MONEI allies with the Spanish Tax Agency to optimize the registration process for self-employed and businesses

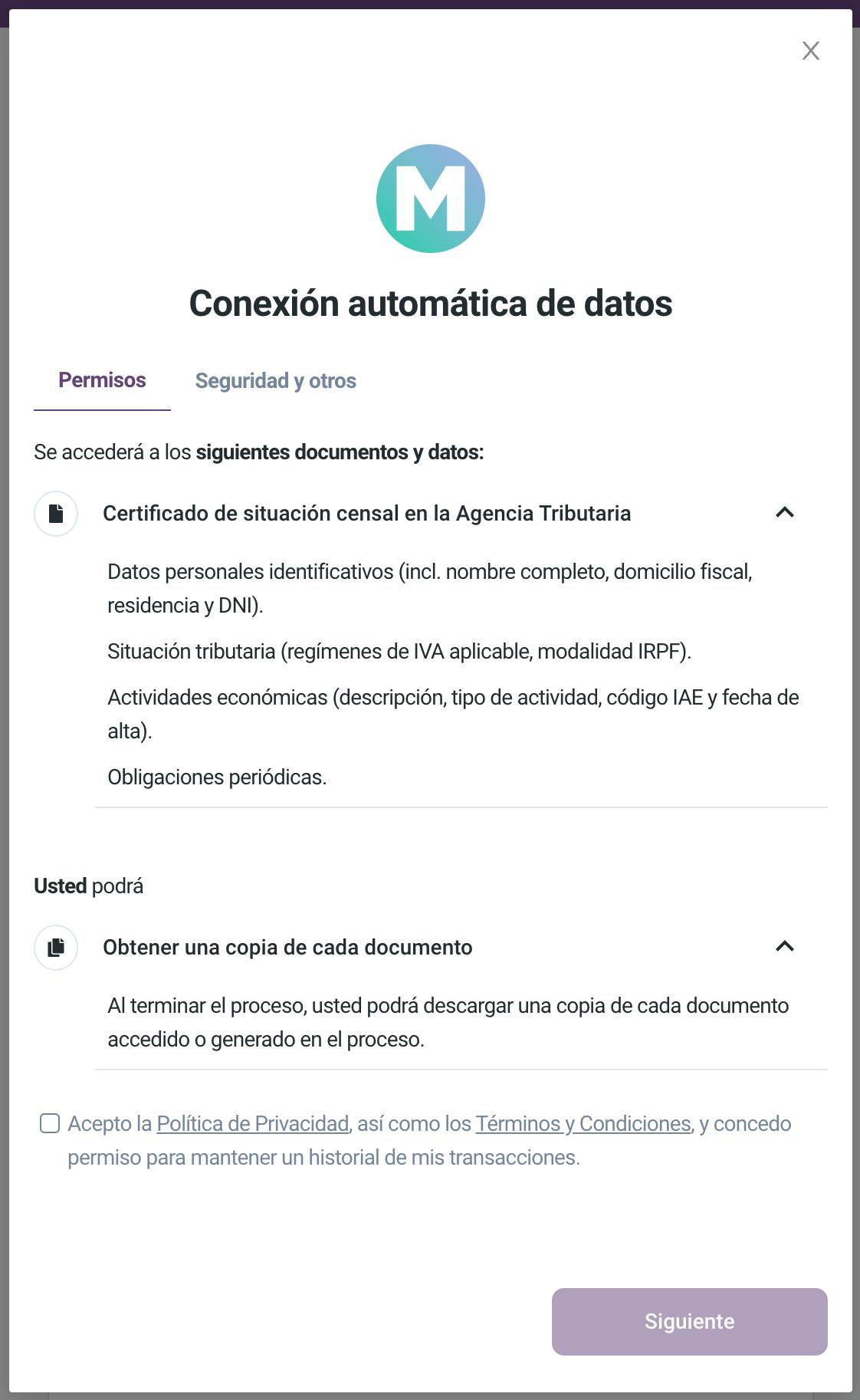

- This alliance allows MONEI users to automatically and immediately download their census certificate and extract all their data in real time.

- The service also has all the KYC -know your customer- processes fully automated so that the self-employed do not have to enter their data manually.

MONEI, the fintech that simplifies and streamlines digital payments, becomes the first payment gateway in Spain to connect with the Agencia Tributaria (Spanish Tax Agency) in real time to optimize the process of registering freelancers and businesses as customers. This new functionality allows the fintech to download immediately and automatically the certificate of census status of its potential customers, and extract their data with all the security guarantees. In this way, it is accredited that the applicant is up to date with its fiscal and tax obligations.

By being able to manage it directly through MONEI, users no longer have to make an appointment or go in person to the offices of the Tax Agency to request the certificate that certifies their status as self-employed. Thanks to this pioneering solution, a process that could previously take days and required proactive management by the self-employed can now be carried out 100% online and in a matter of seconds.

The alliance allows MONEI to optimize the integration processes required for merchants to expand their offerings with more payment methods through a single gateway. With this solution, the fintech ensures compliance with all regulations set by the Bank of Spain for registering freelancers while improving the user experience. The functionality has all KYC -know your customer- processes fully automated so that the customer does not have to insert their data manually and can start operating with MONEI instantly.

Alex Saiz Verdaguer, founder and CEO of MONEI, highlighted that this milestone "reiterates our commitment to optimize processes in the world of payments and allows us to offer more effective, convenient and easy-to-use solutions. This partnership represents a very significant moment as it is the first time that the Tax Agency has shared its data with a fintech and we are proud of the trust placed in MONEI. With this unprecedented solution, we once again demonstrate the potential of collaboration between the public and private sector; and these developments undoubtedly bode well for a more innovative, efficient and secure industry."

About MONEI

MONEI is a fintech that simplifies and speeds up digital payments. The company allows any entity to integrate with Shopify and other e-commerce platforms through a simple API. Thanks to its technology, both users and companies can combine more than 40 payment methods, local and alternative, through a single platform.

The omnichannel payments platform also has MONEI Pay, the first application (available on iOS and Android) that allows physical businesses to accept payments from their mobile phone by generating a digital QR code, thus eliminating the need for traditional POS devices at points of sale.

Likewise, the fintech integrates the MONEI Connect solution, which allows commercial platforms to manage and scale end-to-end payment experiences through a payment partner API. This tool has fully automated Know Your Customer (KYC) processes to facilitate the incorporation of new users into companies.

MONEI client funds are protected in safeguard accounts of supervised and regulated banking entities. The fintech is a member of several working groups within the European Payments Council and the European Central Bank. MONEI also has a payment entity license from the Bank of Spain, which allows it to carry out payment services, and have a contractual relationship directly with Spanish businesses.

👋 Want to receive more content like this? Subscribe to MONEI’s once-a-month newsletter to get a roundup of the latest articles about e-commerce, payments, and expert business tips.

MONEI

MONEI is the leading omnichannel payments platform in Southern Europe.