Tap to Pay: What is it and How Does it Work?

Store owners across the world often mention “tap to pay” but if you traveled back in time, your customers might have thought you wanted them to decipher a riddle. Payment methods are constantly evolving. There was once direct trade. Then came cash. Debit and credit cards had a big impact. Now tap to pay is transforming the global market.

Over time, contactless payments have become even more important. For speed and convenience, customers tap their cards, phones, and even wearable devices on payment terminals at checkout to make purchases.

Let’s discover what tap to pay is, how to use it, the different methods available, its benefits, and the devices you need to accept it. We’ll also look at the types of businesses that use this payment option so you can see if it’s right for you.

Table of contents

- What is tap to pay?

- How to use tap to pay

- Transaction methods for tap to pay

- What are the benefits of accepting tap to pay?

- Types of businesses that use tap to pay

- How to accept tap to pay at your retail store, restaurant, in your taxi, or on the go

- Accept tap to pay from your phone with MONEI Pay

What is tap to pay?

Tap to pay (sometimes also referred to as tap to phone or tap on phone) lets customers make secure payments with contactless EMV chip cards or NFC-enabled devices like smartphones and wearables. NFC or near field communication is a short-range technology that transfers information between devices without them ever touching.

It makes processing transactions quicker, it’s more hygienic, and it allows customers to pay without handing over their cards.

How to use tap to pay

If your payment terminal has the symbol with four curved lines, portraying a radio signal, as shown below, it supports contactless payments. It will share encrypted information with any NFC-enabled card, mobile phone, or wearable device that’s within two inches to approve or reject the payment.

NFC allows devices to identify specific frequencies with radio waves. Its specialized frequency of 13.56 MHz ensures accuracy and enables close-range interactions between two devices. It works similarly to other radio frequency identification (RFID) technologies that are used to quickly scan multiple items in shopping malls, grocery stores, and airports.

Active devices, like a point-of-sale (POS) terminal or a smartphone using Apple Pay or Google Pay, constantly emit radio waves. When two active devices send and receive information to each other across an electromagnetic field, they create an active NFC payment.

Passive devices like plastic credit/debit cards don’t constantly emit radio waves. When a passive device enters an active device’s field, a passive NFC payment is made. As long as you have the right payment terminal, you can accept both active and passive NFC payments.

Tap to pay vs tap to phone vs tap on phone: is there a difference?

The three terms are interchangeable when referring to the technology itself — it works in the same way. But Apple, for example, branded the feature for its smartphone as Tap to Pay on iPhone and for Android devices, it's usually referred to as Tap to Phone (TTP).

Transaction methods for tap to pay

Originally, this payment method was only possible using contactless cards. Now, there are more ways to make a transaction and this will likely increase over time:

Mobile payment apps

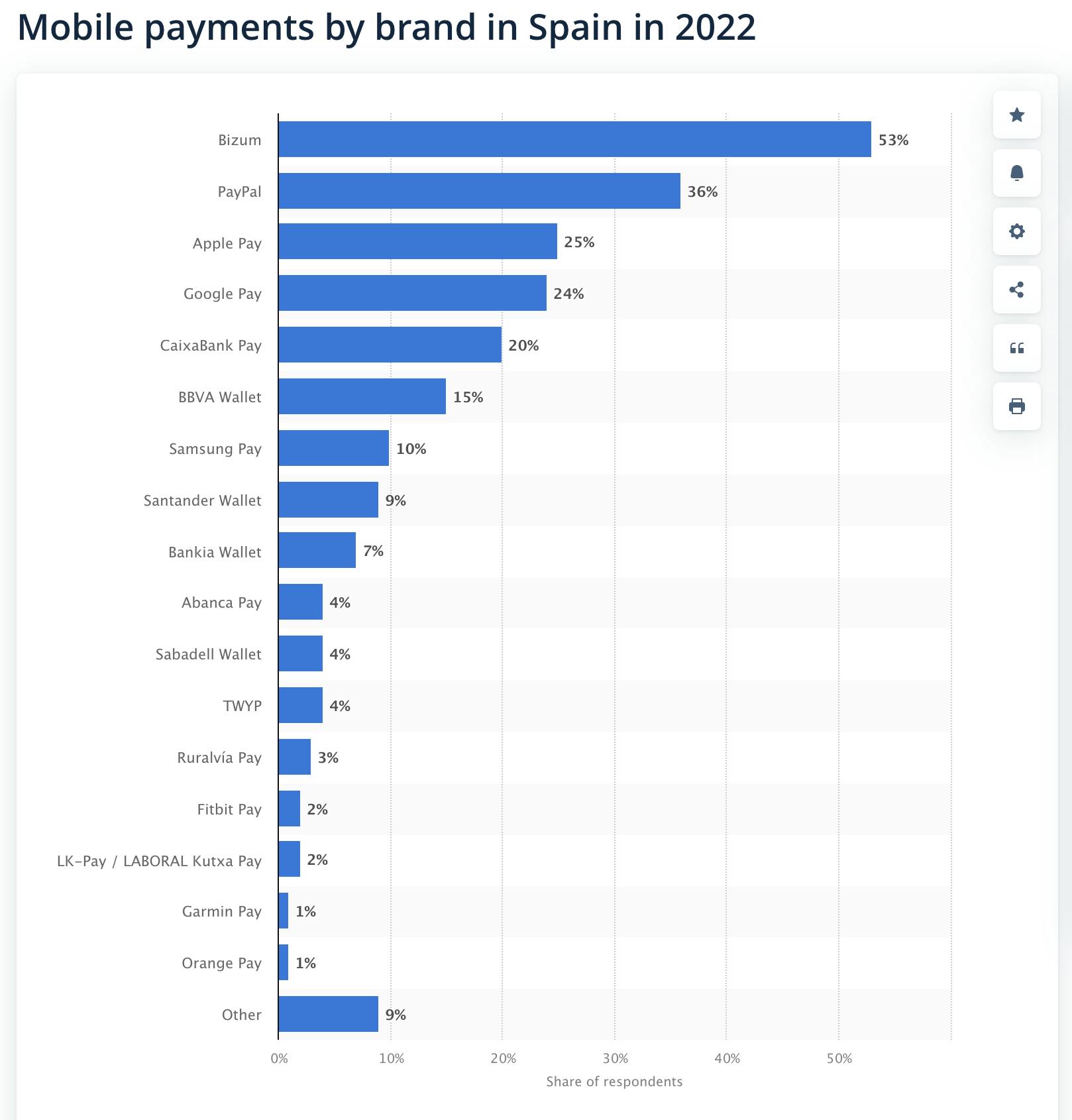

Approximately 85% of people globally own a smartphone in 2023, and more than 14 million people in Spain now use a mobile payment application.

Most people carry their phones with them everywhere, which is why mobile payment apps and mobile wallets have become so popular.

Customers can hover their NFC-enabled phone over a POS or another device that has NFC (like an iPhone), which will activate their payment app. Their encrypted debit/credit card details are passed from the phone to the payment terminal to complete the transaction.

For example, if the customer has an iPhone, they can either store card details in their Apple Wallet or use Apple Pay for quick and contactless NFC-enabled payments.

📚 Further reading: What are NFC Mobile Payments? All You Need to Know About This Contactless Payment Method

Chip cards

The radio wave symbol that’s on your NFC payment terminal is also on the back of NFC-enabled debit and credit cards. These cards have an EMV (Europay, Mastercard, and Visa) chip that exchanges data to make a payment. Contactless cards are the original tap to pay method and they’re still the most popular too.

Wearables

It's projected that the wearable payments devices market will be worth $82 billion by 2026. If your customer is wearing a smartwatch, bracelet, ring, or key fob integrated with NFC technology, they can tap or wave their device over the payment terminal to complete a purchase. And because there’s no need for a wallet or even a phone, this is the ultimate convenience for many consumers.

📚 Further reading: What are Instant Payments? (+ How They’re Changing the Industry)

What are the benefits of accepting tap to pay?

Shoppers want it. In fact, Spain saw the highest growth rate in contactless payments in Europe in 2021. Forty-one percent of customers in a Visa survey say they won’t shop at a store that doesn’t offer contactless payment methods. And in the UK alone, a record 91% of all card transactions made in 2022 were contactless.

Speeding up the checkout process

With tap to pay, a customer can walk into your store, choose what they want, and go to the self-checkout to pay all in under 10 minutes. You and your staff can spend more time helping shoppers when the payment process is quick and frictionless. In fact, it’s up to 10 times faster than other forms of payment.

📚 Further reading: Cashless Payments: Pros, Cons, How to Accept Them, & 8 Types

Boosting customer satisfaction and loyalty

Many of the benefits for businesses are also benefits for customers, such as an increase in speed, security, and convenience. All of these improve the overall customer experience, which, in turn, boosts customer satisfaction and loyalty.

Increasing sales

Imagine a customer who passes by your store at the end of a run. They want to buy a sturdy sports bottle for their next run, but they forgot their wallet. Just as they’re about to go home, they realize you accept tap to pay. Their watch, which just tracked their best time in a month, can now be used as a contactless payment method, they don’t feel at all inconvenienced, and you didn’t miss out on a sale.

Improving payment security

According to a European Central Bank survey, payment safety and security are essential among European consumers. Here’s how accepting tap to pay can help improve payment security:

- Encryption. Every time a tap to pay payment is made, the encryption changes, making it extremely difficult for a hacker to take advantage. Even if they manage to decipher a code, it’ll be too late as it’s only valid for one transaction.

- Tokenization. When a contactless payment is made, an algorithm generates a unique random value, which replaces a customer’s primary account number (PAN). The value, also called a token, passes safely through the internet, without exposing the customer’s credit card details.

- Two-factor authentication. Apple Pay and many other mobile payment methods ask you to set up two-factor authentication (2FA) to verify each transaction with a Face ID, PIN, or fingerprint. So even if your phone is lost or stolen, there’s no way someone else can use it for payment.

📚 Further reading: AI in Payments: How It’s Transforming the Industry

Accepting credit card payments without a terminal

Accepting contactless payments on your phone, means you can make transactions virtually anywhere, without a credit card terminal. This allows you to lower your expenses without the need for POS hardware or extra software. It makes the whole process faster and easier for customers too, which is likely to boost sales.

Attracting more customers

Different customers prefer different ways of paying. Many elderly people and some living in rural areas still prefer to pay with cash, but for millennials and Gen Z, digital wallets are becoming more common.

In fact, more than 5.2 billion people globally will be using digital wallets by 2026. In Spain, digital wallets and mobile payments like Bizum are the most popular method of payment in retail stores and restaurants. In the UK, 48% of respondents said contactless payments were their preferred choice.

Creating time for store staff

Manually processing cash and card payments can take up a large part of the day. Smaller lines and quicker transactions are great for customers but they’re also beneficial for store staff. A salesperson can help a customer make a choice, use a mobile POS to take the payment where they stand, and get straight on with the next part of their day.

📚 Further reading: What is Credit Card Processing and How Does it Work?

Types of businesses that use tap to pay

If you accept in-person payments, there’s a good chance that tap to pay is useful for your business. Let’s see which types of businesses already use it:

Brick-and-mortar retailers

For brick-and-mortar stores, large and small, it’s invaluable.

Let’s use Jaynie as an example. She walks into “Substance & Style” and is greeted by a staff member who discovers she’s already searched the website for a new handbag and submitted her email address for a 10% discount on her first purchase.

The benefits of omnichannel commerce mean Jaynie’s data is already in the system so the salesperson can immediately direct her to the handbag she’s interested in. Jaynie left her wallet at home but has her phone with her. She pays for her new purse using her mobile wallet and carries her phone home in her new handbag.

E-commerce brands experimenting with in-person sales (pop-ups or events)

Customers are used to the easy payment methods you offer in your e-commerce store, so if they come to your pop-up shop or your stand at an event, they’ll expect the same level of service.

Make the payment experience easier and faster for your customers by using an NFC-enabled payment terminal (a mobile POS or your smartphone) to accept tap to pay.

If you're just dipping your toes into physical retail before deciding if you want to open a permanent brick-and-mortar store, using a mobile payment app that supports contactless payments is a great money-saving solution. All you need is your phone and you can skip the hassle of purchasing expensive POS hardware.

📚 Further reading: How to Accept Card Payments on Your Phone

Restaurants

Your staff serves the finest dessert, followed by an espresso to finish the evening off perfectly for your customers. All that’s left to do is pay the bill. Thankfully, that’s easy too. The waiter takes out a smartphone, your customer pays seamlessly, and everyone leaves with a smile on their face.

Food trucks

Have you ever been to a festival at lunchtime? There are always a lot of options to choose from. The stalls with big queues are tempting because there must be a reason why everyone’s going there. The empty food trucks might be amazing but you wonder why no one’s going there.

Then there’s the truck with a steady flow. It’s just as busy as the truck with a large queue but everyone’s ordering and paying quickly, mainly because the business lets customers tap their credit card or mobile device over the payment terminal to complete their purchase in seconds.

Taxi drivers

Many customers don’t carry cash anymore. As a taxi driver, you’ve probably experienced waiting for a passenger to get cash from an ATM or to find some in their house, possibly never to return. A better way is to simply pass the NFC terminal (or your NFC-enabled smartphone) to the passenger in the back seat and collect payment.

📚 Further reading: Taxi Card Payments: A Simple Guide to Accepting Cashless Payments in Your Taxi

Service-based businesses

House cleaners, plumbers, electricians, personal trainers, or [enter your service], you all need to accept payments. A fast, secure, and convenient method of payment is tap to pay and it’s perfect when you’re on the go. You provide a great service, your customer pays with a tap, and you can quickly move on to your next job.

How to accept tap to pay at your retail store, restaurant, in your taxi, or on the go

There’s more than one way to accept tap to pay. Let’s see the most common methods:

Chip reader

First introduced in the UK in 2003, Chip and PIN readers have evolved to accept contactless payments, with the first contactless credit card appearing in 2007. As long as your Chip reader, which is also known as a chip card reader or chip card terminal, has the contactless symbol, you can use it.

Tap to Pay on iPhone

With Tap to Pay on iPhone, you can securely accept contactless payments by adding a mobile payment app to your phone. You don’t need to purchase any extra POS hardware for this. Simply install the app and start selling products wherever you are using your phone to accept various payment methods.

📌 Get on the waitlist: With MONEI Pay, you can accept QR code payments from your phone. But we’re working hard to enable NFC payments soon. Sign up for MONEI now to be notified when tap to pay is available. And while you’re waiting, start accepting cards, Bizum, Apple Pay, and Google Pay from your Android or iOS smartphone.

Tap to pay on Android (also known as Tap to Phone)

The technology is also available for Android and works in a similar way, but for Android devices, it's referred to as Tap to Phone (TTP). All your customers have to do is tap their smartphone or wearable (with a mobile wallet installed) over your NFC-enabled payment terminal to complete the payment.

Tap to pay on a tablet

As long as your tablet has NFC functionalities and you have the right payment app installed, you can also accept contactless payments. Tablets can be especially useful in brick-and-mortar stores, where you can use them as a sales tool and collect payment at the same time.

Accept tap to pay from your phone with MONEI Pay

Now that you know what tap to pay is, its benefits, how to use it, and the types of devices it works with, it’s a good time to introduce it to your business. With MONEI Pay, you’ll soon be able to take tap to pay payments from your phone. Sign up here and you’ll be notified once it’s available. And in the meantime, digital QR code payments (also via MONEI Pay) are a great contactless alternative.

Tap to pay FAQ

How does tap to pay work?

It uses Near Field Communication (NFC) technology. When a customer taps their smartphone, wearable, or card on an NFC-enabled device, the payment information is transmitted wirelessly, allowing for a quick and seamless transaction.

What do I need to accept tap to pay at my business?

You'll need a point of sale or card reader that is NFC-enabled. Soon, you’ll also be able to accept tap to pay transactions via MONEI Pay. Subscribe to get notified when NFC becomes available.

Is tap to pay safe for my customers to use?

Yes, it's generally considered safe. Encryption protects your customer's information, and because the credit card, debit card, or device never leaves the customer's hand, it can reduce the risk of physical card theft.

Will accepting tap to pay increase my transaction fees?

At MONEI, contactless payments have the same transaction fees as regular card payments, but other providers might have a different fee structure.

What if a customer tries to tap a card or device that isn't enabled for contactless payment?

If a customer attempts to tap a card or device that isn't enabled for contactless payment, the transaction will not process. They will need to insert or swipe their card or use another payment method.

Are there transaction limits for tap to pay purchases?

Some banks or payment processors may have a limit on the amount for a single contactless transaction. However, the limit can vary by country, bank, or payment network. For example, contactless payments in Spain have a €50 limit, in the UK, there is a £100 limit, and the US has a $200 limit.

Do all customers have NFC technology enabled on their cards or smartphones?

Not necessarily. It depends on whether their bank or card provider supports contactless payments. If the card has an EMV chip, it can be used for tap to pay transactions. Not all smartphones are NFC-enabled by default so customers may need to configure the settings. However, with digital wallet apps like Apple Pay and Google Pay, once the customer sets up their app and adds payment methods, contactless transactions should be possible without further setup.

Can customers use tap to pay for online transactions?

No, it’s for in-person transactions only. However, many digital wallets, like Apple Pay or Google Pay, can also be used for online transactions.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).