Online Payment Failure: Why it Happens and How to Avoid it

Image source: Unsplash

None of us like to see an online payment failure message after we’ve spent time entering all our payment details at checkout. Going through the payment flow again doesn’t take long, but a failed transaction can also make you question how trustworthy the e-commerce store is. This ultimately leads to lost sales for merchants. In fact, 64% of e-commerce businesses rank failed payments as their top challenge.

Digital payments continue to be the most common way to make and receive payments. As an e-commerce business owner, failed payments are an issue that shouldn’t be neglected. Doing so can result in a poor customer experience, more abandoned cards, and lost sales revenue.

Table of content

- Why do online payments fail?

- What are the different types of payment failures?

- What causes online payment failure?

- Common online payment failure error messages

- 4 tips to help reduce failed payments

Why do online payments fail?

The easiest way to understand why online payments fail is to first take a look at the online payment process.

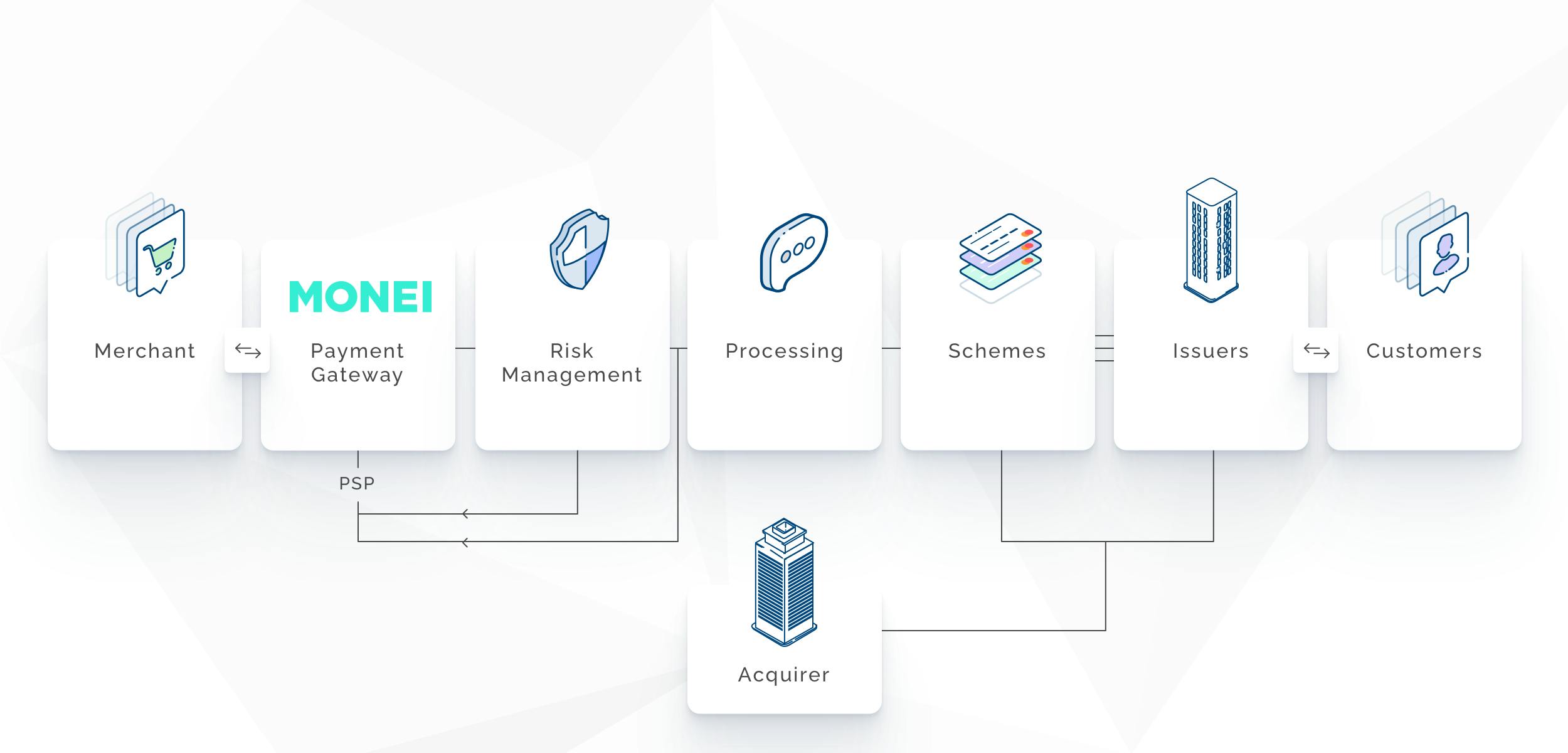

When the consumer starts an online transaction, the payment gateway facilitates the route to and from the payment processor. After running fraud checks, and 3D Secure confirmation, the card data gets sent to the acquiring bank (also known as the merchant acquirer). Then the acquiring bank securely sends the payment information to the card schemes. Also known as card networks (i.e. Visa, Mastercard UnionPay, JCB, and American Express).

After another round of security checks, the payment is sent to the issuing bank where it is then either approved or declined. Then a message is sent back to the acquirer and finally, the approved or declined payment message is sent to the merchant. All these steps happen in a matter of milliseconds.

📚 Further reading: 23 Must-Have E-commerce Website Best Practices to Help You Sell More

What are the different types of payment failures?

- Online payment failure from the consumer’s side. These types of errors can happen when a customer provides incorrect card details, the wrong one-time password (OTP), or they have insufficient funds in their account. It’s also referred to as an incomplete payment.

- Online payment failure from the merchant’s side. These types of failures can happen when there is a technology or security error that the seller is responsible for.

- Online payment failure when there is a data transfer error. This happens when the customer receives a payment failure message, but the payment eventually goes through so the cardholder’s account gets debited.

- Online payment failure when the amount is not charged. This means the payment failed and the customer’s account was not debited.

What causes online payment failure?

As we already mentioned, failed payments from the customer's side are sometimes caused by providing incorrect details or happen due to a lack of funds.

From the merchant’s side, the reasons are more complex, making it important to understand the causes in more detail.

System downtime

The players involved in online payment processing include the payment gateway, payment processor, acquiring bank, and issuing bank. These parties experience downtime, whether it’s planned for or not.

When this happens, the server can’t get approval for the payment, and the transaction can’t be completed, resulting in an online payment failure.

Further reading: Your Guide to Payments Terminology

Payment technology fails

As you saw in the online payment flow infographic above, payment processing involves a considerable amount of steps to debit the payment from the customer’s account and credit it into your business bank the merchant’s account.

When your customer starts the payment process, they need to select a payment method (credit card, Apple Pay, Google Pay, Bizum, installment payments, etc.), and after choosing the payment option they need to input payment details. For example, their name, credit card number, and CVV (i.e. credit card security code).

Then the payment data is sent to the payment gateway, so it can transfer it to the card network. After the details are verified and the transaction is authorized, the amount is sent to the acquirer, and then transferred to the merchant’s account.

If a small failure happens during any one of these steps in the payment process, the customer will receive an error message, and the transaction won’t be completed.

📌PRO TIP: Unlike Resdsys, MONEI is a reliable payment gateway that has the option to route payments to the best-performing provider, resulting in more successful payments and fewer false payment failure errors. Learn why MONEI is the best Redsys alternative. ✅

Security is compromised

Virtually every player involved in online payment processing is required to uphold security requirements to detect and avoid online payment fraud.

Banks, including issuers, are armed with advanced technology that detects and analyzes fraud.

These fraud tools verify and analyze if the online transitions are authenticated based on previous spending patterns. If something seems out of place, the transaction is blocked and declined.

There are a few common red flags that cause transactions to be blocked or declined:

- Bank Identification Number (BIN) is blacklisted. A transaction can get denied if the BIN on the card is blacklisted. Blacklisting tracks and records cardholders who show inconsistent activity. Then the system uses filters to identify customers who aren’t trustworthy. If there are any red flags, the authenticity of the shopper’s transaction is checked.

- The maximum transaction limit is surpassed. Some merchants set a maximum transaction amount and if the limit is exceeded the transaction may be declined by the payment gateway.

- There is a security threat. Suspicious activity from the issuing bank’s side that threatens security can result in a blocked or declined transaction.

Additional reasons for online payment failure

- Merchant account blocks the transaction

- Credit or debit card is expired or canceled

- The billing address is invalid

- The bank flagged the cardholder’s account

- The customer’s credit card is maxed out

- The payment gateway is not configured properly

- The consumer’s account is suspended or closed

- The payment gateway does not support the online payment method chosen by the consumer

📚 Read also: A Simple Guide to Accepting Credit Card Payments Without a Merchant Account

Common online payment failure error messages

Understanding online payment failure messages and when they occur can help you manage customer complaints and pinpoint recurring issues.

Here are the most common error messages to be aware of:

- The transaction cannot be authorized. This error message usually occurs when the password or OTP is wrong.

- Signature validation failed. This error message appears when the 3D signature is wrong. A 3D signature is required from the cardholder to validate the transaction.

- Payment not captured. This error message happens when the customer has insufficient funds in their account or if they input the wrong credit card security code (CVV).

4 tips to help reduce failed payments

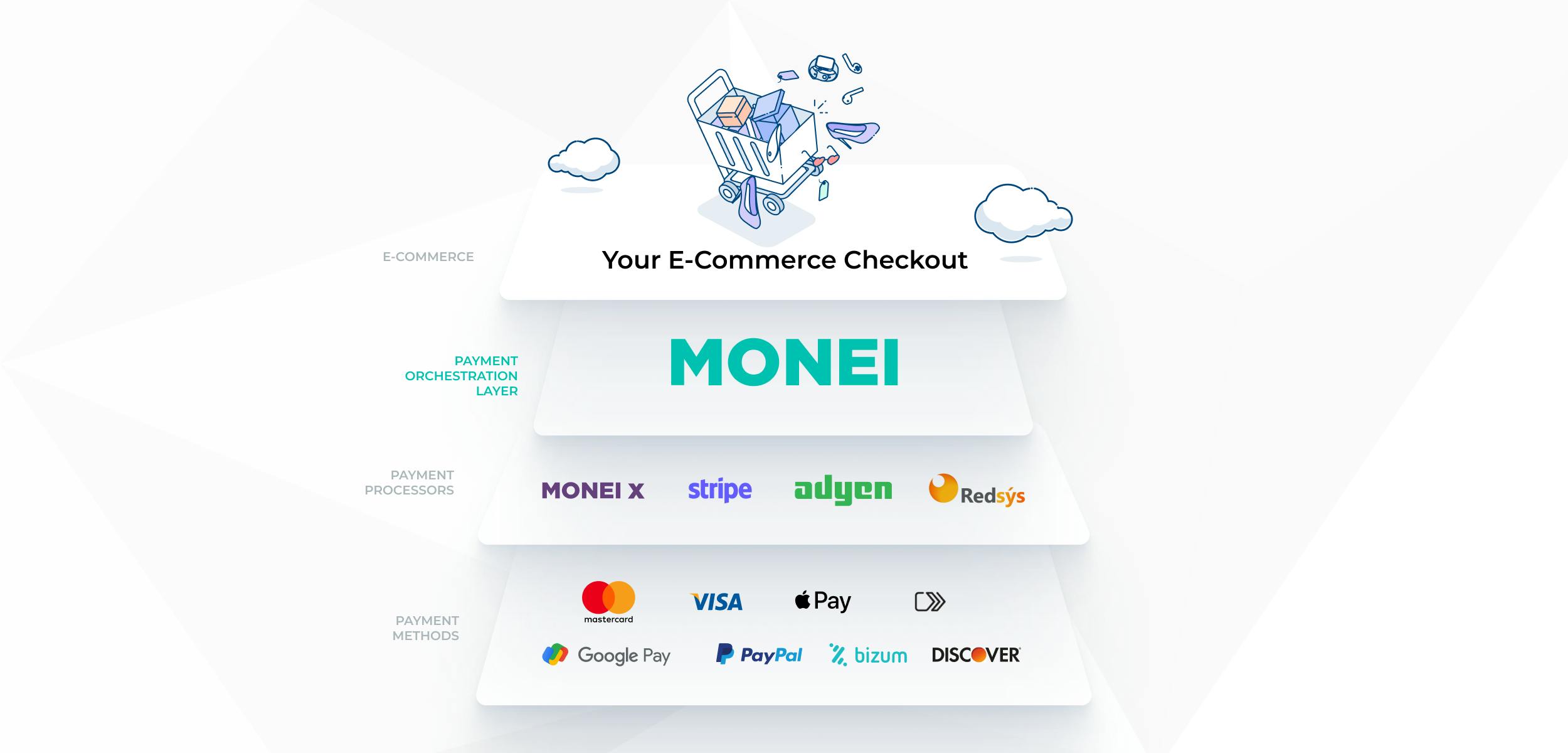

1. Use a payment gateway that routes transactions to multiple payment processors

During the online payment process, transactions get sent to various parties including the payment processor. If your payment gateway only allows you to route payments to one processor, the chances of experiencing system downtimes and failed payments are higher.

Use payments orchestration to send transactions to multiple payment processors. This way, if one is down, your customers won’t immediately receive a payment failure message. Instead, you can set up routing rules to send the payment to another processor. You’ll approve more payments, improve the customer experience, and increase your conversion rate.

2. 2. Find an e-commerce payment service provider (PSP) with advanced functionalities

Payment processing may happen in a matter of seconds, but the work happening behind the scenes is complex. Opting for basic digital payment features may not be sustainable as your business grows.

Our payment technology goes beyond helping you accept online orders. Its serverless architecture allows you to scale and process a high volume of transactions without system crashes or technology failures.

3. Prioritize online payment security

Following online payment security regulations doesn’t only protect your customers, it also protects your business from fraudsters and other security risks.

But figuring out what steps to take to become compliant can be overwhelming when you’re building a brand.

We’ve already taken the necessary steps to follow payment security regulations. So, you can leave your payment security up to us — we are PCI DSS Level 1 compliant. This ensures your customers’ credit card details and your business information are always safe and secure. As a MONEI merchant, you’ll never have to worry about compromising sensitive payment data.

Further reading: PCI Compliance Explained

4. Accept a wide range of online payment methods

Using a payment gateway that enables you to accept a wide range of online payment methods is a surefire way to reach more customers around the world and sell more. That’s why we aggregate all major, alternative, and local payment methods into a single payments platform. We aim to make it easier for you to manage your digital payments from a centralized dashboard.

Wrapping up

While it’s impossible to completely avoid online payment failures, understanding the causes can help you work around the issues. It will also help you make the process easier and more clear for your customers. This way you can avoid failed transactions that happen due to customer mistakes. And, when errors do occur, you’ll know the best way to manage them.

You may also like to read:

- What is an Email Payment Link? [+How to Use Them to Accept Payments Anywhere]

- MONEI Obtains its Payment Institution License from Banco de España

- Payment Gateway vs Payment Processor

Online payment failure message FAQ

Why do customers receive online payment failure messages?

Payment failure messages occur when there's an issue processing a transaction. It happens for various reasons, including insufficient funds, incorrect card information, a technical error with the payment processor, or the customer's bank rejecting the transaction because of security concerns.

How can I reduce the occurrence of online payment failure messages?

You can minimize these errors by integrating with a reliable payment service provider (PSP) that lets you configure multiple payment methods to cater to more customers and offers payments orchestration to route transactions to the best-performing payment processor. Regular updates and security checks are also important.

What should I do when a customer reports an online payment failure message?

First, reassure the customer and apologize for the inconvenience. Then, ask them to provide the exact error message they received. Depending on the error, advise them to check their card details, try a different payment method, or contact their bank. If problems persist, get in touch with your payment gateway provider.

Is it possible that an online payment failure message is a false alarm?

Yes, sometimes a temporary glitch or network issue can trigger a false payment failure message. Asking the customer to retry the payment after a while can resolve the problem. Or using payments orchestration to automatically route transactions to another payment processor (in the case of system downtime) can also lead to more successful transactions.

How can I improve my customer service in handling online payment failure messages?

Training your support team to handle these issues efficiently and courteously is crucial. Make sure they understand common payment errors, and that they can provide clear instructions to customers. Offering live chat or phone support for immediate help can also improve customer service.

Does a high rate of online payment failure messages indicate a problem with my e-commerce system?

Yes, a high failure rate can indicate issues with your payment gateway, e-commerce platform, or user interface. You should investigate the problem, consider seeking expert help if necessary, and communicate transparently with your customers about fixes.

Can online payment failure messages deter customers from making future purchases?

Yes, a poor checkout experience, including payment failures, can discourage customers from returning. It's crucial to ensure a smooth, error-free payment process, and handle any issues promptly and professionally to retain customer trust.

Should I inform customers in advance about possible online payment failure messages and how to handle them?

You don’t need to bring up online payment failure reasons unless they actually happen. But if they do happen, it’s important to be proactive. Having a FAQ section on your website detailing common payment errors and troubleshooting steps is another way to provide support, should issues arise.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).