Types of Payment Methods: The Essential Guide

You’ve got your products, website, and marketing plan, but what about your payment methods? If you’re only offering one or two ways to pay, you might be missing out on sales without even realizing it.

Today’s shoppers want options. Some love the ease of Apple Pay, others stick to credit cards, and depending on where your customers live, they might prefer a local payment method you haven’t even considered yet.

In this article, you’ll learn about the different types of payment methods, why they matter, and how to choose the ones that make sense for your business.

Table of contents

- What is a payment method?

- What are the different types of payment methods?

- What are the most popular payment types?

- Why is it important to accept more payment method types?

- Compare payment methods

- Accept more payment method types online and in-store

What is a payment method?

A payment method is a way consumers pay for products or services. Ranging from credit or debit cards to mobile wallets to prepaid cards, and more, nowadays, there’s a range of options available for both physical and online payments.

What are the different types of payment methods?

You will find below the definitions for the following types:

- Cash

- Cards (credit, debit and prepaid)

- Contactless NFC payments

- Mobile payments (e-wallets, Peer-to-peer payments, QR code payments)

- Bank transfers or direct debit

- Payment links

- Buy Now, Pay Later (BNPL)

- Telephone or mail order payments

Cash

The longest-standing form of payment around is cash, and it’s not disappearing just yet.

According to data from Statista, in 2018, POS (point of sale) cash stood at 70% percent and declined only five points to 65% in the first quarter of 2025. During the same period, the share of respondents paying cash on delivery for online transactions experienced a 4% decrease. When compared to 2024, consumers paying cash in advance declined by only 1%.

That being said, the general direction of payment methods across the world is moving away from cash, especially in Nordic countries. Norway has one of the lowest numbers of ATMs and around 96% of its population does online banking.

And despite the high use of cash in physical stores, on average, only 7.8% of the Spanish population (mainly those over 65) uses only cash to make purchases.

It’s not possible to make online payments with cash and the number of ATMs in countries that are moving toward a cashless society is reducing. Many ATMs also charge a withdrawal fee, discouraging further use.

A Santander report confirms that on average consumers have around 2.6 alternative payment methods, with 25–34-year-olds having the most (3.3) and those over 65 having the least (1.7).

Credit card

With credit cards, customers can pay for a product even if they don’t have money in their account. The customer’s bank covers the cost and the customer pays the bank later. Some customers pay the minimum amount due each month, but others pay the full balance each month, to avoid owing interest.

Credit cards are used online and for contactless in-store payments thanks to NFC mobile payment and EMV (Europay, Mastercard, and Visa) chip card technology. Cards are still a popular payment method in Spain and in other countries like the UK, where there were 37.23 million active credit card accounts as of February 2025.

However, in many countries, including Spain, digital wallets like Google Pay and Apple Pay and local payment methods are catching up. According to our data, Bizum payments are surpassing credit cards.

So is it still important to accept card payments online and in person? Yes. But it shouldn’t be the only payment method available.

Debit card

Debit cards, also one of the most common online payment types in Spain, look similar to credit cards and the payment process is also comparable, but with a debit card, a customer pays for a product using money in their account. This is the customer’s own money, not the banks’ so nothing is owed later and customers don’t have to pay any interest on their purchase. To own a debit card, you must have a bank account.

📚Further reading: How to Accept Card Payments on Your Phone

Prepaid card

Another very similar card is a prepaid card. It uses the same technology as a credit or debit card and works in the same way. Just like a debit card, a prepaid card uses a customer’s own money. The main difference with this payment method is that a prepaid card is preloaded with cash and you don’t need a bank account.

Contactless NFC payments

Contactless payments date back as far as 1995. The Seoul Bus Transport Association issued a UPass card for passengers in South Korea. Since then, contactless payments have become more common.

They work using a technology called near field communication (NFC) that allows a customer to simply tap to pay from up to two inches away. This involves waving an EMV chip card, smartphone, or wearable over a card reader or NFC-enabled device. For a customer, contactless payments are almost instantaneous, which is why it’s not surprising that 72% of the Spanish population has already adopted contactless payments.

Contactless payments are safe and secure. EMV technology reduces the risk of fraud and there’s a limit to the number of contactless purchases that can be made in a row and a €50 spending limit per transaction in Spain, which makes the cards less attractive to thieves.

Mobile payments

Mobile payments are broken down into three main categories:

Mobile wallets

Mobile wallets like Apple Pay and Google Pay allow a cardholder to store their details for future use. When a customer wants to pay, they simply tap or wave their mobile phone or smartwatch over a POS terminal to process the transaction.

Peer-to-peer payments (P2P)

Peer-to-peer payments (P2P) make it possible to pay without sharing any payment details. Customers can send and receive money with services like Bizum (which now has over 28 million users in Spain) and PayPal from a mobile device through a linked bank account or card.

P2P payments keep account details secret as the payee only needs the recipient’s email address or phone number to make a payment. They never have to enter payment details again after linking their bank account or card to the payment app.

As the recipient, you receive the payment immediately. And if it’s a payment between friends, the receiver can instantly use the funds to pay someone else within the app.

Customers often feel more secure paying online with a P2P payment method and with MONEI Pay, your customers can even use Bizum to pay in-store.

QR code payments

QR code payments make transactions quick and easy. Customers can use their smartphone camera to scan a QR code, check the transaction amount, and complete the payment. If you need to accept physical payments (in-store or on the go), this takes away the need for bulky POS devices. You can use your phone or tablet to accept QR code payments anywhere with MONEI Pay.

📚Further reading: Incapto Experiences a 66% Uplift in Coffee Cup Orders by Switching to MONEI

Bank transfers or direct debit

Bank transfers and direct debits facilitate payments directly from one account to another. To make a payment, you usually need the recipient’s name and IBAN number. Some banks require different details, especially if you’re paying internationally. Having said that, most direct debits and bank transfers are for local payments.

For example, SEPA Direct Debit is a Europe-wide direct debit payment method that lets customers enter their IBAN and name to complete payment. And iDEAL is the most commonly used payment method in the Netherlands. All major Dutch consumer banks accept bank transfers facilitated by iDEAL, there are no chargebacks, and settlement times are faster.

📚Further reading: What is SEPA?

Payment links

Payment links are a safe way to request payment from a customer over your preferred channel including email, SMS, social media, and WhatsApp. With MONEI’s Pay By Link feature, you don’t need a website to create and send payment links. When your customer clicks on the link, they’re directed to a secure payment page where they can enter their payment details to complete the transaction, then the link expires.

Buy Now, Pay Later (BNPL)

BNPL is forecasted to reach US$9.53 billion in Spain by 2029, something that’s not surprising considering its benefits for both consumers and businesses alike.

Offering Buy Now, Pay Later options can attract more customers and increase sales, as it allows customers to make purchases and pay for them in installments over time. This payment method is particularly appealing to customers who prefer flexible payment plans without incurring immediate full costs. BNPL can lead to higher average order values and conversion rates for your business. However, it's important to consider the fees charged by BNPL service providers and the potential impact on cash flow, as payments are often received in installments rather than upfront.

Telephone or mail order payments

Sometimes, there’s no way of paying physically and although it’s becoming less common, your customer might not have access to the internet either. That’s when they’d use telephone or mail order payments. To process this type of payment method, you can type the customer's card details into a virtual terminal to complete the transaction.

📚 Further reading:

- What’s the Difference Between a Payment Gateway and Virtual POS?

- Is PayPal a Secure Payment Method for merchants and customers?

What are the most popular payment types?

The popularity of payment types varies on a country-to-country basis.

In Spain, digital wallets account for just under 8% of the market, cards are no longer the most popular payment method, accounting for 40.10% of transactions, and Bizum now leads the way with nearly 50% of consumers using it for online purchases, according to our 2024 Black Friday Cyber Monday data.

Why is it important to accept more payment method types?

Your customers already know how they want to pay. It’s up to you to make sure they can use their preferred payment option. You’ve already seen how many different types of payment methods there are and they’re growing all the time.

Digital wallets are becoming more and more popular, credit cards are on the decline, and P2P payments are constantly evolving. In order to keep up with consumer behavior and your competition, it’s crucial to accept customer-preferred payment methods.

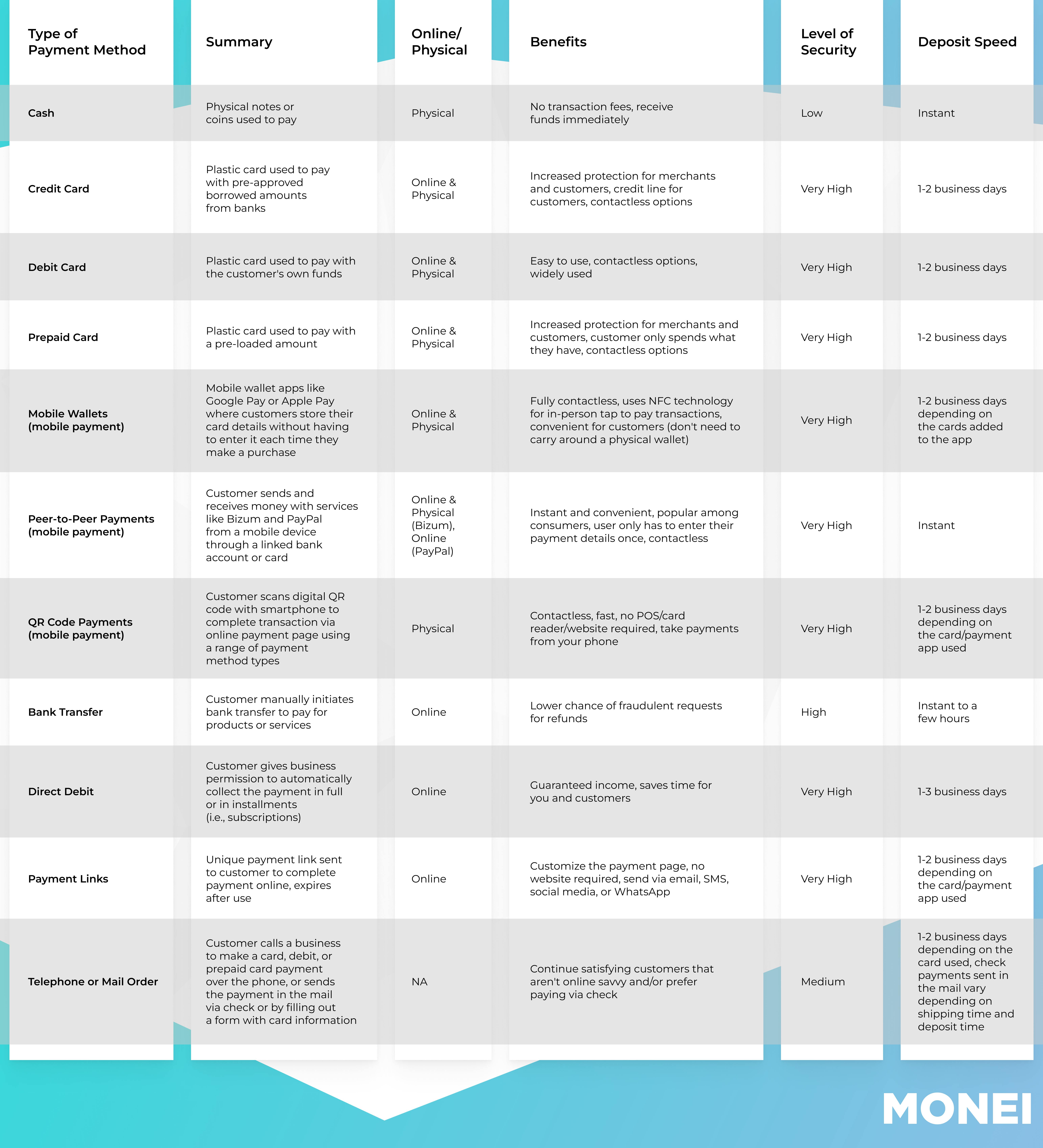

Compare payment methods

You want to accept as many payment methods as possible but the best payment methods for a local furniture store could be completely different from a restaurant, an online clothing store, or a service-based business. Compare the payment methods below to see the best options for your business.

Accept more payment method types online and in-store

Now that you’re more familiar with the types of payment methods, old and new, and you know the most popular payment types, it’s time to accept as many payment methods as possible to keep your customers happy. Get started with a payment service provider (PSP) that lets you accept a wide range of payment methods (online and off) from a single platform — sign up for MONEI.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).