges, and the possibilities for the future, it’s time to set up the right payment system for your business.

Choose a payment gateway that lets you accept a range of popular local payment methods from a single platform rather than having to set up local acquiring in each of the countries you want to sell to. Get started with MONEI today.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).