Payment Trends in Spain Q2 & Summer 2022

Mobile payments are the future, and we have the data to prove it.

Consumer payment behavior is constantly evolving. That’s why we regularly analyze our merchants’ sales data and share quarterly payment reports to help you stay competitive, boost customer satisfaction, and increase conversions.

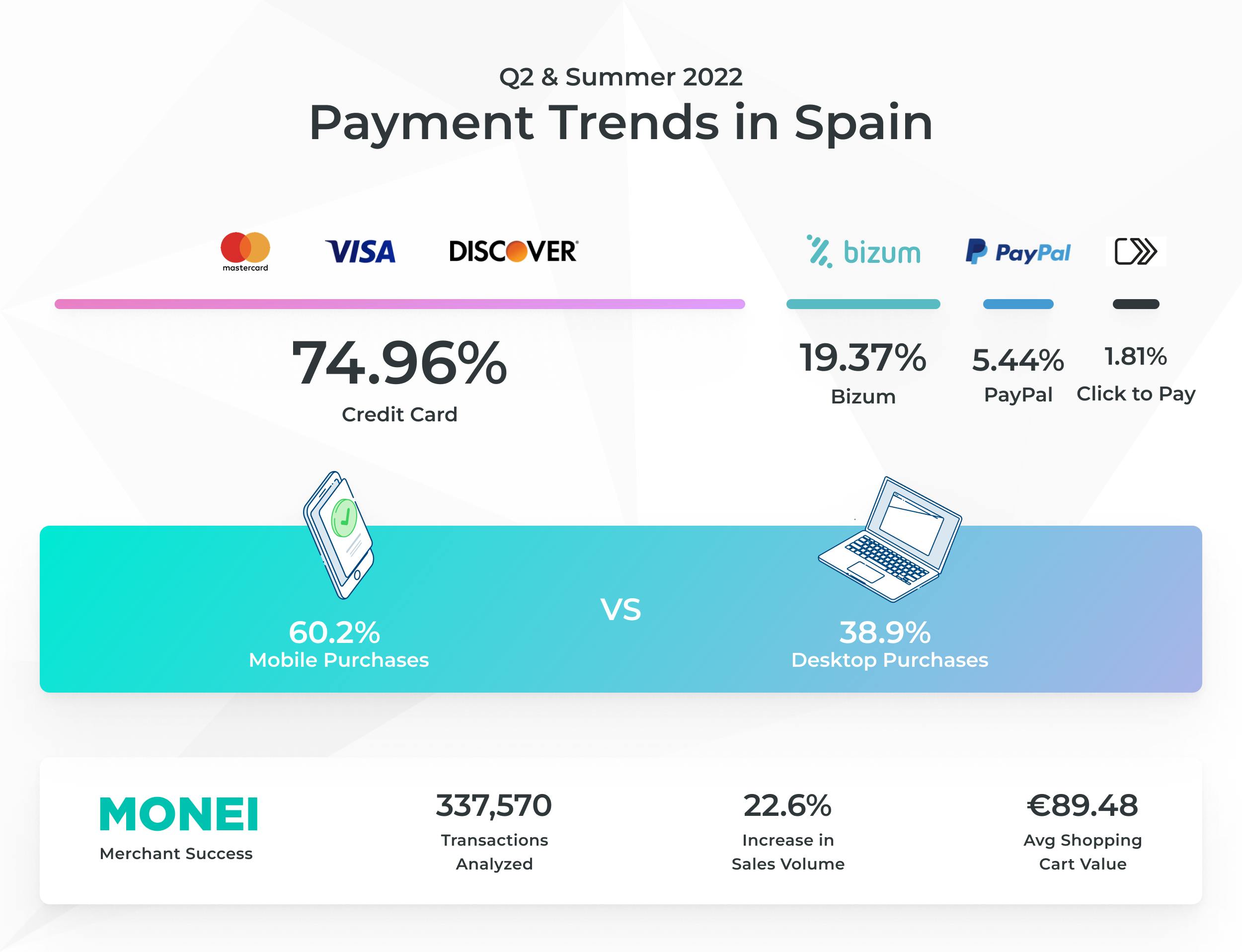

This time, we analyzed 337,570 successful transactions made during the last twelve months to present the findings from April through August 2022.

💡 Looking for more recent payment data? Check out our 2022 and Q1 2023 Payment Trends in Spain report.

Key takeaways according to MONEI's quarterly payments report:

- Mobile shopping has grown from 49.49% market share to 60.2% in just one year

- Average order value (AOV) has fallen by more than €10 in one year, while the number of transactions has remained stable

- Click to Pay starts an upward trend and is already close to 2% of the market share

Mobile payments overtake desktop payments as the primary device used by Spaniards for online payments

The report reveals that consumer preference for mobile is increasingly clear: it has increased from 49.49% market share in the second quarter of 2021 to 60.2% in the summer of this year.

Mobile purchases now account for more than half of the market share, while desktop purchases dropped from 48.28% to 38.87% in the same period. Tablets remain in the background, failing to exceed a 2% share.

Economic uncertainty can already be felt in online purchases, which averaged €86.56 during the months of July and August. This is €13 less than the average order value compared to the same period last year and €5.84 less than in the months of April, May, and June. During Q2 of 2022, the AOV was €92.40, down from €99.52 in Q1 of the same year.

"This report helps online retailers better understand their customers and improve their experience," says Alex Saiz, founder and CEO of MONEI. “Similarly, we see how Spanish consumers are preparing for a possible crisis and have reduced average spending on purchases. This is not only a reflection of the current situation, but it also predicts what we will see in the future.”

Key payment method trends in Spain

Spain payment method trend 1: Card payments decrease

Credit cards remain in the lead, accounting for 74.96% of purchases made in the summer. But this figure confirms a downward trend since 2021. There has been a big drop compared to the 84.27% it boasted in the same period last year.

Spain payment method trend 2: Bizum payments begin to flatten

Bizum continues to grow and holds a 19.37% market share, but its popularity is increasing at a slower pace. It jumped from 6.72% share in 2021, but in recent months, it has only gone up by 0.54% compared to the second quarter of 2022 and by 3.37% compared to the first quarter.

Spain payment method trend 3: Digital wallets are steady with Click to Pay growing

PayPal, Apple Pay, and Google Pay remain stable, although none have managed to exceed 6% share.

Click to Pay, meanwhile, is on an upward trend: from no significant representation in 2021 to 0.88% in the second quarter of 2022 and 1.81% during the summer months.

📚 Further reading: MONEI and Mastercard Join Forces to Introduce Click to Pay, the Technological Solution that Speeds Up Online Purchases

Diversify your payment stack

Accepting card payments remains essential. But it shouldn’t be the only online payment method available on your checkout page. Adding alternative and local payment methods to your online store is crucial, especially if you have (or want to have) international customers.

That’s why we make it possible to accept a wide range of payment methods using only one platform.

Direct debit or bank transfer payments

E-wallet or digital wallet payments

Peer-to-peer payments (P2P)

- Bizum

- SOFORT

Buy now, pay later (BNPL)

- Cofidis

- Klarna

Merchant success

As we already mentioned, customer AOV has decreased, but our data proves that overall merchant sales volume continues to increase (22.6%) when compared to previous periods. Online businesses are growing steadily amid economic uncertainty, and physical retail is also coming back to life.

📚 Further reading:

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).