Merchant Acquirer vs Payment Processor: What’s the Difference?

Image source: Unsplash

As a busy e-commerce business owner, gaining a deep understanding of the difference between merchant acquirer and payment processor probably isn’t top on your to-do list. We get it. But having basic knowledge of each is crucial to make sure you’re choosing the best payment service provider for your online store.

Both play an essential role in processing online payments, but in this article, you’ll learn how they're different and how they work together, so you can make an informed decision about the best provider for your business.

You’ll find answers to the following questions:

- What is a merchant acquirer?

- What is a payment processor?

- How do merchant acquirers and payment processors work together to complete transactions?

- Key differences between merchant acquirers and payment processors

What is a merchant acquirer?

A merchant acquirer, also known as an acquirer or acquiring bank is the financial institution or bank that processes credit and debit card payments (from card schemes like Visa and Mastercard) for your e-commerce business.

Essentially, the acquirer is a payment facilitator that allows you to complete online payments. It also takes responsibility for payments and handles payment settlements into your business bank account.

It’s essentially a payment facilitator that allows you to complete online payments and it’s responsible for the following:

- Providing businesses with merchant accounts or virtual POS services to help you accept card payments.

- Facilitating the authorization and collection of transactions that take place between your company and the issuer or issuing bank (the financial institution that provides consumers with a credit card from networks like Mastercard, Visa, or American Express).

- Assuming the risk of chargebacks, fraud, and payment disputes on card transactions.

The acquiring bank communicates with the issuer through the card networks to verify transaction details and to make sure the funds are available. Once the transaction is approved, it collects the funds on behalf of your business and usually settles them into your business bank account within 1-7 business days.

MONEI partners with the Banc Sabadell, BBVA, and Caixabank in Spain to offer built in merchant acquiring services when you open a MONEI account.

📚 Further reading:

- Acquiring Bank vs Issuing Bank: 3 Minute Guide

- How to Accept Payments Online: 6 Step Guide

- Your Guide to Payments Terminology

What is a payment processor?

A payment processor is a service provider that facilitates electronic transactions between customers and businesses by handling and authorizing payments made with credit cards, debit cards, and other methods like digital wallets. It’s necessary for both online and in-person payments and its main functions are to verify transaction details, confirm that sufficient funds are available, and securely transfer those funds from the customer's account to your business bank account.

How do merchant acquirers and payment processors work together to complete transactions?

In-person payment flow

During in-person payments, the processor transfers information between your business, the acquirer, and the issuing bank. Brick-and-mortar businesses process payments using a point-of-sale (POS) or payment terminal that can read EMV chip cards.

When a customer pays via credit card in person, the card is authenticated and then information is sent from the POS to the issuing bank where the transaction is either approved or declined. Then the payment processor sends the payment status to the terminal and payment information to the acquirer for approved transactions.

📌 Pro Tip: Get MONEI Pay to take in-person payments from your phone. It's the perfect POS alternative to let customers checkout anywhere in your store, restaurant, or on the go using QR code payments.

Online payment flow

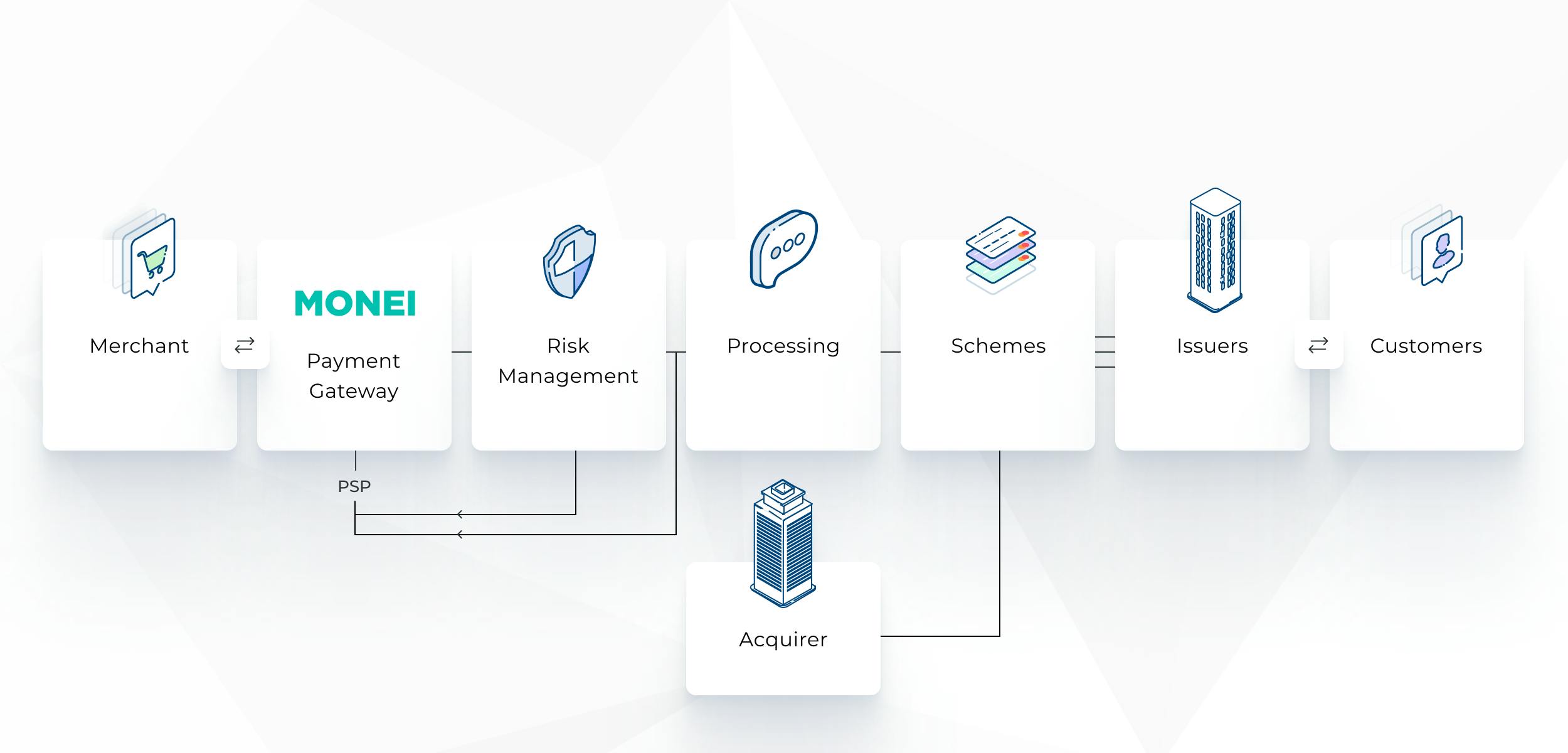

In online payment processing, the processor works with a payment gateway or payment service provider (PSP) to send information between the issuing and acquiring bank, and your business to complete the transaction.

When the customer enters their card information online, it’s sent through the payment gateway where the data is encrypted and turned into a token.

Tokenization is used to protect sensitive payment information by replacing the data with a non-sensitive equivalent. After a token has been created, it gets sent through the processor. Then, through the payment gateway, the processor notifies the customer if the transaction has been approved or declined.

💡Pro Tip: Check out our guide on how to choose the best payment gateway for your e-commerce business to learn what questions to ask and factors to consider before you select a payments partner.

Setting up payment processor routing rules to send transactions to more than one processor (in case one is experiencing downtime) can help reduce false payment failure messages. This is also known as payment orchestration and results in more approved payments and improves your e-commerce conversion rate.

Once the payment is approved, the processor relays the payment information to the acquiring bank.

📚 Further reading: A Simple Guide to Accepting Credit Card Payments Without a Merchant Account

Key differences between merchant acquirers and payment processors

Their relationship to your business:

Since it provides and maintains a virtual POS account, the acquirer has a direct relationship with your business. It assesses account risks and assumes some liability in case of disputes or chargebacks. However, if you choose an all-in-one payment service provider like MONEI, you don’t need to set up a separate virtual POS account.

The payment processor is a business service that authorizes transactions on your behalf. You don’t need a direct relationship with the payment processor if you work with a payment service provider (PSP) that intermediates.

Sometimes the PSP and processor are combined (like MONEI), so you don’t need multiple service providers.

How they function in the transaction process:

The acquirer partners with businesses to process card transactions and handles the setup and management of merchant or virtual POS accounts. It also authorizes transactions, collects payments from issuing banks, and assumes the risk of chargebacks, fraud, and disputes.

The payment processor enables and authorizes electronic transactions by verifying transaction details, checking for sufficient funds, and securely transferring money between the customer’s account and your business bank accounts

Their relationship with issuing banks and card networks:

The payment processor communicates with card networks and issuing banks to verify and authorize transactions. Processors typically partner with multiple acquirers, serving as intermediaries between financial institutions and businesses.

Acquirers are members of card networks and have agreements to process transactions on their behalf. They work directly with card networks and issuing banks to authorize and settle transactions.

In a nutshell, payment processors handle the technical side of authorizing and processing transactions and acquirers focus on the financial side, including setting up merchant or virtual POS accounts and liaising with issuing banks. Both are essential to ensuring secure and frictionless electronic payments.

Do I need a merchant acquirer if I use MONEI?

MONEI is an all-in-one payment platform that functions as both a payment processor and an acquirer. When you sign up with MONEI, there’s no need to partner with a separate acquirer or open a dedicated merchant or virtual POS account. MONEI manages all aspects of payment processing, from transaction authorization to fund collection.

Use an all-in-one PSP that handles the entire online payment process

As a complete payment service provider, MONEI simplifies the payment workflow by integrating the roles of processor and acquirer into a single solution. This way, you can accept various digital payment methods, such as credit and debit cards, without the hassle of dealing with multiple service providers.

After connecting MONEI to your website and configuring payment methods in your account, you can accept many online payment methods including credit and debit cards and a range of alternative payment methods. We add new payment options regularly, so you can reach more people, improve the customer experience, and grow your e-commerce sales.

You may also like to read:

- What is SCA? (+ How it Benefits Consumers)

- Strong Customer Authentication Guide

- PSD2: What is It? Why it’s Important + How to Be Compliant

Merchant acquirer vs payment processor FAQ

Do I need both a merchant acquirer and a payment processor to accept card payments?

Yes, both are necessary for you to accept card payments. The payment processor is needed to authorize and manage the transactions, and the merchant acquirer is required to receive the funds.

Can the same company be both a merchant acquirer and a payment processor?

Yes, some PSPs do serve as both a merchant acquirer and a payment processor. These are often referred to as integrated or all-in-one solutions, and they can simplify the payment process by offering both services together. MONEI’s payments platform offers built-in merchant acquiring and processing services, so you don’t need to get virtual POS credentials from an acquiring bank to accept online payments or set up another integration with a payment processor.

Which is more important for my business, the merchant acquirer or the payment processor?

Both are equally important for different reasons. Without a merchant acquirer, you would have no bank account to receive the funds. Without a payment processor, you would not be able to authorize and manage transactions efficiently.

What should I consider when choosing a merchant acquirer and processor?

Consider the fees they charge, their reliability and reputation, the quality of customer support, their understanding of your industry, and their ability to integrate with your existing or preferred payment systems. Or you could use a PSP like MONEI, so you don’t have to deal with getting a merchant ID from an acquiring bank or setting up a separate integration for payment processing.

Can I switch between merchant acquirers or payment processors?

Yes, but switching can involve some complexity and potential downtime for your payment systems. It's best to choose carefully at the outset to minimize the need for changes later on.

Are merchant acquirers and payment processors regulated?

Yes, both types of institutions are regulated to ensure they follow certain standards and rules, particularly regarding the security of transactions and the protection of customer data. Always ensure that your chosen acquirer and processor comply with the necessary regulations in your country and industry.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).