How to Accept Payments Online: 6 Step Guide

You bought your domain, started your Shopify subscription, and published your product pages with beautiful images and enticing descriptions. Your online store is almost ready to share with the world, but you’re still not quite sure how to accept payments online.

You know it’s important to accept payments online, especially considering how much they’re growing year after year. According to Statista, global digital payments reached $8,35 trillion in 2022 and Mordor Intelligence states that the European digital and mobile payment transaction value has increased by more than 30% in the last three years.

With this kind of growth, the question isn’t whether you need to accept payments online, it’s how to accept payments online as soon as possible. With almost 70% of the Spanish market paying with cards and almost 25% paying with Bizum, it’s time to accept as many online payment methods as possible.

Click here to accept payments online now

It can feel daunting when you have to worry about payment security, accepting the right online payment methods, and making sure the way your payment page looks and functions builds trust rather than causing customers to abandon their carts. But with the right payment service provider (like MONEI), it doesn’t have to be. That’s why we created this guide to help you accept payments online in a few simple steps.

How to accept payments online in 6 simple steps

Since you’re ready to start accepting payments online, we assume you already have a website, but if you don’t, check out our article comparing the 15 best e-commerce platforms.

Otherwise, let’s dive into how to accept payments online:

1. Find an online payment gateway

2. Integrate with your e-commerce website

3. Configure online payment methods

4. Set up payment routing rules

5. Customize your payment page

6. Consider adding recurring billing or subscriptions to your business

1. Find an online payment gateway

Online payment gateway technology securely confirms the legitimacy of an online payment and transmits payment data from the cardholder (your customer) to the acquiring bank. Finally, the payment gateway confirms whether the transaction is either approved or declined.

Depending on the payment gateway you choose, you might have to sign up for a virtual POS with an acquiring bank in order to accept online payments. But some payment gateways (like MONEI) have built-in merchant acquiring. This way, all you have to do is open an account with us and skip the headache of also registering a virtual POS.

📚Further reading:

- What is a Payment Gateway? (+ Compare Options)

- How to Choose the Best Payment Gateway for Your E-commerce Business

- What’s the Difference Between a Payment Gateway and Virtual POS?

2. Integrate with your e-commerce website

Once you’ve chosen your payment gateway, you need to integrate it with your e-commerce website to accept online payments. Each site is slightly different but whether you’re using Shopify, WooCommerce, Wix, PrestaShop, or one of the other popular e-commerce platforms, the best payment gateways (like MONEI) offer a plugin. If you have a custom site, you can use a payments API instead.

Whichever option you use, it’s worth considering whether you want a prebuilt payment page or a custom checkout. With the right payment gateway, both options allow you to securely accept credit and debit cards, Bizum, Multibanco, SEPA Direct Debit, and more.

Can I accept payments online without a website?

Yes. With MONEI, you don’t need a website. You can create and send payment requests using Pay By Link. Send them via email, SMS, or WhatsApp. Use the MONEI Pay app to do it all from your smartphone. And if you need to, you can accept in-person payments via QR codes from any mobile device.

📚Further reading: QR Code Payments: What They Are, How They Work, and How to Accept Them

4. Configure online payment methods

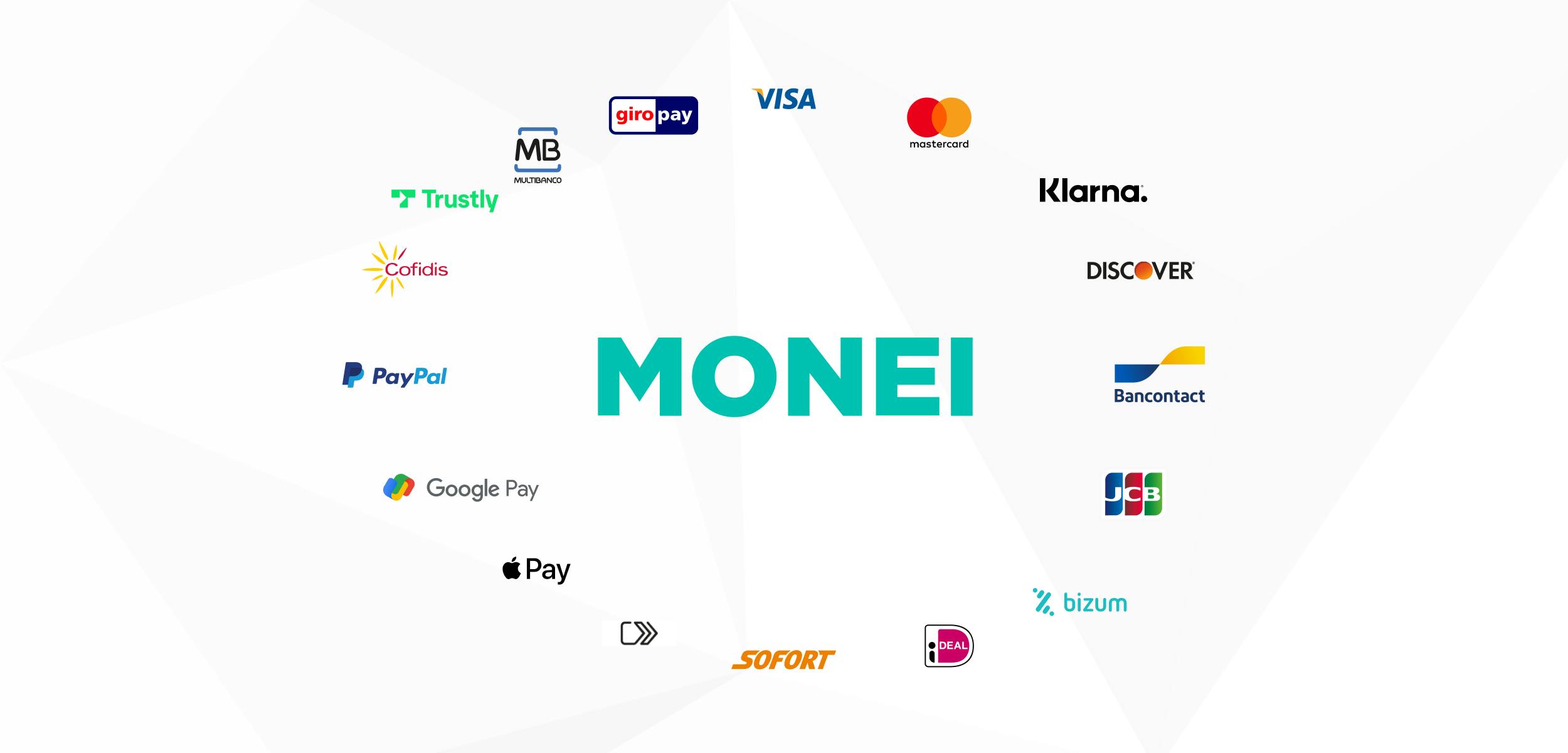

It’s important to accept all the most popular online payment methods from credit cards to digital wallets to local payment methods like Bizum. Let’s take a look at these online payment methods and more:

Credit and debit cards

Although credit cards are becoming less popular in Spain, they’re still one of the most popular payment methods so it’s important to accept them online. You can easily do that with a payment service provider (PSP) that processes Visa, Mastercard, and other popular card network transactions.

Apple Pay

With 500 million users worldwide, Apple Pay is quickly becoming one of the most popular ways to complete a transaction online in Spain and further afield. With the right PSP, your customers can use this quick and convenient method in your online store whenever they need to complete a transaction.

Google Pay

Just like Apple Pay, Google Pay has hundreds of millions of users across the globe. Make sure you accept Google Pay so you don’t miss out on customers who use it as their preferred payment method.

Bizum

Bizum is one of the most popular payment methods in Spain. It works as a mobile payment solution that means customers only need a payment link and their phone number. You can easily accept this fast and secure payment method with the right PSP.

📚Further reading: 11 Important Reasons to Accept Bizum in Your Physical or Online Business

PayPal

PayPal has been one of the most popular digital wallets in the world for years and has almost half a billion active users worldwide, it’s a method many of your customers will want to use.

Multibanco

When you’re selling to other countries or regions, you need to accept cross-border payments. Cross-border e-commerce can greatly increase your overall growth so accepting payments from Portugal’s number one local payment method, Multibanco, is beneficial if your business is based in Spain.

Klarna

The Swedish powerhouse, Klarna, operates in 17 countries and takes over two million payments a day. With over 250,000 merchants, there’s a good chance some of your customers are already using it to pay for their purchases.

Click to Pay

Click to Pay is a relatively new online payment method but it’s growing quickly and will soon be a dominant force in the market. It’s quick, secure, and supported by major card networks like Mastercard and Visa.

SEPA Direct Debit

SEPA Direct Debit was introduced by the European Payments Council. It supports direct debit payments in 36 countries. If you want to expand your business across the EU, SEPA Direct Debit is a must for accepting both one-time or recurring payments.

📚Further reading: Configure Payment Methods in PrestaShop: 5 Step Guide

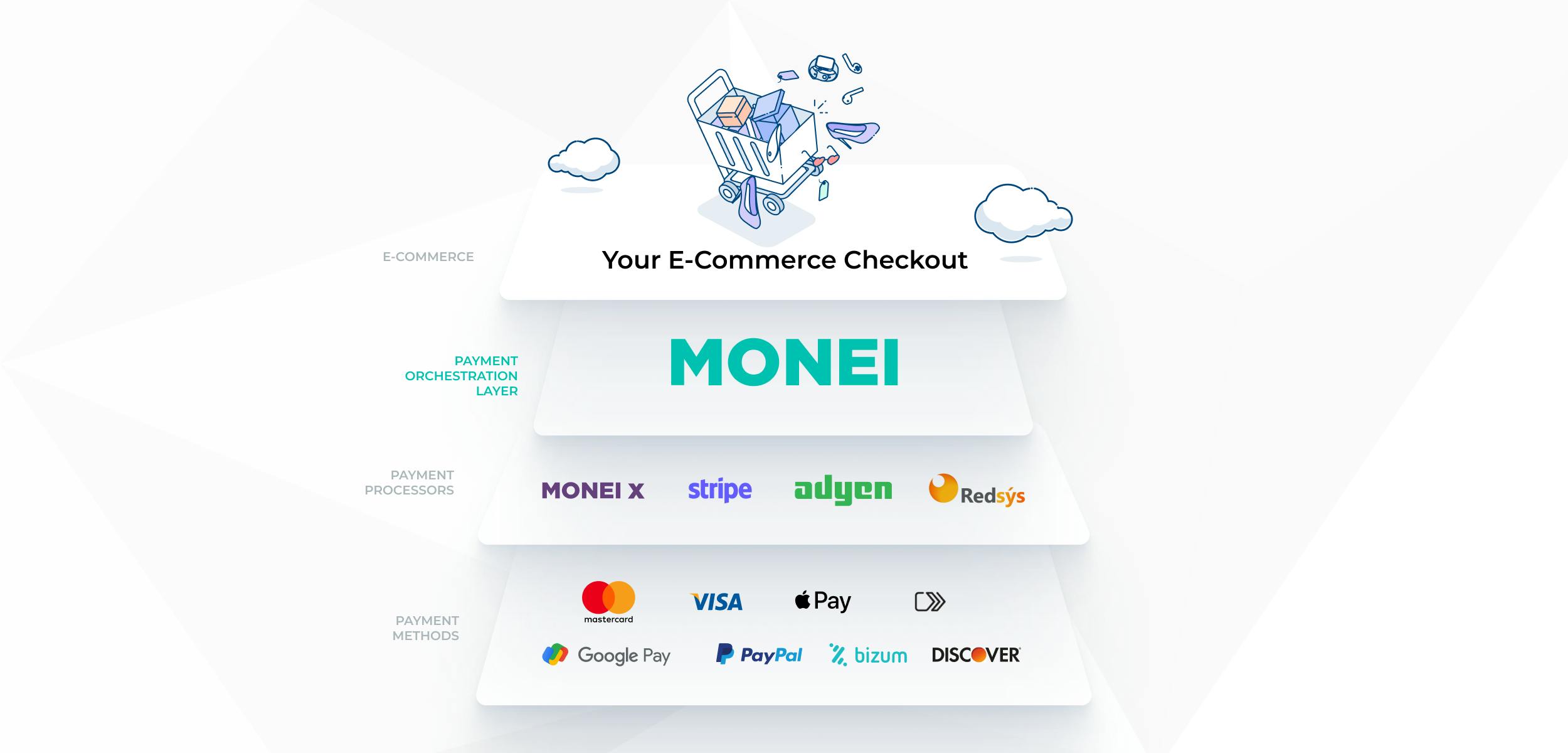

5. Set up payment routing rules

Payment routing rules, also known as payments orchestration, allow you to route customer transactions to multiple payment processors. This way, if one processor is experiencing downtime the payment will be sent to another one — increasing transaction approval rates. Reducing failed online payments can not only increase your revenue, but it also improves the customer experience, among many other benefits.

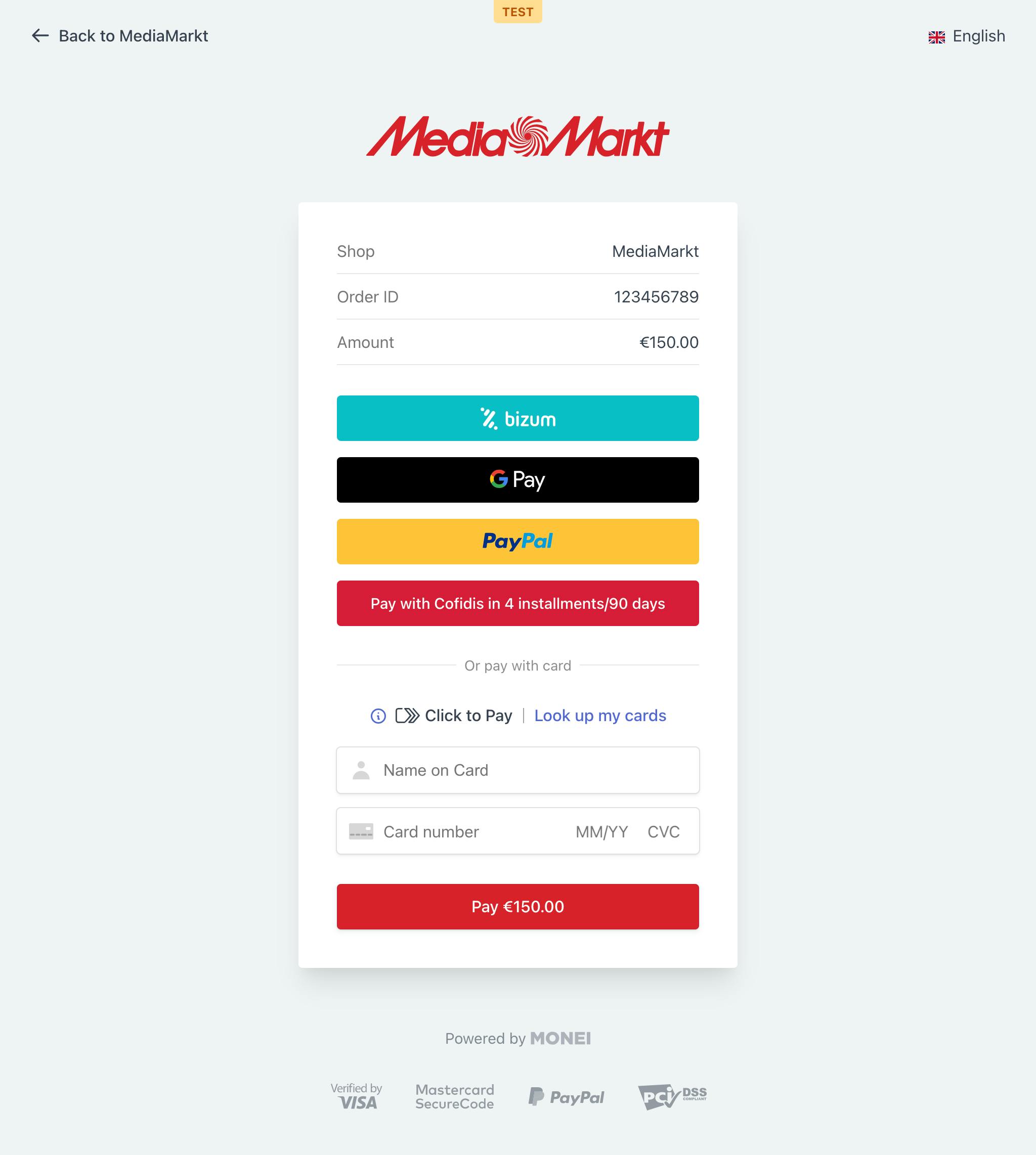

6. Customize your payment page

You want your customers to feel like they’re with you at all times. The more familiar your brand feels the more trust you’ll build. A customized payment page means you can add your logo and brand colors so your customers never feel like they’re leaving your e-commerce site. With MONEI, you can also add your custom domain rather than redirecting customers to a third-party payment page or URL.

7. Consider adding recurring billing or subscriptions to your business

When it makes sense for your products or services, recurring payments or subscriptions can support your business growth. With the right PSP, you can manage and customize subscription plans from your dashboard and your customers can pay in weekly, monthly, quarterly, or annual installments.

📚Further reading:

- How to Start a Subscription Business [Quickstart Guide]

- Subscription E-commerce: All You Need to Know (+13 Examples)

- 15 Tips on How to Grow a Profitable Subscription Business

Accept payments online today

Now that you know how to accept payments online, it’s time to get started. Stay ahead of the competition and accept a wide range of online payment methods to meet your customers’ needs.

How to accept payments online FAQ

How can I accept online payments on my website?

To accept payments online you can either register for a virtual POS with your bank and integrate with a payment gateway or use a payment service provider like MONEI that has built-in merchant acquiring services (i.e., you don’t need to set up a virtual POS yourself).

What is the most secure way to accept payments online?

The four most secure online payment methods include:

- Credit card

- Digital wallets like Apple Pay and Google Pay

- Bizum

- Payment links

How can I accept payments online without PayPal?

The fastest way to accept payments online without PayPal is to use a payment gateway like MONEI. The onboarding process takes less than 10 minutes, you don’t need to get a virtual POS from your bank, and you can accept a range of online payment methods from a single platform.

What is the most preferred online payment method?

In Spain, credit and debit cards are used most frequently by customers, but local payment methods like Bizum and digital wallets like Apple Pay are gaining popularity.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).