How to Choose the Best Credit Card Payment App

Can I accept credit card payments on my phone? If this is something you've been asking yourself, the answer is yes, you can.

But how? It's a lot easier than you may think to take payments on your phone (or other mobile devices) with a credit card payment app.

Also known as a mobile payment app, mobile credit card processing app, and credit card reader app, the best credit card payment app can help you improve the in-person payment process for your customers and your business.

In this article, you’ll learn what a credit card payment app is, how it works, the features to look for, the benefits of using a credit card payment app, and how to choose the best credit card payment app for your small business.

Let’s get started.

Table of contents

- What is a credit card payment app?

- How do credit card payment apps work?

- What features should a credit card payment app have?

- The benefits of using a credit card payment app

- How to choose the best credit card payment app

- How does the MONEI Pay credit card payment app work?

- What’s the best credit card payment app for your business?

What is a credit card payment app?

The best credit card payment app can help you save time and money, particularly if you’re not ready to invest in a traditional POS system that involves hardware and software costs.

With a credit card payment app, all you have to do is download the app, and then you can accept card payments on your phone, tablet, or another mobile device. And depending on the payment service provider (PSP), you can also accept alternative payment methods like Google Pay, Apple Pay, and Bizum (in Spain).

📚 Further reading: Bizum for Freelancers: Everything You Need to Know

Aside from taking contactless payments in-store or on the go and issuing refunds all from your mobile phone, credit card payment apps come with many more benefits which you’ll learn later in this article. Let’s first look at how a mobile payment app works.

How do credit card payment apps work?

Not all credit card payment apps work exactly the same, but two of the most common technologies are scan to pay and tap to pay. Let’s take a look at how they both work:

Scan to pay

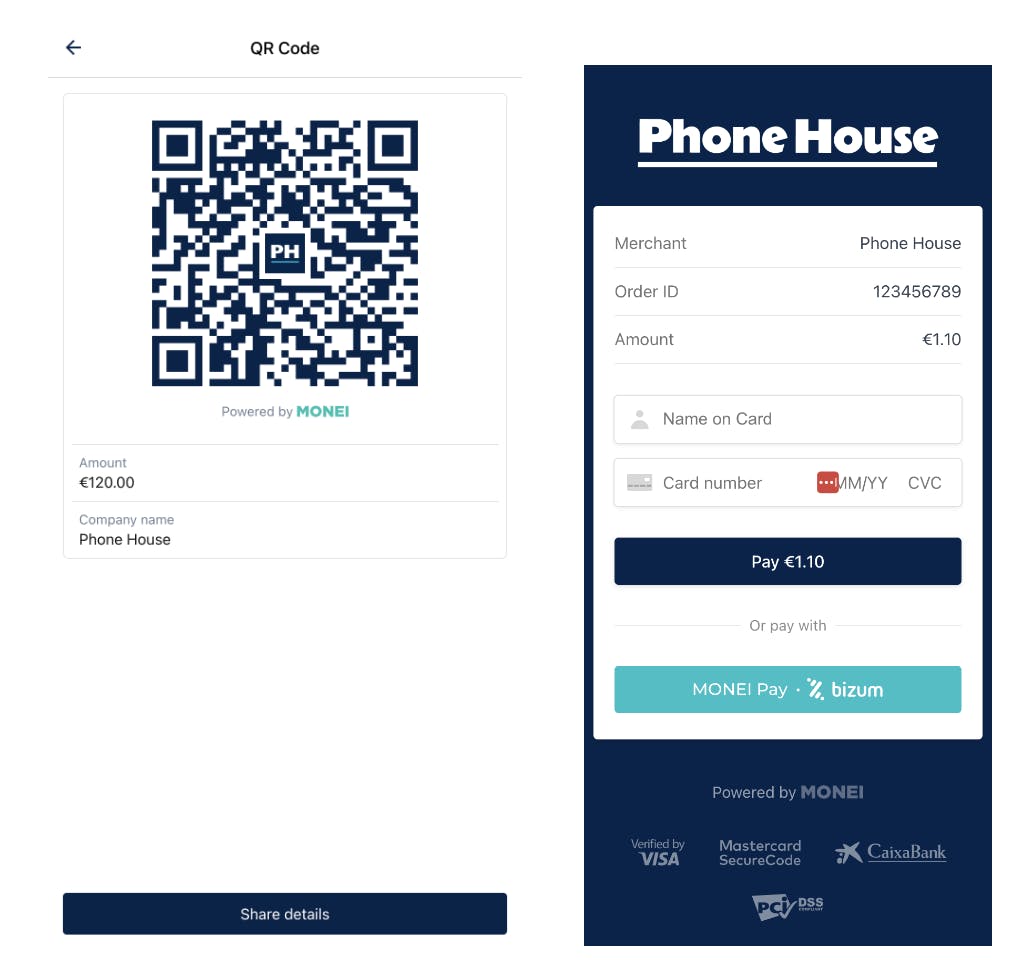

Scan to pay is a fast and secure way to accept card payments on your phone. It involves digital QR code payments (quick response), which are similar to barcodes.

You create a payment on your mobile device which generates a digital QR code. Then the customer scans the code to pay and completes the transaction from their smartphone. It’s contactless and lets you accept mobile payments anywhere in your store, restaurant, or at events.

📌 Pro Tip: Manage your business on the go with the MONEI Pay app. Download the mobile payment app to your mobile device (Android or iOS). View transaction history, issue refunds, generate digital QR code payments, and keep a pulse on your business from anywhere.

Tap to pay

Near field communication (NFC) technology is what makes tap to pay possible. This short-range wireless technology lets customers tap to pay by holding a contactless chip card, their smartphone, or a wearable over the payment terminal (in this case your mobile device).

Just like scan to pay, the payer doesn’t have to touch the card terminal or pass their credit card to you or your staff. Its popularity increased during the pandemic, but it’s here to stay not only because it’s safer, but it’s also faster and more convenient for shoppers.

But how are payments actually processed with a credit card payment app?

Good question.

Credit card processing involves many players like the payment gateway, acquiring bank, and issuing bank, to name a few. The best credit card payment app will have integrated mobile payment processing so you don’t have to deal with multiple providers and connections.

Ideally, you’ll want to use a PSP that also has merchant acquiring services so you don’t have to request a merchant ID from your bank. This is usually referred to as an all-in-one payment service provider.

What features should a credit card payment app have?

Not all mobile payment apps are created equally, but the best credit card payment app will come with the following features:

- Support of many payment methods including all the popular card brands, but also alternative and local payment methods

- Process transactions without POS hardware

- Send payment links to customers via email, SMS, WhatsApp, or social media without a website

- Generate digital QR codes directly in the app to accept payments anywhere

- Payment page customization

- Contactless in-person payments technology like scan to pay (QR codes) and/or tap to pay (NFC technology)

- Add users and equip store staff with a mobile point of sale (think Apple stores)

- Integrate with existing restaurant management or retail POS systems using a simple API

- Real-time view of transaction history on any device

- Issue full or partial refunds from the app

- Send digital receipts via email, SMS, or WhatsApp

The benefits of using a credit card payment app

When deciding if a credit card payment app is right for your small business, weighing the benefits compared to other payment processing options is key. Let’s take a look at some of the advantages:

Taking payments anywhere

With the best credit card payment app, you can accept contactless in-person payments anywhere. Whether it’s in your store, at your restaurant, during a pop-up event, or in your client's home (if you run a service-based business), mobile credit card processing apps make it possible to take card payments on your phone, from any location.

Reducing costs

Traditional retail, restaurant, or taxi POS systems involve expensive and bulky hardware, plus the software costs to run the devices. Why not use a device you already own to accept card payments? You already know it’s a brilliant idea, but might be skeptical about the potential costs. With a credit card payment app, you can (depending on the provider) save up to 50% on hardware and transaction fees.

📌 Pro Tip: Save money on transaction fees with MONEI. As you sell more your transaction fees will decrease in real-time, thanks to our dynamic pricing model. You’ll have more money to reinvest in your business and grow. Get started ››

Improving the checkout experience

Waiting in line when you’ve already found the products you want to purchase can kill the mood — and it will likely do the same for your customers. Not to mention, long wait times can also lead to lost sales. With the best credit card payment app, you can avoid customer queues by building payment stations around your shop. Or don’t even create stations and be ready to help customers check out from any corner, aisle, or area of your store.

Increasing sales

An easier and faster checkout process can help your bottom line. Avoiding lost sales, offering many payment options, and making the payment process more convenient means customers won’t get frustrated and leave before they’ve had a chance to complete their purchase. This positive experience will likely turn them into repeat buyers, and it will help your business stand out from the competition.

Viewing transaction history anytime

Using a credit card payment app means you can keep a pulse on your sales from anywhere.

All you have to do is open the app and go to transaction history to review recent sales. This way, if you’re busy working on another part of your business, you can easily check in to review staff performance, average purchase values, and daily sales totals. You’ll always know where your business stands.

Equipping your staff with a mobile POS

Whether you have one or multiple retail stores, run a restaurant, or need to take taxi card payments, with a credit card payment app, you can make sure your staff is equipped to accept mobile payments anywhere.

📚Further reading: 8 Important Benefits of Mobile Payments

Boosting brand awareness

The best credit card payment app will let you customize your payment page and purchasing flow. For example, with scan to pay, a customized QR payment page includes your brand colors and logo for a cohesive experience across channels.

Digital receipts sent via email, SMS, or WhatsApp can also include your branding, ensuring a memorable customer experience.

How to choose the best credit card payment app

Finding the best credit card payment app for your small business may feel overwhelming, but if you run through all the important questions, it doesn’t have to be. Take the following into consideration:

- Is the credit card payment app compatible with your device? Not all mobile payment apps are built for Android and iOS devices, so it’s important to find out whether the one you’re considering will work with your existing devices.

- Which credit cards does it support? Some mobile payment apps support all major credit card brands while others only let you accept a few. Decide what’s important for your business and make sure the app will let you configure those options.

- Can you accept digital wallet payments too? Depending on the mobile payment app, you can also accept Apple Pay and Google Pay transactions, which are technically still card payments. These digital wallets are simply a place for consumers to store their credit card information for future in-store or online purchases.

- What fees are involved? Figure out what transaction fees are and how they compare to other PSPs. Some providers may also have a daily or monthly fee, which could offset transaction rates.

- Does it take payment security seriously? Whatever PSP you choose, make sure it's PCI DSS compliant.

- Does it have the features you need? Will you need to add additional users? Does your business require manual payments at times? Is the app intuitive and easy to use? These are some of the features to consider, but it's best to create a list of "must-haves" before choosing a credit card payment app for your small business.

- Does it offer support via email, chat, and phone when you may need it the most? Occasional troubleshooting is inevitable. But the level of support you get when it does happen can make a big difference. Find out how and when you can get help before running into issues.

How does the MONEI Pay credit card payment app work?

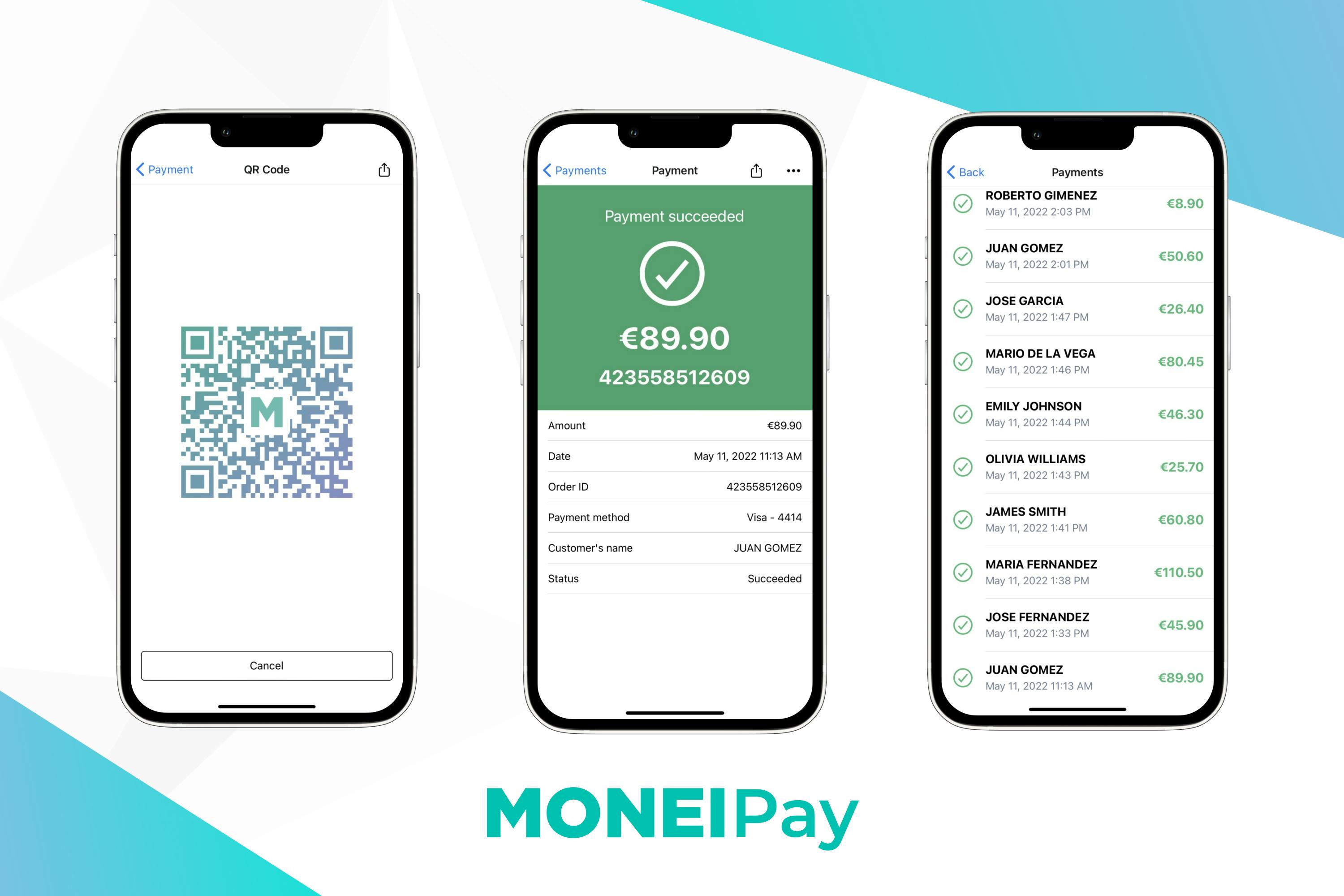

MONEI Pay is a simple yet powerful mobile payment app for retail stores, restaurants, taxi drivers, freelancers, and essentially any type of business that wants to accept card payments in-person from a smartphone or another mobile device.

Getting started and using the app is easy:

- Sign up for MONEI

- Download the mobile payment app to your smartphone or tablet

- Add users to equip your staff to accept payments anywhere

- Create digital QR code payments by entering the purchase amount

- Customer scans the QR code to pay

- Customer selects their preferred payment method

- Customer finishes the transaction with the tap of a button

- Analyze sales from any device either via the app or by logging in at pay.monei.com

- If necessary, issue full or partial refunds via the app

In most cases, you can use our API to integrate MONEI Pay with your existing restaurant management or retail POS software. Contact support to learn more.

📌 Pro Tip: Use MONEI Pay to send payment links to your customers. Do you run a service-based business or need to accept payments at a later date? Create manual Pay By Link payments in the app and send them to your customers via email, SMS, WhatsApp, or social media — no website required. Get started ››

What’s the best credit card payment app for your business?

The answer to this question will depend on your specific business needs, but choosing a credit card payment app with the features you learned about in this article is a great place to start.

📌 Get Started: Try MONEI Pay — the best credit card payment app. Accept contactless QR code payments in-store, at your restaurant, or on the go from any mobile device. Spend 50% less than standard POS costs, boost customer satisfaction, and accept the widest range of payment methods from one platform. Get MONEI Pay ››

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).