Local Payment Methods: The Ultimate Guide for E-commerce Merchants

Are you trying to reach a global customer base, but you’re not sure where to start? Having an e-commerce business eliminates physical borders so knowing your national and international customers’ preferred local payment methods is crucial to improve the checkout experience and boost online sales.

According to MarketWatch, the global cross-border e-commerce market size is forecasted to have a compound annual growth rate (CAGR) of 15.5% from 2021 to 2027, creating huge potential for you to grow your online business.

But to do this, you’ll need to accept the preferred payment methods of both domestic and cross-border shoppers. Accepting local payment methods is one of the most powerful ways to stay competitive.

In this article, we’ll take a closer look at the definition of local payment methods, the benefits of accepting local payment options, and the various types of local payment methods in seven European countries: Spain, Portugal, France, Italy, Germany, UK, and the Netherlands.

Let’s dive in.

What are local payment methods?

Local payment methods are essentially popular payment options in a specific geographic location. They are the most used payment methods in a region as well as payment options that are only available in certain countries or regions.

For example, credit cards are a popular local payment method in Spain, but they’re also popular in other regions. But Bizum payments is a payment method that's only available in Spain. These are both considered local payment methods in Spain due to popularity (credit cards) and availability (Bizum).

As an e-commerce merchant, it’s crucial to accept local payment options to reach more people and improve the payment experience. The more methods of payment available on your website, the more likely you are to increase conversions. In Spain, more and more consumers are choosing local payment methods. For example, Bizum, the peer-to-peer payment solution, is now accepted by nearly 20,000 e-commerce merchants in Spain and has 16 million (and counting) users. The total e-commerce purchases made using Bizum as of September 2021 is 205 million euros.

By accepting more local payment methods and letting customers pay via their preferred option you’ll boost customer loyalty and sales.

Types of local payment methods

Nowadays, there is a wide range of online payment methods that you can accept in your e-commerce store. That’s why it’s crucial to understand the local payment preferences of your target customers. And if you sell internationally, you’ll want to also consider how you can appeal to cross-border e-commerce customers by accepting popular local payment options from their region.

By doing this, you’ll build trust, reduce cart abandonment rates, build a global following of loyal customers, and boost sales revenue.

Here are the types of online local payment methods:

Digital wallets

According to Statista, in 2020, digital and mobile wallets accounted for approximately 45% of global e-commerce payments, making the digital wallet by far the most popular online payment method worldwide. This number is expected to increase to over 50% by 2024.

Digital wallets make the checkout process fast and convenient. Once customers add their payment information to the app, it’s securely stored so they can make future payments in a few taps. PayPal is the most popular digital wallet in Spain, but Apple Pay, Google Pay, and Amazon Pay are not far behind.

📚 Further reading: Tap to Pay: What is it and How Does it Work?

Credit cards

The popularity of credit card payments depends on the country. In some cases, countries have national credit card brands that are often co-branded with Visa or Mastercard and can only be used for domestic purchases. If you’d like to accept orders from these cardholders, you’ll need to make sure your credit card payment processor supports Visa and Mastercard, which usually is the case. This is one of the questions to ask when you’re choosing a payment gateway for your e-commerce store.

Bank transfers

Bank transfers are used to transfer money to and from bank accounts either in a specific region or internationally. Customers receive a unique reference number and bank account details of the account they can send their payment to either by mail, phone, or online. These types of payments are preferred by consumers who don’t have a credit card or prefer not to use one for payment.

Buy Now, Pay Later (BNPL)

Buy now, pay later options allow customers to pay for their order in installments over a specific period of time. In 2020, pay later options grew by 55% in Spain and BNPL market share ranges from 2%-18% depending on the region.

Peer-to-peer (P2P) mobile payment apps

The global P2P payments market is anticipated to grow at a considerable rate between 2021 to 2026.

Peer-to-peer payment apps allow users to easily transfer money or request payment from friends and family. But the usage of P2P solutions has expanded to e-commerce, and now customers can use these apps to pay for online purchases. As we mentioned earlier, Bizum is a popular P2P payment app in Spain. Others such as Verse and Joompay are also gaining popularity in Europe, and Visa Direct is making cross-border peer-to-peer payments possible.

📚 Further reading: What are Cross-Border Fees? (And How to Avoid Them)

6 Benefits of accepting local payment methods in e-commerce

Accepting local payment methods helps you reach more people and boost customer satisfaction. By doing this, you’ll have more chances to build trust and loyalty in your brand and ultimately sell more.

Let’s look at these benefits in more detail:

1. Reduce abandoned carts

According to Baymard, on average 69% of people abandon their online shopping cart and a percentage of this is due to not enough online payment methods being available — leading to frustration for both you and your customers.

Losing a shopper when they're so close to completing their purchase results in lost revenue for you and a poor customer experience for them. There are many ways to reduce your cart abandonment rate, but offering several payment options including local payment methods is an essential one.

2. Reach more people

Accepting the widest range of online payment methods possible will help you expand your reach and customer base. The preferred payment options among consumers are vastly different across demographic segments and regions. That’s why it’s important to offer alternative payment methods including local payment options that are popular among your target market. This way, you’ll improve the checkout experience and convert more shoppers into loyal, paying customers.

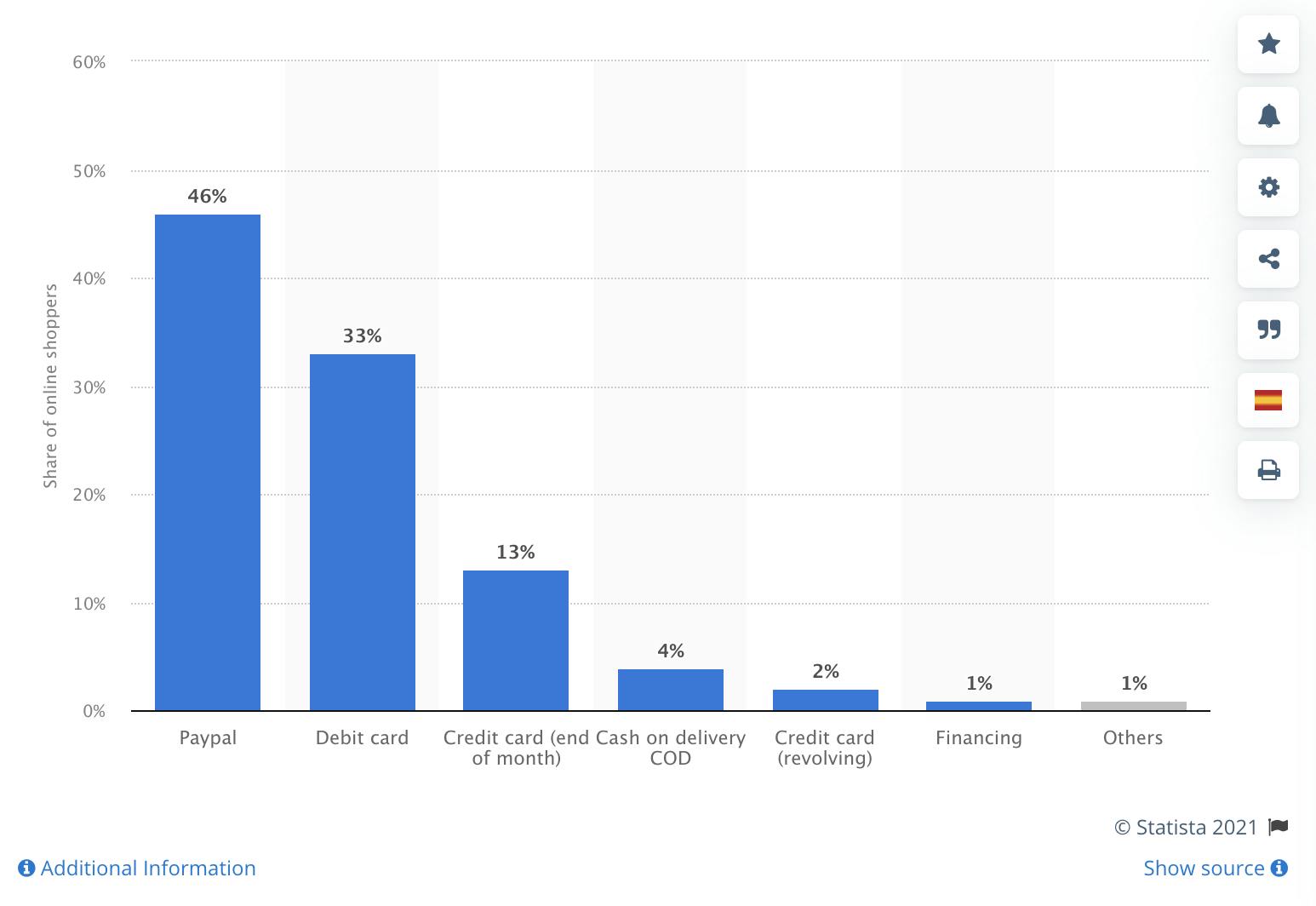

For example, in 2020, the preferred method to pay online in Spain was PayPal, with 46% of shoppers using it, while credit or debit card payments were used by 33% of consumers. If you’re not accepting both of these payment methods, you’re missing out on a large portion of online sales. The goal is to reach the largest number of people possible and to do this, you must offer the payment options they prefer.

3. Improve the checkout experience

Making it as easy as possible for customers to pay is essential to your bottom line. And by offering local payment methods, you’ll create a frictionless payments experience that’s flexible and convenient for shoppers. Accepting local payment methods also provides a sense of familiarity and trust for prospective customers.

Let’s say your business is based in Spain and you notice that a lot of your website traffic is coming from Portugal. You may want to consider adding popular local Portuguese payment methods to your e-commerce checkout. You could start by adding Multibanco to your payments mix.

Multibanco is an interbank network in Portugal and is supported by all major banks in the country. Consumers can easily use this payment method to pay for e-commerce purchases by using an ATM or through their internet bank. For this reason, almost all customers in the region use it for online transactions. So to reach the maximum number of potential customers in Portugal, accepting the Multibanco payment method is vital.

📚 Further reading: MONEI Helps Spanish SMEs Accept Multibanco and Grow in Portugal

4. Boost trust in your brand

Accepting local payment methods gives shoppers the feeling that they’re buying from a local business, and this can lead to a higher level of trust. If customers have more faith in your company, they’ll be more likely to give you their payment information and complete their order.

For example, if a shopper from Portugal sees that you accept Multibanco payments they’ll feel confident that your online store is trustworthy and already has a presence and customer base in Portugal. This will also make your business feel more inclusive to cross-border customers.

5. Increase customer loyalty

Offering a flexible payment experience not only builds trust in your brand, but because of the added convenience, it also leads to customer loyalty. If customers know they can checkout using their preferred local payment options, they’ll come back again and again.

6. Stay competitive

If most e-commerce businesses in your region are accepting a range of payment methods, and you’re not, you’ll likely lose customers to the competition. That’s why it’s important to diversify the payment options available in your store by including local payment methods that are popular among consumers in your area or the regions you sell to.

Most popular local payment methods in Europe

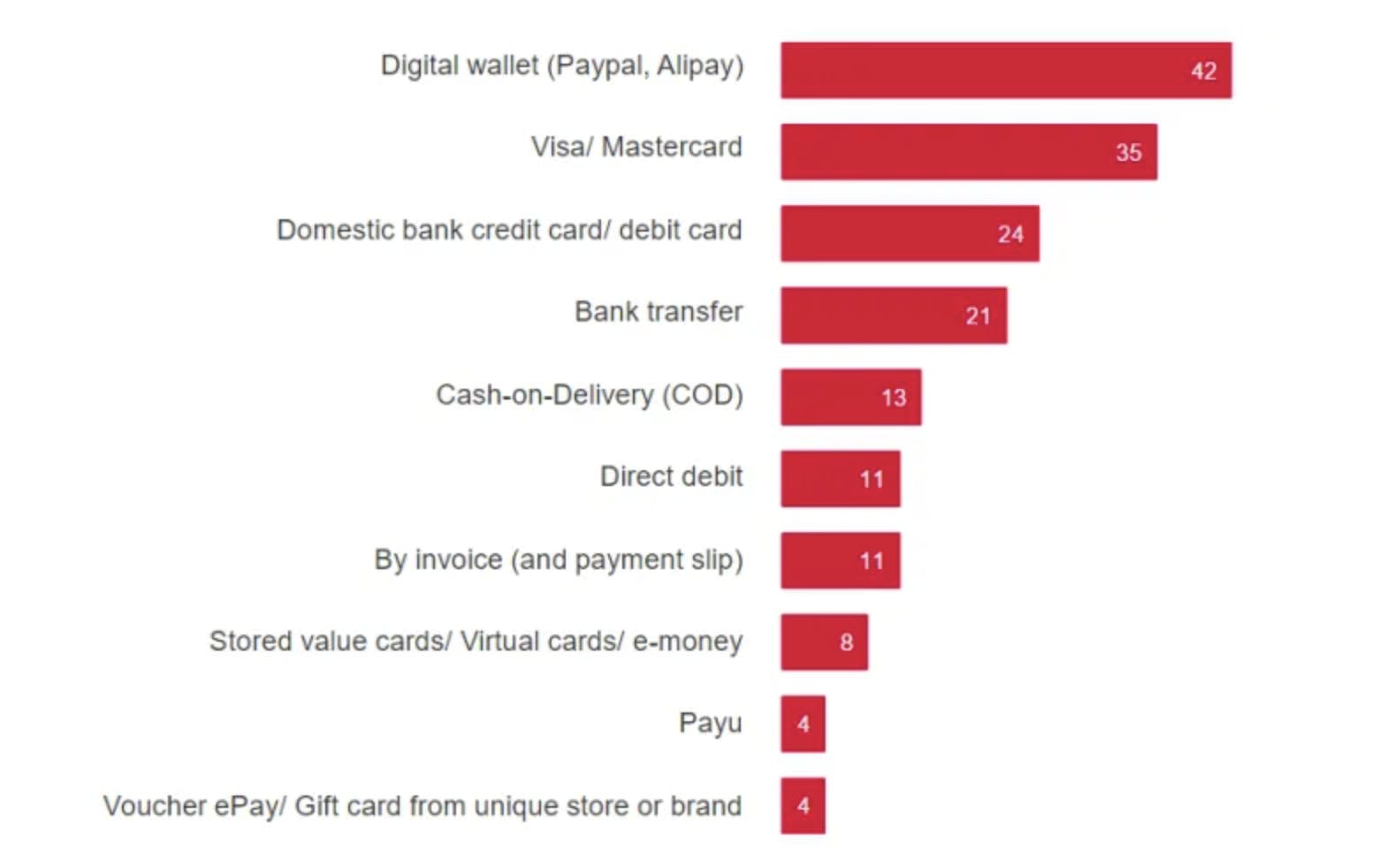

The popularity of the different types of local online payment methods varies depending on the country, but according to this Ecommerce News study, in Europe, the top four payment methods preferred locally rank in this order:

- 42% Digital wallet

- 35% Visa/Mastercard

- 25% Domestic bank credit card/debit card

- 21% Bank Transfer

Image source: Ecommerce News

And according to Statista, in Spain specifically, the top three preferred online payment methods locally are PayPal (46%), debit card (33%), and credit card (13%).

Image source: Statista

In this section, we’re going to review the most popular local payment methods in a range of European countries. We’ll focus primarily on Spain, Portugal, France, Italy, Germany, UK, and the Netherlands.

Digital wallet

In Spain, Italy, and Portugal more than 50% of consumers prefer to pay using a digital wallet, which is not surprising. Once customers add their payment details to their preferred digital wallet app, it’s stored for future purchases. This makes digital wallets one of the most convenient and secure methods of payment.

Amazon Pay

Amazon Pay is a digital wallet solution created by Amazon that lets customers use their amazon.com account to make purchases online. Consumers can store their credit or debit card details in the app to make the purchasing process faster and more convenient.

Accepting Amazon Pay (and other digital wallets) can help reduce your abandoned cart rate and increase sales since its users can complete online purchases without entering payment details each time.

Amazon Pay is a popular local payment method in the following countries:

- Spain

- Portugal

- France

- Italy

- Germany

- UK

- Netherlands

Click to Pay

Click to Pay lets customers make online purchases without having to create or initiate an account. Once the shopper adds their payment details to Click to Pay, making future purchases requires fewer steps in the payment process. The initial setup requires consumers to link their credit card to Click to Pay to eliminate the need to input their personal information and credit card number each time they pay.

Click to Pay is a popular local payment method in the following countries:

- Spain (We are the first payment gateway to support Click to Pay in Spain)

- UK

PayPal

PayPal is one of the most popular digital wallets with over 400 million active users (and counting). It lets customers send and receive money, and shop online without sharing their credit card information or financial details. PayPal users can either preload money or add their bank account or credit card information to their account and then select PayPal at checkout. Shoppers are then redirected to log in to PayPal to complete their purchase.

PayPal is a popular local payment method in the following countries:

- Spain

- France

- Italy

- Germany

- UK

- Netherlands

Apple Pay

Apple Pay is a digital and mobile wallet that lets consumers conveniently pay online or through contactless in-person payments. It’s compatible with iOS devices and shoppers can securely store their credit and debit card information in their Apple Pay wallet. Then all they have to do is confirm the payment using Face ID, Touch ID, or by scanning their fingerprint.

Apple Pay is a popular local payment method in the following countries:

- Spain

- Portugal

- France

- Italy

- Germany

- UK

Netherlands

Paylib

French digital wallet, Paylib, lets French shoppers conveniently make mobile and online purchases. It’s also used for P2P payments. This local payment method is outranking PayPal in France with a forecast of 20 to 25 million users by the end of 2021. The Paylib digital wallet is supported by major French banks including Crédit Agricole, BNP Paribas, and Societé Generale.

Paylib is a popular local payment method in the following countries:

- France

Google Pay

With Google Pay, consumers can make payments using the debit or credit cards that are saved in their Google account. The end result is a frictionless payment experience for Android users whether it’s an online or offline contactless payment.

Google Pay is a popular local payment method in the following countries:

- UK

- Spain

Credit and debit card

Visa and Mastercard are the second most popular methods of payment in Europe, but there are also local credit card brands to consider.

Visa

Visa is one of the most widely known and used global credit card brands. It’s accepted online and via point-of-sale (POS) in more than 170 countries. During the online checkout process, the cardholder chooses credit card payment, enters their Visa card number, expiration date, and security code to complete the payment. Then you receive instant confirmation of the payment.

Visa is a popular local payment method in the following countries (from our list):

- Spain

- Portugal

- France

- Italy

- Germany

- UK

- Netherlands

Mastercard

Mastercard is another widely used global credit card brand. It’s accepted online and via point-of-sale (POS) in more than 210 countries and supports 150 currencies. It works in the same way as Visa credit card payments. During the online payment process, the shopper chooses credit card payment, enters their Mastercard card number, expiration date, and security code to complete the payment. Then confirmation of the payment is sent to you instantly.

Mastercard is a popular local payment method in the following countries (from our list):

- Spain

- Portugal

- France

- Italy

- Germany

- UK

- Netherlands

American Express

American Express (AMEX) is a credit card network with a global reach, but the US is its biggest market. Consumers who use AMEX generally have more spending capability, which makes accepting this credit card beneficial to the growth of your online store. The downside is that depending on your location and business profile, the merchant fees you incur are usually above Visa and Mastercard credit card rates.

American Express is a popular local payment method in the following countries (from our list):

- Portugal

- France

- Italy

- Germany

- UK

- Netherlands

Carte Bancaires

Carte Bancaires (CB) is a popular credit and debit card network in France. These cards are usually co-branded with Visa or Mastercard and can be used for domestic credit or debit card payments in France.

If your business is not based in France, the co-branding also allows you to accept cross-border CB payments (from French customers) through your Visa or Mastercard connection (i.e., your credit card payment processor). If you’re looking to reach customers in France for lower card transaction costs and to provide a more convenient payment process, consider accepting Carte Bancaires and Carte Bleue transactions.

Carte Bancaires is a popular local payment method in the following countries:

- France

Carte Bleue

Carte Bleue is a French debit card payment system. It allows for transactions without authorization from the customers bank. It’s essentially a credit card minus the cardholder fees. Carte Bleue has been integrated with the Carte Bancaires (CB) card scheme and all its cards are part of CB, but not all CB cards are considered Carte Bleue.

Carte Bleue only cards are not supported outside of France. But it’s possible for customers to get a Carte Bleue Visa card that works internationally. In France, all Visa cards are also Carte Bleue.

Carte Bleue is a popular local payment method in the following countries:

- France

CartaSi

CartaSi is an Italian credit card brand that is co-branded with Visa or Mastercard networks. Consumers can use it for online payments and you can accept this credit card brand as long as you already have payment processing set up for Mastercard and Visa.

CartaSi is a leader in electronic payments with a total of 13 million credit cards in circulation and over two billion transactions. There is a commission fee for merchants and you are financially responsible in case of chargebacks and fraud.

CartaSi is a popular local payment method in the following countries:

- Italy

Bank transfer and direct debit

In Europe, bank transfers are preferred by 21% of consumers and 11% of shoppers opt for direct debit payments. While these payment methods are not the most popular ones, it’s still important to accept them in your e-commerce store.

SEPA (Single Euro Payments Area)

SEPA offers direct debit and credit transfer services in European Union countries. As we mentioned earlier, in this article we’re focusing on Spain, Portugal, France, Italy, Germany, UK, and the Netherlands, but SEPA is not limited to these countries. Here, we’ll look at what each of its services entails as well as the countries on our list where SEPA is the most popular local payment method.

SEPA Direct Debit is a Europe-wide direct debit solution that allows you to collect one-off or recurring payments in euros from bank accounts in the 34 SEPA countries. It’s a bank transfer initiated by merchants or businesses once the consumer gives permission. SEPA Direct Debit is an economical way of collecting payments in Europe, but the downside is chargebacks can occur for up to 13 months.

SEPA Direct Debit is a popular local payment method in the following countries:

- Spain

- Portugal

- UK

- Netherlands

- France

- Germany

SEPA Credit Transfer

SEPA Credit Transfer (SCT) lets shoppers pay for their order by transferring money directly to your business bank account, using their European bank account. Both your business and the customer must be based within the SEPA EU region.

SEPA Credit Transfer is a popular local payment method in the following countries:

- Netherlands

- France

- Germany

iDEAL Bank Transfer

iDEAL is used in the Netherlands to make secure online payments between bank accounts.

This standardized payment method is easy to use and requires only a few steps from the shopper. During the checkout process, the customer selects the iDEAL payment method, chooses their bank, and then the usual online banking environment opens. All the customer has to do is authorize the prefilled payment. Then the purchase amount is debited from the consumer’s bank account and transferred to your business bank account.

There is no credit risk and seconds after the payment has been authorized by the shopper, you receive a successful payment notification. Once you know the payment has been processed, you can fulfill the customer’s order. This is a low-risk option for merchants because the customer cannot reverse the payment once it has been authorized. Payment is credited to your bank account in the same timeframe as a credit transfer.

iDEAL is a popular local payment method in the following countries:

- Netherlands

Multibanco

Multibanco was founded in 1985 and lets consumers make online purchases using cash at 13 thousand ATMs across Portugal. It's the most popular local payment method in the country, with 90% of Portuguese people using a Multibacno debit card. Add Multibanco to your e-commerce store to let customers pay through their online banking app without sharing personal or card details. Multibanco is secure, fast, and partners with the main banks in Portugal.

- Portugal

Mulitbanco Net

Multibanco NET (MB NET) lets Portuguese consumers make payments online using virtual credit cards. The virtual credit cards are issued by Mastercard, Visa, or American Express depending on the shopper’s bank. Shoppers must log in to the MB NET site to create a virtual credit card, set a limit, and get a credit card number and security code to make online payments. They can also choose if the card is for one-time use or multiple uses.

You can accept MB NET transactions using your existing credit card payment processor as long as it already supports online payments via Visa, Mastercard, and American Express.

Multibanco NET is a popular local payment method in the following countries:

- Portugal

MB WAY

MB WAY is a Multibanco payment service that lets customers pay online and in-store, send money, request money, withdraw money via their smartphones, and generate MB NET virtual credit cards in the MB WAY app or in banking apps.

MB WAY is a popular local payment method in the following countries:

- Portugal

Open Banking

Authenticated directly between a customer and their bank, open banking payments help merchants avoid chargebacks due to failure to capture funds or as a result of fraud. During the checkout process, shoppers select the payment option and are then redirected to the online banking environment of their bank account where they can confirm the payment.

Open Banking is a popular local payment method in the following countries:

- France

- UK

MyBank

MyBank lets Italian online shoppers initiate SEPA Credit Transfers through their online mobile banking environment without having to enter their payment details or bank account information. This electronic authorization solution streamlines the online payment process and is open to all authorized payment service providers (PSPs) in the Single Euro Payments Area (SEPA), including payment and credit institutions.

MyBank is a popular local payment method in the following countries:

- Italy

Paydirekt

Based in Germany, Paydirekt (recently merged with Giropay) is an alternative payment method that lets customers make only payments via their checking account and home banking environment. The solution has been adopted by many large German banks to offer an alternative that competes with credit cards and PayPal. For e-commerce merchants, Paydirekt provides an immediate payment guarantee, easy connection via PSPs, advanced security, verification for buyers, and a simple interface.

Paydirekt is a popular local payment method in the following countries:

- Germany

Trustly

Trustly is an easy-to-use alternative payment option to credit cards. It lets customers sign into online banking to make payments without leaving the e-commerce website or mobile app.

Trustly is a popular local payment method in the following countries:

- Germany

- Netherlands

Giropay

Giropay is a popular local payment method in Germany. It lets shoppers use their trusted online bank account to make online purchases. As a merchant, you receive an instant payment confirmation and are guaranteed payment.

Giropay is a popular local payment method in the following countries:

- Germany

ELV

Elektronisches Lastschriftverfahren, or more commonly known as ELV, is an electronic direct debit payment method supported by banks in Germany.

Customers can allow you to debit the order amount directly from their bank account during the checkout process, and authorization happens by email, orally, or online. The fees are cheaper than credit cards and this payment option is best for one-time payments. Customers can cancel ELV direct debits for up to six weeks and there are not many instances of fraud with ELV. The risk for merchants is that ELV payments can be canceled and there is no protection against chargebacks.

ELV is a popular local payment method in the following countries:

- Germany

PayByBank

PayByBank lets shoppers in the UK pay through their mobile banking app. It’s a simple way for you to accept automated bank transfers directly from the customer’s bank account.

PayByBank is a popular local payment method in the following countries:

- UK

Bacs

Bacs (now owned and operated by retail payments authority Pay.UK) is a direct debit payment option that lets you collect occasional or recurring payments from customers. It’s used by both B2B and B2C companies and reduces the costs of collections, saves time, and deposits funds directly into your business bank account once the payment has been cleared.

Bacs is a popular local payment method in the following countries:

- UK

Bancontact

Accepting Bancontact is your gateway to Belgian consumers. Ninety-four percent of all debit cards in circulation in Belgium are Bancontact cards. With over 224 million online transactions processed in 2021 and its connection with 20 of the country's banks, if you want to sell cross-border to Belgium, accepting Bancontact is a must.

- Belgium

Buy now, pay later (BNPL) installment payments

According to Grandview Research Inc., the global buy now pay later market size is forecasted to have a CAGR of 22.4% from 2021 to 2028, with the expectation that it will reach USD 20.40 billion by 2028.

Here are a few of the popular buy now, pay later solutions in Europe:

Cofidis 4xcard

As we mentioned earlier, in 2020, the use of buy now, pay later options grew by 55% in Spain. Reach more customers, stay competitive, and increase your conversion rate with a local BNPL solution, Cofidis 4xcard.

With Cofidis installment payments, you’ll get paid in full while your customers enjoy paying in 4 installments. Cofidis pay later payments are eligible for purchases between €75 and €1,000. And the payment process for shoppers is simple: all they have to do is provide their personal ID and it takes less than three minutes to complete the online application.

Cofidis 4xcard is a popular local payment method in the following countries:

- Spain

SOFORT - Pay Now by Klarna

Also known as Pay Now by Klarna, SOFORT’s online banking payment method is popular in a number of European countries. It lets customers make fast and easy payments for online purchases using their online banking details. Then you instantly receive confirmation of the transfer order and can fulfill the online order or allow the download for digital products.

SOFORT - Pay Now by Klarna is a popular local payment method in the following countries:

- Spain

- Italy

- UK

- Germany

- Netherlands

Klarna - Pay Later (Pay in 4)

Klarna is a buy now and pay later solution that lets shoppers do exactly that. They can pay in 4 interest-free payments, pay in 30 days, or choose 6-36 month financing.

Klarna - Pay Later is a popular local payment method in the following countries:

- Germany

- UK

- Netherlands

Ratepay

Ratepay is a popular shop now, pay later payment option in Germany. Shoppers can choose full payments or installments when they place their orders. And you’ll get paid immediately. This way you can ship the order while Ratepay takes on the risk of non-payment.

Ratepay is a popular local payment method in the following countries:

- Germany

AfterPay

AfterPay is one of the top five payment brands in the Netherlands and offers a “pay after delivery” solution for e-commerce businesses. The consumer experience is seamless and reliable and for merchants, AfterPay is a full-service payment method with guaranteed payment and no chargebacks.

AfterPay is a popular local payment method in the following countries:

- Netherlands

Peer-to-peer mobile payment apps (P2P)

Once used only to send and request money from friends and family, P2P mobile payment apps are gaining popularity in e-commerce.

Here are a few to be aware of:

Bizum

Bizum is a Spanish peer-to-peer mobile payment app that lets customers send money to friends and family and make online purchases faster. All they have to do is provide their mobile phone number, and once it’s validated the money gets transferred securely from the consumer’s bank account to your business bank account.

Bizum is a popular local payment method in the following countries:

- Spain

💡Pro tip: Reach more customers and boost conversions by accepting Bizum payments. With MONEI’s payment gateway, you can accept Bizum in your Shopify, Wix, or WooCommerce store today. Or integrate MONEI with your custom built-website using our payments API. Do you also sell in person? Accept Bizum payments (and more) from any location with the MONEI Pay app.

BANCOMAT Pay

Italian mobile payment app, BANCOMAT Pay, is accessible to over 37 million Italian PagoBANCOMAT cardholders, and 440 banks use its services. The app can be used online, in-store, and for P2P payments. During the e-commerce checkout process, the customer enters their mobile number and confirms payment with a PIN, fingerprint, or face recognition through the mobile app.

Bancomat Pay is a popular local payment method in the following countries:

- Italy

Verse

Verse is another Spanish P2P payments app. It was acquired by Square in 2020 and lets users instantly send and request money from each other, deposit money into a bank account in two days, share expenses and split bills, and use a credit card stored in the app to make purchases.

Verse is a popular local payment method in the following countries:

- Spain

- Italy

- Portugal

And it’s gaining traction in France and the UK.

Joompay

Joompay is a P2P mobile payment app for iOS and Android users and is owned by Joom marketplace. It’s similar to Venmo and Wise and recently expanded into the European market.

Its users can send money to someone as long as they know their phone number, email address, or custom paytag that securely stores personal information. The P2P app can be used to pay bills, make online purchases, and send money to someone in another country. Its customizable payment pages and custom URL feature make it a great option for you to collect money from customers.

Joompay is a popular local payment method in the following countries:

- Spain

- France

Prepaid cards

Prepaid cards are not a very popular payment method among the countries we’ve included in this guide. But it’s worth mentioning Postepay Cards which are specific to Italy.

Postepay Cards

Postepay Cards are prepaid electronic or plastic credit cards that Italian shoppers use to shop and pay online in a secure environment. They are co-branded with Mastercard and Visa allowing for international online purchases and do not need to be attached to a bank account. The spending limit is € 2,500 per year and the single transaction limit is € 999.

Cardholders can reload their Postepay Cards at Postamat ATMs, the Poste Italiane website, via their mobile phone, or at the post office. Transactions are processed as Visa or Mastercard payments and the same commissions apply to merchants.

PostePay Cards are a popular local payment method in the following countries:

- Italy

Are you ready to start accepting local payment methods?

Now that you’ve gone through this exhaustive list of local payment methods that, depending on your target market, you should consider accepting in your e-commerce store, you’re probably wondering how to integrate local payment methods into your checkout page.

It may feel daunting, but it doesn’t have to. We’re here to help. Our advanced e-commerce payment gateway is a one-stop platform that lets you accept the widest range of online payment methods, and manage it all from a single merchant dashboard.

All you have to do is create an account and then connect it with your e-commerce platform or custom-built website. We have plugins and integrations for Shopify, Wix, WooCommerce, and Salesforce (more in the works). And a payments API that lets you capture, confirm, cancel, and refund individual payments.

If you have questions or need help, contact our support team.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).