7 Benefits of Multiple Payment Options For Businesses

In today's fast-paced e-commerce landscape, flexibility and convenience are not just luxuries — they are necessities. As a business owner, you're always on the lookout for strategies to enhance customer satisfaction and boost your bottom line. Enter the world of multiple payment options, a game-changer in checkout optimization.

Whether you're a small startup or an established online retailer, understanding the impact of payment flexibility can be a pivotal step in your business journey.

Read on to learn the benefits of multiple payment options, the risks of not accepting the right ones, and how to add more payment methods to your business.

Table of contents

- 7 Benefits of multiple payment options

- The risks of not offering multiple payment methods

- Integrating multiple payment options

- Accept multiple payment options with MONEI

7 Benefits of multiple payment options

Offering multiple payment options not only benefits customers, it also has many advantages for your business. Let’s see what they are:

1. Maximize conversion rates

Imagine a customer experience where they see five products they absolutely love, add them to their basket, and go to the checkout, only to find that they can’t pay because, Bizum, their preferred payment method isn’t available.

The likelihood is they’ll leave your site and find the products they want somewhere else. If they can complete the transaction the way they want, you’ll make the sale and increase your overall conversion rates.

2. Increase customer loyalty

When customers know they have the option to pay however they like, they’re much more likely to shop with you again. It’s simpler, quicker, and more convenient for them and increases the chance of stronger customer loyalty for you.

3. Reduce abandoned carts

You’ve already seen how you can maximize conversion rates and the added benefit is reducing abandoned carts. According to a Baymard survey, 11% of respondents would abandon their cart if there weren’t enough payment methods. Instant payments, where customers can Click to Pay, for example, expedite their experience and reduce the likelihood of them looking for products elsewhere.

4. Improve customer experience

Accepting multiple payment options improves the overall customer experience by reducing friction so shoppers can complete transactions quickly and with their preferred methods.

5. Enhance brand perception

Brand perception is all about the way customers and other stakeholders feel when they see something associated with your brand, like a logo or your business name. When you offer customers multiple payment options at checkout, it enhances their perception of your brand.

6. Appeal to a wider demographic

Different customers prefer different payment methods. Some like to use traditional credit or debit cards, others prefer direct debit or bank transfers, like iDEAL, and increasingly, more customers want to pay with an e-wallet or digital wallet, like Apple Pay or Google Pay. That’s before we even consider mobile payment apps like Bizum.

With so many predispositions, offering one or two payment methods could be enough for the majority of your current customer base but if you want to reach new customers and appeal to a wider demographic, you need to offer more options.

📚 Further reading: Black Friday Cyber Monday Payment Trends (2023)

7. Make the checkout process easy

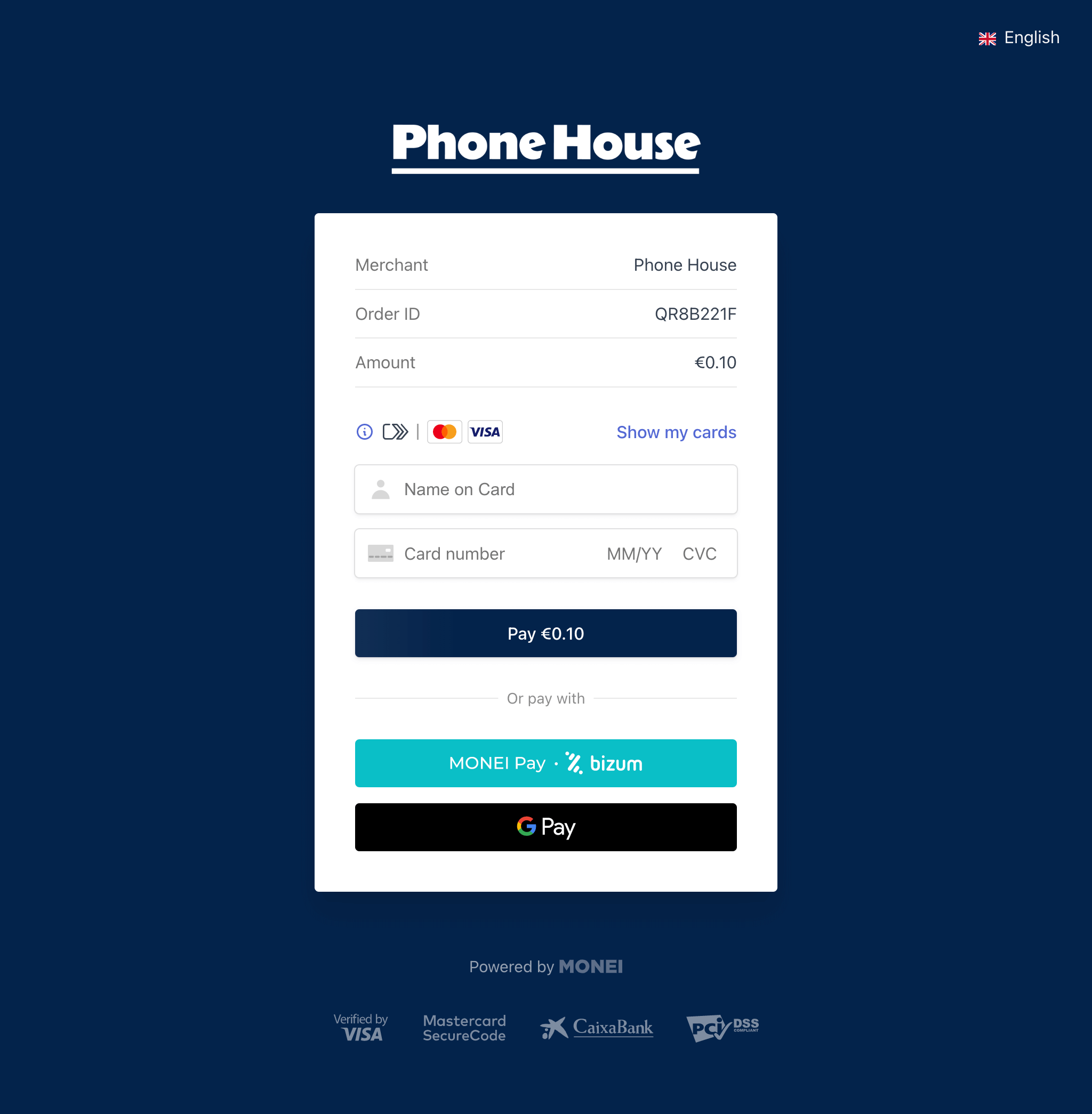

Offering multiple payment options makes checking out easier for your customers. Everything they need is waiting at the checkout page for them so they can simply click through to the option that makes sense. It’s hassle-free and encourages repeat purchases.

The risks of not offering multiple payment methods

If you don’t accept multiple payment options, customers might shop elsewhere, which means you lose sales, but even worse than that, they may never come back. They could also share their bad experience with friends, family, or in reviews, causing you to lose out on other potential customers going forward.

Integrating multiple payment options

With so many benefits, it’s important to understand how to integrate multiple payment options into your business. There are different ways to achieve this, so you need to work out the best solution.

Understand customer needs

Research and use data to identify your target customers’ preferred payment methods. They often differ by location and sometimes change depending on the region or the business type, so it’s worth knowing exactly which options your customers want to use.

📚 Further reading: Local Payment Methods: The Ultimate Guide for E-commerce Merchants

Work out the costs

Different fees apply to each payment method, depending on the type and the quantity of transactions. Your PSP (payment service provider) and the plan you go for make a difference here too. Choosing the right payment gateway based on your business needs can save you a lot of money and make your life easier too.

Comply with security best practices and regulations

Whichever payment methods you choose to accept, your business must be compliant with security measures. The best way to do this is to choose a PSP that has built-in security like PSD2, 3D Secure checkouts, and strong customer authentication.

📚 Further reading: Secure Payments: How to Accept Them Online and In-Person

Integrate with a payment gateway

The right payment gateway makes accepting multiple payment options easier and cost-effective. It’s important to choose one that matches your needs. If you operate across multiple countries, make sure you have the option to accept local payments wherever you are. For example, the preferred mobile payment solution in Spain is Bizum, and Portugal’s favorite mobile payment method is MB WAY.

📚 Further reading: How to Choose the Best Payment Gateway for Your E-commerce Business

Accept multiple payment options with MONEI

To keep up with consumer demand, you need to accept multiple payment methods and as you’ve learned, there are numerous benefits. Choose a PSP like MONEI to quickly and easily offer customers their preferred payment options from a single platform.

Multiple payment options FAQ

What is an example of a multiple payment?

Instead of using a single payment method, your customer can choose between two or more options to complete a transaction. In certain situations, you might even have one customer using two payment methods to finalize one transaction. They might need pens for home, which they pay for using Bizum, and pens for the office, which they purchase using a business credit card.

Why is it important to have multiple payment methods?

Multiple payment methods have numerous benefits, including maximizing conversion rates, increasing customer loyalty, reducing the chances of an abandoned cart, and improving the overall customer experience. Plus, if you don’t accept a range of options, your potential customers might prefer to go to a business that does.

What is the most common payment method?

Customers want the option to pay in multiple ways, from Bizum to Apple Pay to Google Pay and iDEAL, but credit cards are still the most common payment method in Spain.

How can I configure multiple payment options with MONEI?

After your MONEI account has been approved, consult this support article to add more payment methods to your checkout.

What does multiple payment methods mean?

Accepting multiple payment methods means you offer your customers a selection of ways to pay for your goods, as opposed to only allowing credit and debit cards, cash, or bank transfers, for example.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).