How to Accept Card Payments on Your Phone

Whether your business is run entirely on the go or you have one or many permanent physical locations, the ability to accept card payments on your phone can make a difference in sales revenue and customer satisfaction.

Mobile payments not only reduce checkout queues, but they also let you accept contactless card payments anywhere in your store or while you’re on the move. Sounds simple, right? That’s because it is.

Read on to learn how to easily accept card payments on your phone while saving time and money and keeping your customers happy.

Table of contents

- How to accept card payments on your phone

- 6 Benefits of accepting card payments from your phone

- What types of businesses accept contactless payments on Android or iPhone?

- What does it cost to accept card payments from your phone?

- Are mobile credit card payments and processing secure?

- Start accepting card payments on your phone

How to accept card payments on your phone

Point-of-sale hardware and software is often expensive and limiting if your business is mobile. The best (and easiest) way to accept payments from anywhere (either in your store, at your restaurant, or on the go) is with your mobile phone. But how can you do this?

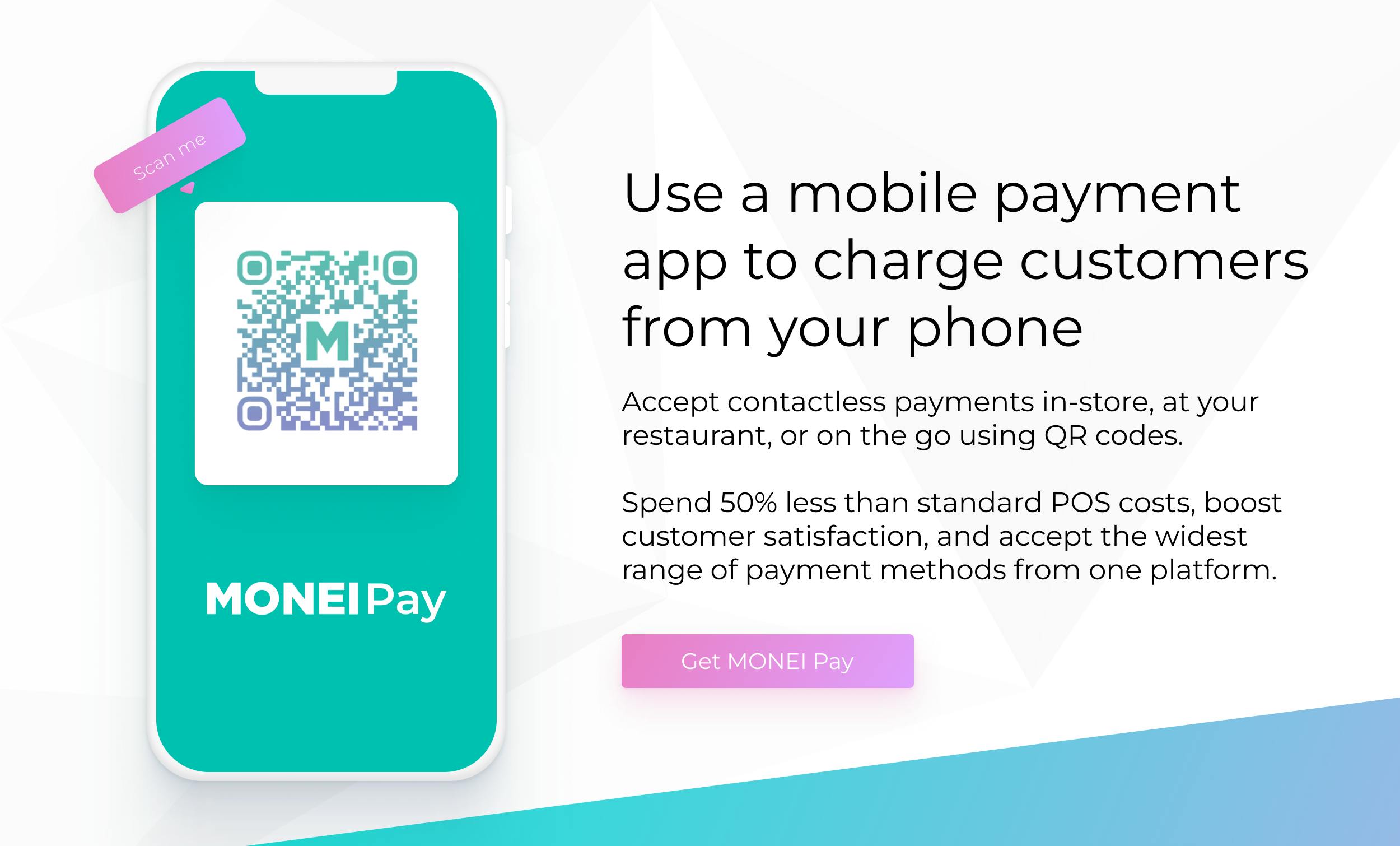

Use a mobile payment app to take payments on your phone

A mobile payment app is exactly what it sounds like. Depending on the payment service provider (PSP), you can download the mobile payment app to your iOS or Android device to accept payments from your smartphone. Some mobile payment apps may require you to manually enter the customer’s card details, but the better ones will help you accept contactless payments on your phone either via QR codes or near-field communication (NFC) technology.

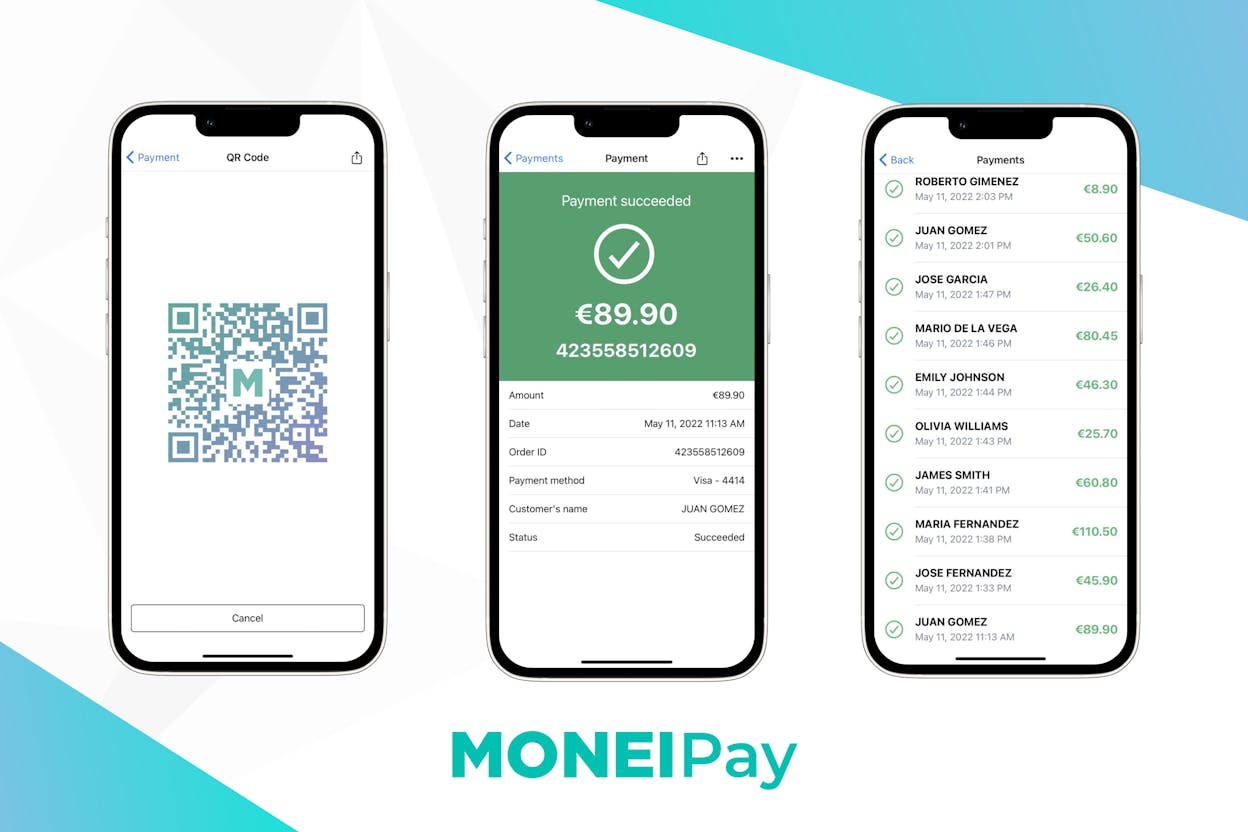

How to accept credit card payments on your phone in five simple steps:

- Open an account with a payment service provider

- Open the mobile payment app on your phone

- Create digital QR code payment or send payment links via email, SMS, or WhatsApp

- Have the customer scan the QR code to pay with their smartphone or finish the transaction via Pay By Link

- The customer can choose to have a digital receipt sent via email or SMS

A mobile payment app that has scan to pay or Tap to Pay technology comes with many benefits including speeding up the payment process for you and your customers. Let’s take a look at all the upsides of accepting mobile payments.

6 Benefits of accepting card payments from your phone

With the right mobile payment app, accepting card payments from your phone has many advantages for your business and your customers. Here are some of them:

1. Accept card payments from anywhere

Whether you have multiple retail stores or restaurant locations, or mostly sell online, but want to experiment with physical retail via pop-up shops and events, using a mobile payment app to accept payments on your phone means you can sell virtually anywhere.

Make your in-store checkout mobile by equipping store staff with a mobile device to take QR code payments from any point in your shop, or start selling in person without an upfront investment on expensive POS hardware.

2. Lower your expenses

Without the need for POS hardware and the software required to process payments, you’ll reduce operating expenses and save money to reinvest in your business. Costs for POS systems can range anywhere from €20 (for the most basic) to €300+ for advanced options. But depending on the PSP, a mobile payment app usually has lower monthly or daily fees. Transaction fees can range, but with MONEI Pay, they’re only 0.65%.

3. Improve the customer experience

Cashless countries are increasingly common. In fact, according to our latest payment trends report, nearly 80% of Spanish consumers use cards for payment. So making sure you can accept card payments regardless of where you’re selling from is crucial.

📚 Further reading: Cashless Payments: Pros, Cons, How to Accept Them, & 8 Types

4. Boost sales

Making the payment process easier and faster for shoppers can only lead to good things. The more convenient it is to pay, the more likely shoppers are to complete the process. Whether it’s at an event or in your store, using a mobile payment app to accept card payments from your phone can help reduce queues and increase conversions.

📌 Pro Tip: Boost sales with a mobile payment app that lets you accept a wide range of payment methods. Use MONEI Pay to accept card payments, Apple Pay, Google Pay, Click to Pay, and Bizum from your phone.

5. Better payment security

PSPs must be PCI compliant and also come with other built-in payment security features like 3D Secure authentication. Using a mobile payment app to accept card payments from your phone is one of the most secure and reliable ways to prevent fraudulent transactions.

6. Track sales on the go

With the right mobile payment app, you can manage your business on the go. View transaction history, issue refunds, and generate digital QR codes to accept contactless in-person payments.

📌 Get Started: Keep a pulse on your business from anywhere with MONEI Pay. Download the mobile payment app to your Android or iOS phone.

What types of businesses accept contactless payments on Android or iPhone?

There’s really no right or wrong answer here. If you sell products or services and want to easily accept card payments from your phone, a mobile payment app is the best way to get started. Here are some of the most common use cases:

Retailers

Whether you have a boutique or multiple retail locations, accepting card payments on your phone — or equipping your staff with mobile devices to take payments — improves the customer checkout experience. Setting up mobile payments in your retail store means you don’t have to use up space in your shop for a checkout counter. You can turn any store area into a point of sale and use every square meter of your space to display merchandise.

Restaurants

Using a phone to take payments at your restaurant eliminates the need for bulky, expensive, and sometimes unreliable restaurant POS hardware. It’s also more convenient for your waitstaff and customers. Servers can take orders and process payments from the same device, groups can easily split payments, and transaction fees are usually less than traditional restaurant POS systems.

Food trucks

Having a way to accept card payments from your phone is vital for food trucks and other street vendors. The last thing you want is a customer who’s waiting to try your delicious food, and then there’s no way for them to pay. With a mobile payment app, you can let them scan to pay using digital QR codes and complete the payment in seconds using a credit card, Bizum, Google Pay, or Apple Pay.

📚 Further reading: How to Choose the Best Credit Card Payment App

Taxi drivers

Whether you’re a solo taxi driver or run a taxi business with a fleet of drivers, accepting card payments from your phone means you won't have to deal with sorting cash, giving customers change, and storing large amounts of money in the vehicle. Use a mobile payment app to take taxi card payments from your phone or another mobile device. It’s faster, more secure, and improves the customer experience.

📌 Pro Tip: Manage your taxi card payments with the MONEI Pay app. Download the mobile payment app to your mobile device (Android or iOS). Generate digital QR codes (to accept contactless in-person payments), view transaction history, and keep a pulse on your business from anywhere. Get MONEI Pay ››

Freelancers

Whether you offer personal training, cleaning, or marketing services, accepting card payments from your phone means you can walk away from a job knowing you’ve already been paid. You won’t have to follow up with an invoice and payment details. Just open your phone, create a payment, and then your customer can scan or tap to pay in seconds. And if you’re an online freelancer, you can still use your phone to create payment links and email them to your customers.

📚 Further reading:

- How to Be a Freelancer in Spain (+ 6 Mistakes to Avoid)

- 6 Must-Have Payment Methods for Freelancers

- Quickstart Guide to Accepting Apple Pay for Small Business

- Payment gateway for small business: everything you need to know

What does it cost to accept card payments from your phone?

Accepting card payments from your phone is up to 50% cheaper than using a traditional POS system. You don’t have to invest in expensive hardware and software to operate it. All you need is your smartphone or another mobile device, a mobile payment app, and Wi-Fi or internet connection. With MONEI Pay, monthly rates and transaction fees are minimal. Plus you can use all features and integrations and adding additional users to your account is less than €0.20 per day.

Are mobile credit card payments and processing secure?

Accepting card payments from your phone is frictionless, contactless, and also 100% safe — especially when you use a payment service provider that’s PCI DSS Level 1 compliant.

It’s also more secure than carrying cash which you can lose or have stolen. With a mobile payment app, transactions are processed in real time and funds are deposited into your business bank account within 24 hours.

Start accepting card payments on your phone

Now that you know how to accept card payments on your phone, the benefits of using a mobile payment app, and the potential costs to be aware of, it’s time to get started.

🚀 Join MONEI today to accept payments on your phone. All you need is your smartphone to experience the convenience, security, and speed that comes with accepting mobile payments anywhere.

Accept card payments on phone FAQ

What is a mobile card payment system?

A mobile card payment system is a method of accepting payments on your smartphone or tablet. This can be done using a card reader or mobile payment app like MONEI Pay, for example.

Do I need a special device to accept card payments on my phone?

You might with some providers, but not with MONEI Pay! Just use your smartphone or tablet and download the MONEI Pay app. Then you can accept QR code payment without any additional hardware.

What fees are involved in accepting card payments on my phone?

Is it secure to accept card payments on my phone?

Yes, mobile payment systems use encryption to ensure the security of card transactions. However, as a merchant, you also need to ensure that you keep your device secure and comply with the Payment Card Industry Data Security Standards (PCI DSS).

Can I accept contactless payments or mobile wallets on my phone?

Do I need internet access to accept card payments on my phone?

Yes, in most cases, you will need an internet connection, either via Wi-Fi or a mobile data network, to accept card payments on your phone.

How do I receive funds after processing card payments on my phone?

After you've processed the payment, the funds are deposited into your business bank account. Settlement times can vary depending on the status of your account and the PSP. Some services offer instant or next-day deposits, while others may take a few business days.

Can I issue refunds from a mobile payment app?

With MONEI Pay, you can. It’s possible to issue both full and partial refunds and it’s easy to do, so you can make sure your customers have the best possible experience.

Can I track sales using a mobile card payment system?

Yes, most mobile payment apps have features that allow you to track sales history, making it easier to monitor your business' performance.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).