The Top 4 Digital Wallets to Add to Your Online Store + Benefits for E-commerce

Image source: Unsplash

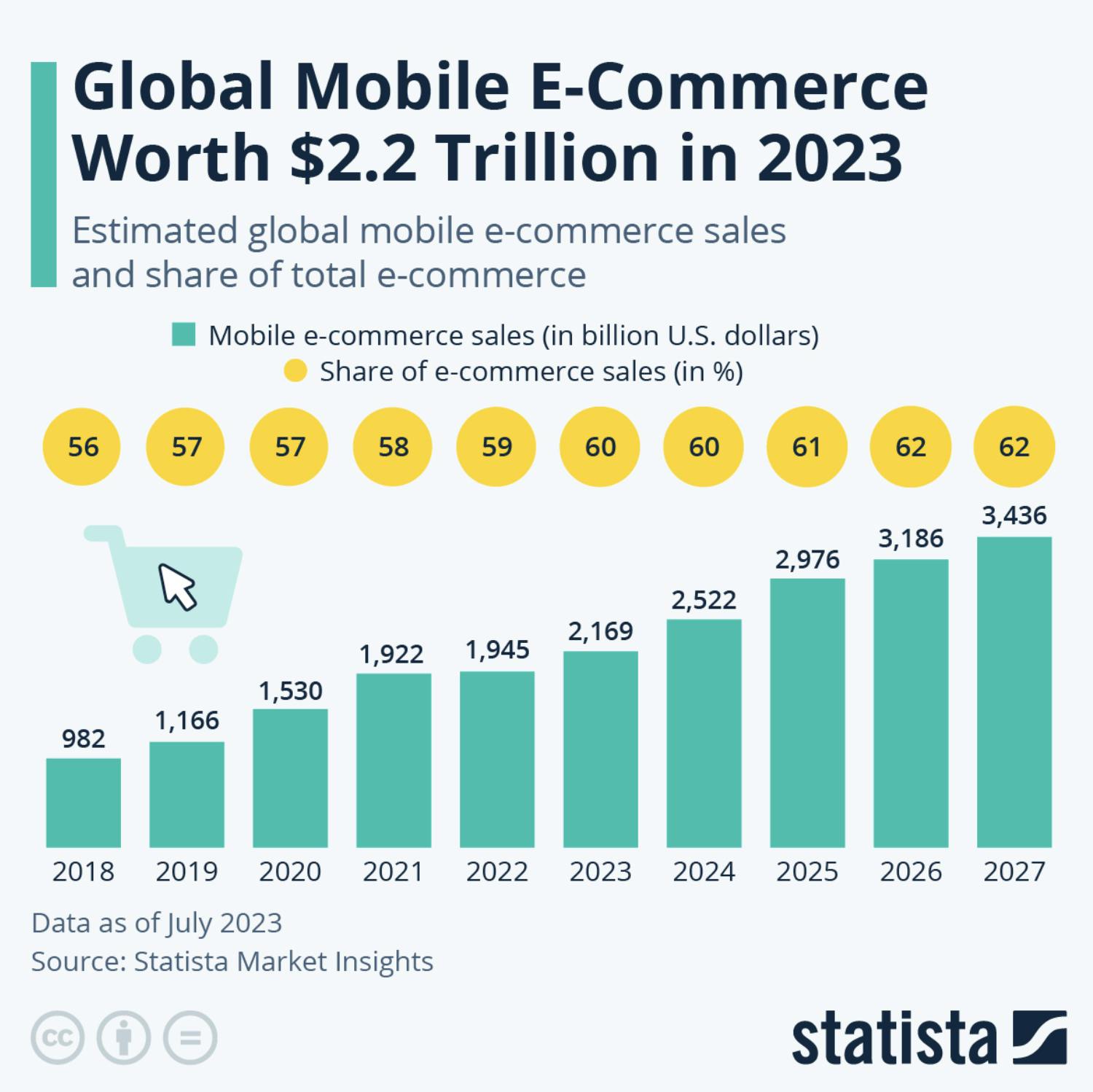

According to Statista, mobile e-commerce sales reached $2.2 trillion in 2023 and now account for 60% of all e-commerce sales around the world.

📌 Add more digital wallets to your e-commerce store now

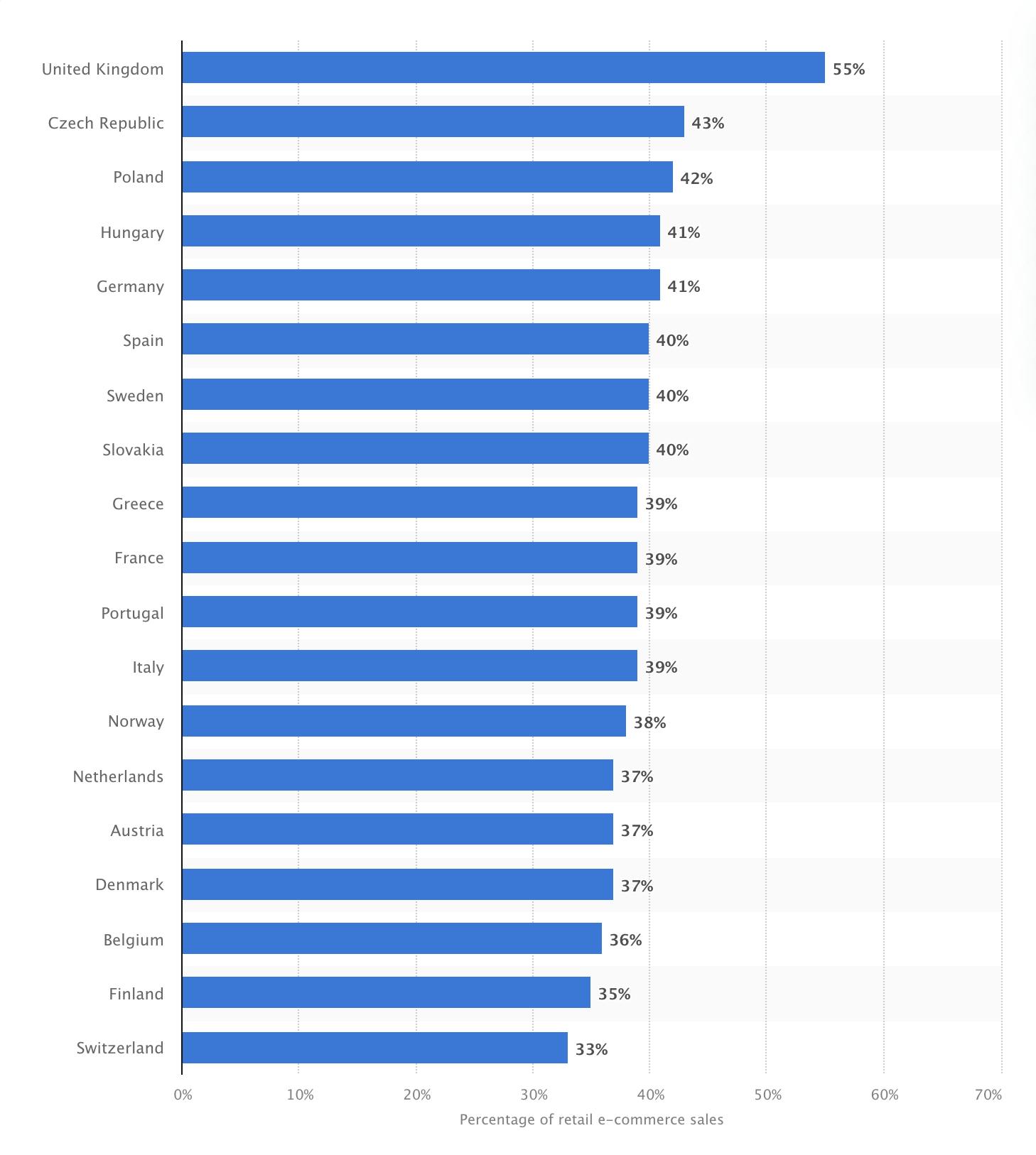

Mobile payment methods including digital wallets like PayPal and Google Pay make shopping through a small smartphone screen easier and more convenient for customers, which is one of the reasons why 75% of Spaniards shop from their mobile phones, the highest percentage in Europe. In 2022, the mobile commerce share of total retail online sales was 40% in Spain and over 50% in the UK.

Creating a positive shopping experience is all about speed, simplicity, security, and customer convenience. Mobile shoppers need a safe and easy way to pay for products without re-entering payment information every time they make a purchase.

Alternative payment methods like digital wallets use tokenization technology to store various payment details in one app and streamline the customer’s checkout experience. The result is a better mobile experience and increased conversion rates.

In this article, you'll learn what a digital wallet is, its advantages for e-commerce, and the top four digital wallets to consider.

Table of contents

- What is a digital wallet?

- Digital wallet vs mobile wallet: what's the difference?

- Advantages of digital wallets in e-commerce

- The top 4 digital wallets to add to your online store

- Configuring digital wallets with MONEI

- 3 reasons why shoppers love digital wallets

What is a digital wallet?

A digital wallet is the same thing as carrying around a wallet full of credit cards, cash, ID, and other personal information. The difference is, that it’s virtual.

Users can save their personal financial information securely in the wallet app.

Also referred to as e-wallets or mobile wallets, they give customers many secure options to make purchases from the convenience of their smartphones.

Digital wallets are used through smartphone applications and are practical because all your payment details are in one place. These third-party apps protect the user's data through passwords and encryption. It lets shoppers make payments and send money from their mobile phones in a few clicks.

MONEI can help you integrate your online shop with the most popular digital wallets including:

E-wallets use Near Field Communication (NFC) technology. NFC is a short-range wireless technology that transfers information quickly between the customer’s smartphone and your payment gateway. It reduces friction during the checkout process and in a couple of taps, the payment is complete.

💡 Also read: How to Accept Payments Online: 6 Step Guide

Digital wallet vs mobile wallet: what's the difference?

Before we continue, let's clear up the common confusion between the terms digital wallet and mobile wallet. As we mentioned, the terms digital wallet and mobile wallet are interchangeable, but there is one small — but important — difference when it comes to the technical capabilities of a digital wallet versus a mobile wallet.

Both wallets store payment information for future purchases, but a digital wallet doesn't allow you to make contactless payments in-store by waving your device near a point of sale (POS) terminal. In this case, you need a mobile wallet like Google Pay or Apple Pay (which are also considered digital wallets).

So, while PayPal is a digital wallet, it’s not technically also a mobile wallet because you can't use it to make contactless payments in-store. Shoppers can only use PayPal to checkout online.

💡 Also read: QR Code Payments: What They Are, How They Work, and How to Accept Them

Advantages of digital wallets in e-commerce

Digital wallets decrease friction during the checkout process. This helps to optimize the mobile commerce customer experience and increase e-commerce conversion rates.

Here are some other advantages for e-commerce:

Reduced cart abandonment

The biggest benefit of enabling e-wallet payments for your e-commerce store is lowered cart abandonment and increased conversions.

By simplifying the checkout process and diversifying the payment methods you accept, more customers will finish their purchases.

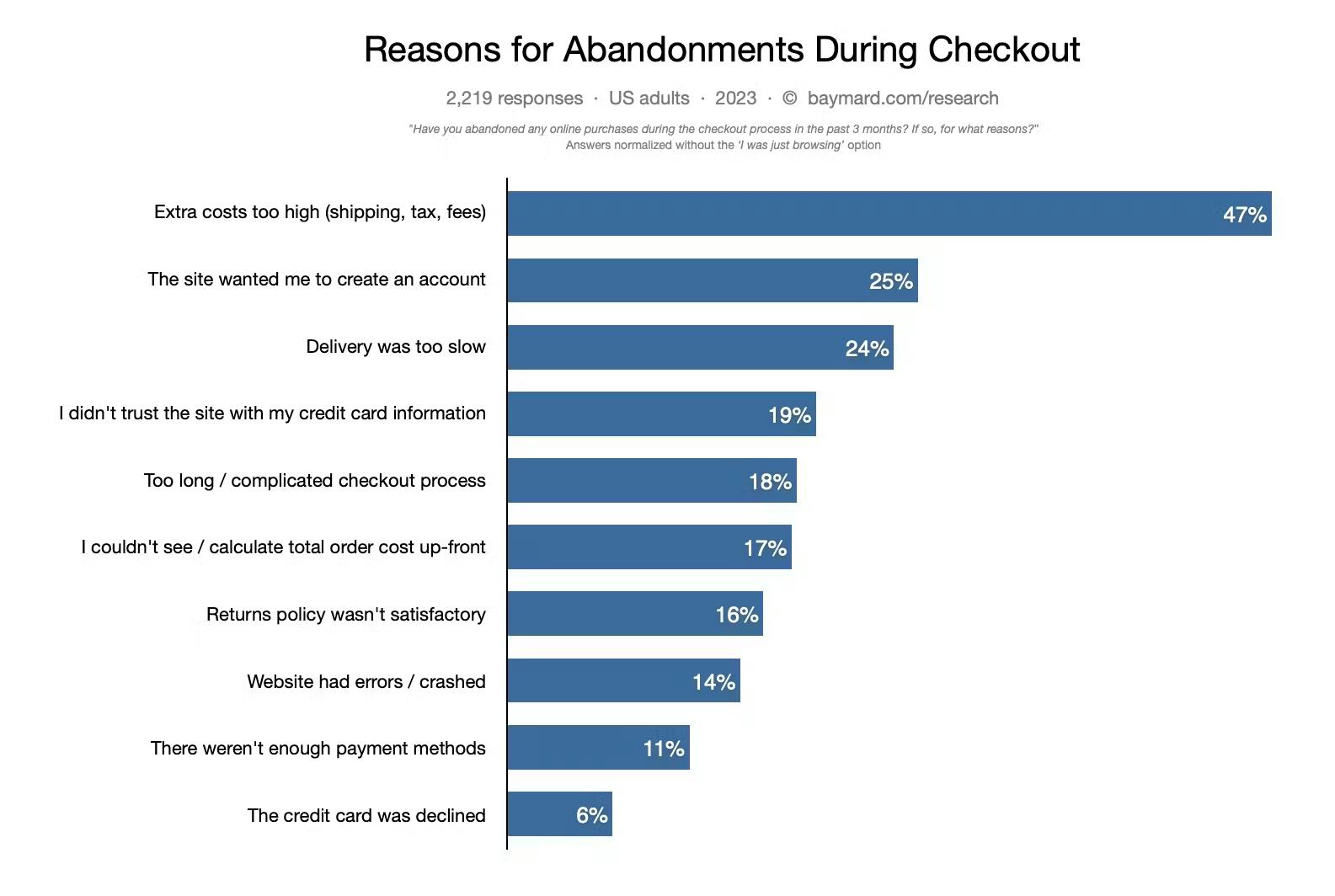

According to a study by Baymard, 18% of shoppers abandon their cart because the process is too long or confusing. And there’s an 11% abandonment rate because there weren’t enough payment methods.

Increased payment security

Credit card data is a target for fraudsters and hackers. Digital wallet transactions use tokenization technology, making them more secure than a debit or credit card payment.

The cardholder's information is saved in the wallet app, so they can choose one of their credit cards while making a purchase. A randomly generated identifier, known as a “token” replaces the card numbers for each transaction. Once the payment is complete, the number is meaningless, making this the most secure online payment method.

Enhanced customer convenience

Digital wallets streamline the checkout process, allowing customers to make purchases with just a click or tap. This reduces friction in the buying journey, often leading to higher conversion rates. Customers appreciate the ease and speed of transactions, leading to a more pleasant shopping experience.

Broader market reach

E-wallets are increasingly popular worldwide, especially in markets where credit card usage is less common. By accommodating these payment methods, you can tap into a broader customer base and potentially boost sales. This inclusion caters to international customers, as well as tech-savvy younger generations.

The top 4 digital wallets to add to your online store

Depending on the payment gateway you choose, integration with popular digital wallets is possible. At MONEI, we can help you add the following e-wallets to your checkout.

PayPal

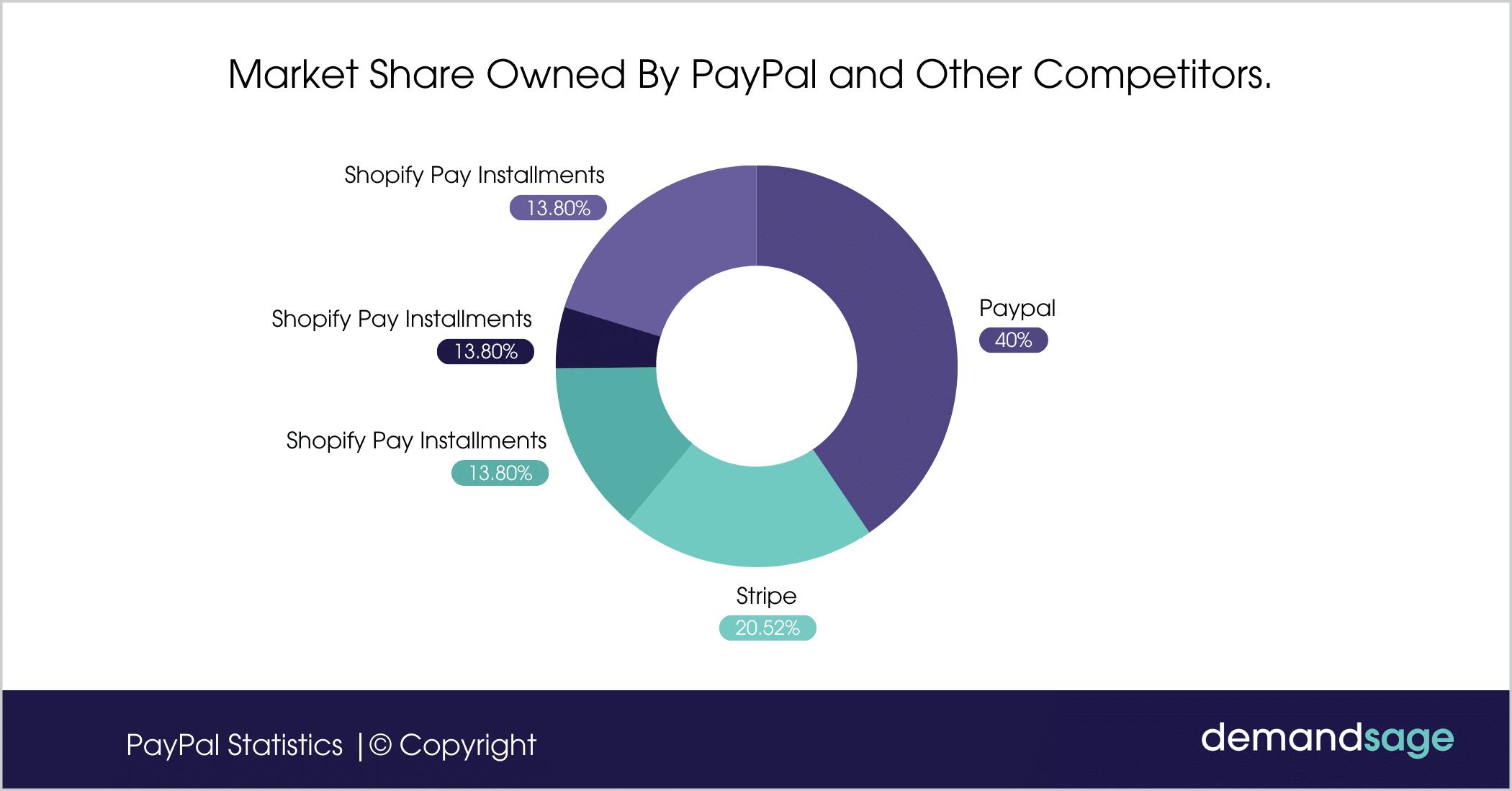

While PayPal users declined in 2023, it still owns 40.52% of the global market share of the payment service segment, making it an important payment method to accept in your e-commerce store.

Because it’s been around since the late 90s, PayPal is recognizable by most people. It offers a considerable amount of options to customers. Users can keep a cash balance in their PayPal account, and link credit cards or bank accounts to it. When the customer makes a purchase, they only have to confirm their PayPal password and can choose their payment source.

Accepting PayPal payments is advantageous because of its reputation and popularity. Shoppers are likely more familiar with it and more comfortable using it.

Apple Pay

Apple Pay is a widely used digital wallet for Apple device owners. It works with your iPhone, iPad, and any other device that uses the iOS operating system.

The iPhone market share is greater than Android and far beats Windows, making Apple Pay a key payment method for your e-commerce store. Touch ID is used to recognize the device owner’s fingerprint. Apple Pay is one of the most secure digital wallets today. Your customer can check out with a single touch, making this a very convenient payment method that leads to increased e-commerce conversion rates.

📚 Further reading: Quickstart Guide to Accepting Apple Pay for Small Business

Google Pay

Google Pay is a digital wallet that lets users purchase from your store using an Android phone with an NFC chip. This type of NFC mobile payment also works with a tablet or watch. Google Pay is a way for you to give your customers more options to conveniently pay for your products.

Once shoppers set up their preferred payment methods, they can easily check out using Google Pay. It’s a great way for you to give customers more payment options. The more payment options you offer, the more appealing your store will be.

Click to Pay

Click to Pay is a fast and secure one-click payment solution supported by major card networks including Visa, Mastercard, and Discover, and it's gaining popularity. With this digital wallet, customers can configure their payment information in Click to Pay on the checkout page. All they have to do is add their card details to the app once. Then it’s tokenized and during all future payments, the Click to Pay button appears as an available payment method. The advantages of Click to Pay are a frictionless payments experience for customers, and fewer abandoned carts plus a higher e-commerce conversion rate for you.

📚 Further reading:

Mobile POS Systems (mPOS): A Comprehensive Guide

The 16 Best Payment Methods for E-commerce

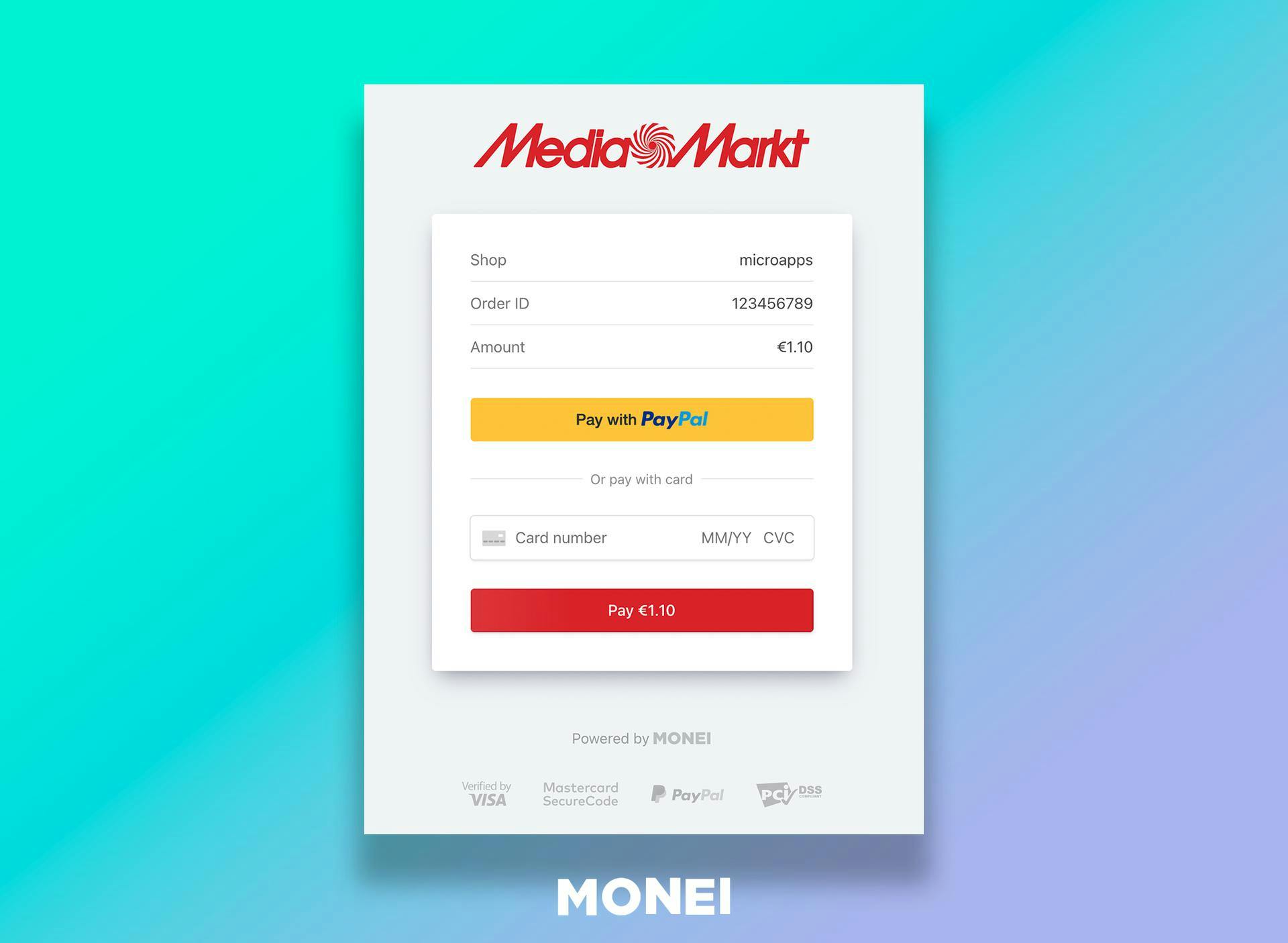

Configuring digital wallets with MONEI

Once you’ve been accepted as a merchant and have activated your MONEI account, you’ll be able to configure payment methods.

After you configure digital wallet payments for your store, you can use our integration guides here.

A few benefits of using MONEI’s payment gateway to accept digital wallet payments are:

- Quick payment configuration

- Easy integration

- Optimized for mobile shoppers

- Safe and secure (3D Secure checkouts and PCI DSS compliant)

- No additional fees for transactions, you only pay credit card transaction fees

Configuring digital wallets for your e-commerce site is quick and easy. Sign up today to make it more convenient for shoppers to pay.

3 Reasons why shoppers love digital wallets

Because digital wallets eliminate the need to carry around a bulky wallet or bag, they're obviously more convenient. But there are more advantages that shoppers enjoy.

1. Safer than credit cards. Two levels of security make digital wallets safer than credit cards. Shoppers need to enter their PIN to open their phones, and they also need a PIN to access their digital wallets.

2. More organized and easier checkout. Digital wallets store information for multiple cards. This way customers can easily choose their preferred card and avoid adding payment details each time they make a purchase. The checkout process is automatic and frictionless.

3. Easier to manage. Digital wallet users can manage all of their accounts and payments within the digital wallet. All account information and receipts are saved in the digital wallet.

Moving forward with adding e-wallets to your website

As an online merchant, the growth potential of accepting digital wallet payments is powerful.

Depending on the payment gateway you choose, you may not be able to integrate digital wallets with your site. Luckily, with MONEI, you can fully integrate each digital wallet with your e-commerce store.

According to Business Insider, it’s predicted that mobile commerce volumes will have a 25.5% growth rate to hit 44% of e-commerce in 2024.

Mobile payments are revolutionizing the way consumers pay for goods. This payment trend is here to stay.

Get in touch if you need help setting up digital wallet payments for your e-commerce business.

You may also like to read:

- Black Friday Cyber Monday Payment Trends (2023)

- Types of Payment Methods: The Essential Guide

- What is a Payment Gateway? (+ Compare Options)

- Online Payment Methods for Your E-commerce Business

Digital wallet e-commerce FAQ

How does a digital wallet work?

When a customer pays with a digital wallet, it sends the payment information from the wallet to your payment gateway. This process is secured using encryption and tokenization to ensure the safety of the customer's data.

Why should I integrate a digital wallet into my e-commerce platform?

Digital wallets provide a faster, more secure payment process for customers, often resulting in higher conversion rates. They also offer an additional layer of security, protecting sensitive card information through encryption and tokenization.

Which digital wallets should I offer in my e-commerce store?

That largely depends on your customer base. However, some of the most popular digital wallets globally include PayPal, Apple Pay, Google Pay, and Click to Pay. Research your target market to understand what they prefer.

What are the costs associated with offering digital wallets?

While the specific costs can vary depending on the digital wallet, there are often transaction fees involved. Technically speaking, a digital wallet is not a payment method, but a place for customers to store credit card details. For this reason, transaction fees depend on the card network. With MONEI, there are no additional fees to configure digital wallets in your account. You’ll only pay transaction fees. Consult the various support articles here for more information.

Are digital wallets secure?

Yes, digital wallets are designed with security in mind. They use various technologies such as encryption and tokenization to secure the payment data. Plus, most people use a password or facial recognition to unlock their smartphones, adding an extra layer of security.

How do digital wallets affect the checkout process?

Digital wallets can streamline the checkout process. Customers don’t need to manually enter their credit card information each time they make a purchase since the information has already been saved in their Apple Pay or Google Pay app. This not only enhances the user experience but also can lead to higher conversion rates.

Do I need to be PCI compliant if my customers use digital wallets?

While digital wallets handle a significant portion of the payment data security, as a merchant, you're still responsible for ensuring the security of customer data on your end. This means maintaining PCI DSS compliance is still essential.

What if my customer's digital wallet payment fails?

Most digital wallets provide error messages that can help diagnose the issue. Common online payment failure issues could be insufficient funds, the transaction being deemed suspicious, or the digital wallet not being set up correctly.

Can I issue refunds for digital wallet payments?

Yes, you can issue refunds for digital wallet payments, much like traditional card payment methods. You can initiate the refund process, and the funds will then be returned to the customer's digital wallet or underlying card/account.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).