Lifetime Value (LTV): What is it? And How to Calculate It

Think that losing out on one sale is no big deal? Have you considered the long term cost? The LTV (lifetime value) could be more than you think.

A customer, let’s call her Hayley, goes into your competitor, looking for a new dress. They find the perfect style but their size isn’t on display, so they look for staff to help. Everyone ignores them and your competitor loses out on a €200 sale. More importantly, Hayley never comes back, making her LTV a big, fat €0.

She visits your store instead and although her size isn’t on display there either, your store staff find the perfect fit in the warehouse. Hayley buys the dress for €155 and comes back every quarter to buy a new treat at roughly €200 per visit. If Hayley continues this trend for 40 years, you’ll gain €32,000 that your competitor could have had.

In this article, you’ll learn what LTV is, how to calculate it accurately, and how to improve it.

Table of contents

- What is lifetime value?

- Points to consider before you calculate a customer’s LTV

- How to calculate customer lifetime value

- The importance of monitoring LTV

- 8 tips to increase customer LTV

- How MONEI can help you increase customer lifetime value

What is lifetime value?

Lifetime value is the total revenue you can expect from a customer’s first purchase to their last. This is called their buyer life. It’s necessary to understand how this relates to the cost of acquiring a new customer (CAC) to understand just how important LTV is.

Points to consider before you calculate a customer’s LTV

Before you calculate a customer’s LTV, you need to consider some important points:

- Loyalty. Customers have so many more options for most products and services than they used to. The competition that always existed on the high street is now online and it’s global. If you can gain loyalty from a customer, you'll have a significant source of revenue.

- Long-term thinking. A one-time sale feels great and it’s how many businesses used to measure the value of a customer. This meant customer support was often seriously neglected as the business already had money in the bank. They didn’t consider future sales and completely ignored the possibility of recommendations.

- Reduced CAC. Acquiring customers is expensive. The more customers you lose after one sale, the more investment you need to put across marketing, sales, and advertising to acquire new customers. Increasing the LTV of five customers could mean you only need three new customers to hit your monthly targets.

- Start early. Your product appeals to certain age groups but the sooner you bring a customer on board and the sooner you focus on making them stay, the more revenue you’ll earn over their buyer life.

How to calculate customer lifetime value

To calculate the customer lifetime value, you need to consider:

- Average purchase value. How much your customer spends on average per transaction.

- The average number of purchases. How many times your customer buys from you per year.

- The total customer lifetime. This could be in weeks, months, or years.

Now you have all the information for the simple lifetime formula (LTV formula):

LTV = Average purchase value number of purchases per year total customer lifetime in years.

Let’s see an example from an online jewelry store, called Jackie’s Jewelry, and a customer who frequently buys accessories. On average, they spend €45 per transaction, they make 15 purchases per year, and they have an expected customer lifetime of 30 years.

LTV = €45 15 30 = €20.250.

The importance of monitoring LTV

Your LTV is based on data and some assumptions. If a customer doesn’t buy from you for the number of years you expect or their average purchase value changes, their LTV changes too. Monitoring LTV allows you to better understand the actions that increase it and the actions that have a negative impact.

Another reason for monitoring is to increase budget prediction accuracy. If you know the average LTV and the average number of customers you sell to in a year, you’ll have a better understanding of your revenue.

🚀 Boost customer satisfaction and sales by accepting more payment methods. Join MONEI with no commitment to test integrations and payments.

8 tips to increase customer LTV

It’s important to understand a customer’s lifetime value but it doesn’t have to stay the same. With the right tips, you can increase it, which in turn increases your revenue, and improves your business growth. Here are 8 tips to improve customer LTV:

1. Maintain and improve product quality standards

Customers are far more likely to return and buy from you again if they’re happy with their previous purchases. If they buy runners from you that feel comfortable from day one and last for 400 miles, they’ll come back to you for their next pair.

2. Look after your customers throughout

Customer service isn’t sales. It’s definitely not about persuading a customer that you have the perfect solution for them, even when you don’t. It’s certainly not about offering the minimum legal requirement on returns. Customer service is about looking after your customers from the moment they consider buying a product from you to the moment that product is no longer of use.

If we take the example of runners again. Imagine a customer had a problem with lacing their shoes to suit their running style and they called your store for help. Your customer service person guides them and directs them to a YouTube video for future reference. That small gesture could keep them coming back to you forever.

3. Upsell and cross-sell

If you’re careful with how you upsell and cross-sell, it can be a great way to increase a customer’s average purchase value. Upselling allows you to add something that offers a little more value for a slightly higher price. Cross-selling is about offering complimentary products that benefit your customer and increase your revenue. The important element with both of these is that any add-on needs to be genuinely beneficial for your customer. If not, they might not come back and their LTV will decrease.

4. Give customers a reason to be loyal

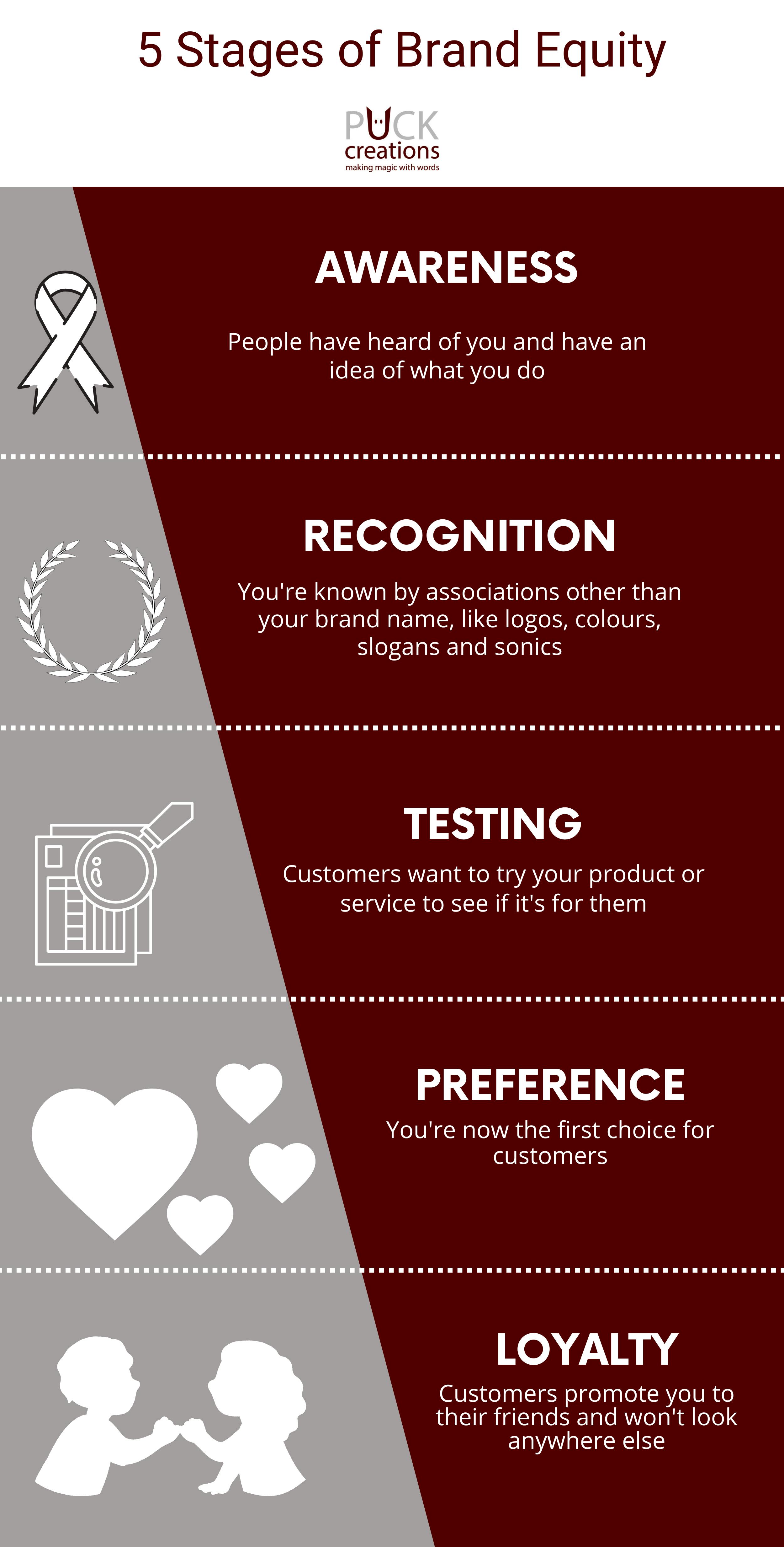

Brand equity is the value your brand has in the market. Once you get customers to the loyalty stage, they come back to buy from you regularly and they even start to promote you to their friends. This has a huge impact on LTV and needs to be one of the main objectives for any business.

5. Focus on brand marketing

As well as being a great tool for making potential new customers aware of your business, brand marketing also reminds your current customers who you are and why they bought from you in the first place. Send regular emails with tips and tricks, or ideas for how to use your products, release social media videos with customers taking advantage of the benefits of what you sell, and offer loyalty discounts to customers who buy regularly, or reminder discounts to those who haven’t bought for a while.

6. Make payments easy

Nothing is more frustrating for your customers than getting all the way to the checkout and not being able to pay because their preferred payment method isn’t accepted or the process is too complicated. Of course, it’s important to accept credit card payments but alternative payment methods like Google Pay, Apple Pay, and Bizum are more in demand than ever.

📌 Pro Tip: Accepting card payments is essential. But it shouldn’t be the only payment method you offer. Adding alternative and local payment methods to your freelance business is crucial. Use MONEI to diversify your payment stack from a single platform.

7. Listen

Something that’s often missed from the customer experience should be the most obvious is listening to your customers. They’re using your products, they’re entering your stores, they’re navigating your checkout process. If they tell you something is great, work out why and double down on it. If they say something could do with improvement, work out why and fix it!

8. Offer incentives to buy more regularly

Many supermarkets offer deals to incentivize their customers to buy more regularly or to spend more on each visit. For example, they might offer coupons to get a discount on crockery once you’ve collected enough stamps. The catch is you need to spend a certain amount before an impending deadline.

This often means that customers will spend more money on each visit to save money in the long run but the supermarkets are careful to still make a profit on the discounted products. One caveat is that you need to make sure any incentive is realistic and that you follow through. If a supermarket quickly runs out of discounted crockery, they’ll quickly lose customer loyalty and could reduce their LTV.

How MONEI can help you increase customer lifetime value

MONEI’s payment gateway gives you a detailed understanding of payments that supports monitoring customer LTV. With better monitoring, it’s easier to understand what works and what doesn’t in order to increase the customer lifetime value. Just as importantly, using MONEI as your payment processor makes transactions frictionless for your customers. They have more options to pay and are far more likely to return for a seamless experience.

Customer LTV FAQ

What is LTV per customer?

Customer LTV or lifetime value estimates the revenue your customer will generate from their first purchase until their last. It’s based on their average purchase value, their buying frequency, and the length of time they continue to be your customer.

What is the difference between CLV and LTV

CLV and LTV are used interchangeably but they’re not exactly the same. LTV studies the combined lifetime value of all customers and CLV looks at each customer’s net worth to the business. Both are important metrics that you can use to predict budgets and to support your business growth.

How do I find my customer LTV?

To work out your customer LTV, you need to know their average purchase value, how often they buy per year, and how long you expect them to buy from your business. With this information, you can calculate the average customer lifespan using the following lifetime value formula:

LTV = Average purchase value * number of purchases per year * total customer lifetime in years.

How do you maximize customer LTV?

To maximize customer LTV, your priority must be to keep customers coming back and buying from you. This starts with listening. Make sure you understand what your customers’ needs are and address them efficiently.

Make sure you maintain and improve quality standards, keep an eye on customer experience, upsell and cross-sell, give customers a reason to be loyal, focus on brand marketing, offer incentives, and make it easy for customers to pay if you truly want to maximize customer lifetime value.

Is customer lifetime value a KPI?

Yes, customer lifetime value is a KPI (key performance indicator). It measures the total value of a customer across their buyer lifetime. Improving this particular KPI is often easier than improving the cost of acquiring a new customer (CAC), so it’s a metric that’s worth monitoring and maximizing.

MONEI

MONEI is the leading omnichannel payments platform in Southern Europe.