Fintech vs Traditional Banks: Competition or Collaboration?

Image source: Fintech Magazine

For a long time, consumers have tolerated the lack of technology found at traditional banks. But as fintech rises, banks are struggling to keep up and deliver the innovation customers crave. The question is, will it be fintech vs traditional banks? Or can they join forces to build the financial services that modern consumers are looking for?

According to Statista, the global fintech landscape in 2025 remained dominated by North America, with more than 12,500 financial technology companies. Europe remained the second-largest fintech hub, with close to 10,000 companies, while Asia-Pacific hosted 6,795 fintechs. The sector has expanded steadily from 2008 to 2025, but the pace of new fintech formation slowed after 2021.

Still, fintech is an important source of potential growth for the overall economy, according to McKinsey. Across Europe, fintech companies have created roughly 134,000 jobs. European fintechs have significantly scaled up their hiring at a time when traditional banks in Europe have been reducing their workforces. According to Statista, the digital payments market is expected to reach 3.81 billion users by 2030.

Beyond supporting local businesses and creating jobs, fintech is becoming a major economic force in Europe. By 2030, the sector is projected to be worth around $190 billion, more than five times its 2021 size, cementing its growing role in the EU economy.

The data shows that fintech is a booming industry that combines financial services and technology to help people and businesses manage payments and financing. But will it last?

In this article, you’ll learn what fintech is, the differences between fintech and traditional banks, and the growth potential of financial technology.

Table of contents

- What is Fintech?

- What are banks?

- Why is fintech growing?

- Will fintech last?

- Fintech use cases

- Fintech vs traditional banks: what’s the difference?

- Will fintech companies and traditional banks work together?

What is Fintech?

Fintech is a combination of the words “financial” and “technology”. It’s a term used to describe new technology that aims to automate and improve the use and delivery of financial services and products.

Fintech helps business owners, companies, and consumers easily manage finances and business processes using software. The technology is usually accessible via your computer or other devices such as a smartphone or tablet.

Fintech began in the late 1990s, as the Internet and e-commerce emerged. By the 21st Century, the technology was used in the backend systems of financial institutions to digitize banking.

Since then, fintech has shifted its focus to consumer-oriented services. It's now used in various industries, including retail banking, investment management, fundraising, nonprofit, education, and financial services for individuals. Cryptocurrencies like Bitcoin and Stablecoins like EURM are also part of fintech development.

🎓Find more definitions in our payment industry glossary.

What are banks?

Traditional banks are financial institutions licensed to receive deposits from and make loans to individuals and businesses. Some banks also offer other financial services, including wealth management, safe deposit boxes, and currency exchange.

There are various types of banks, such as corporate banks, retail banks, and investment banks. In most countries, they’re usually regulated by a central bank or the national government.

Why is fintech growing?

Consumer demand for flexible, digital banking experiences continues to accelerate globally and in Europe. Worldwide, roughly 3.6 billion people now use online banking, and digital channels account for about 77 % of banking interactions across mobile and online platforms. In the EU, over 70% of internet users use online banking services, with high adoption rates in countries such as Denmark (98%) and the Netherlands (97%). Beyond basic usage, surveys show that most consumers log into digital channels daily and prioritize personalized, mobile-friendly experiences, making digital journeys a core factor in how people choose and interact with financial services.

To meet customers’ demand for speed, efficiency, and a frictionless user experience, financial providers need to integrate technology into their services. If retail giants like Amazon let customers complete a purchase in seconds, it shouldn’t require a face-to-face meeting to open a new bank account.

Fintech is bridging the gap between what traditional banks offer and what modern consumers now expect, fueling massive industry growth.

The global fintech market was valued at $127.66 billion in 2018 and is now worth around $209.7 billion.

Image source: Exploding Topics

The fintech market is expected to surpass $644 billion by 2029, at an annual growth rate of 25.18%.

Image source: Exploding Topics

Will fintech last?

Fintech is considered the future of banking and financial institutions.

Traditional banks have evolved drastically in how they operate, thanks to new-age technologies such as machine learning, AI, and analytics. Banks have also begun acquiring fintech startups to expand their offerings. In addition, fintech startup accelerator programs are gaining popularity, with some run by big banks like ING and JPMorgan.

The competition is intense, so some fintech businesses will thrive while others could struggle to stay afloat. But this presents an opportunity for fintech startups and traditional banks to team up and adapt quickly to the new digital world.

Fintech use cases

Mobile applications, software, and other financial technologies help automate and improve conventional forms of finance for businesses and consumers.

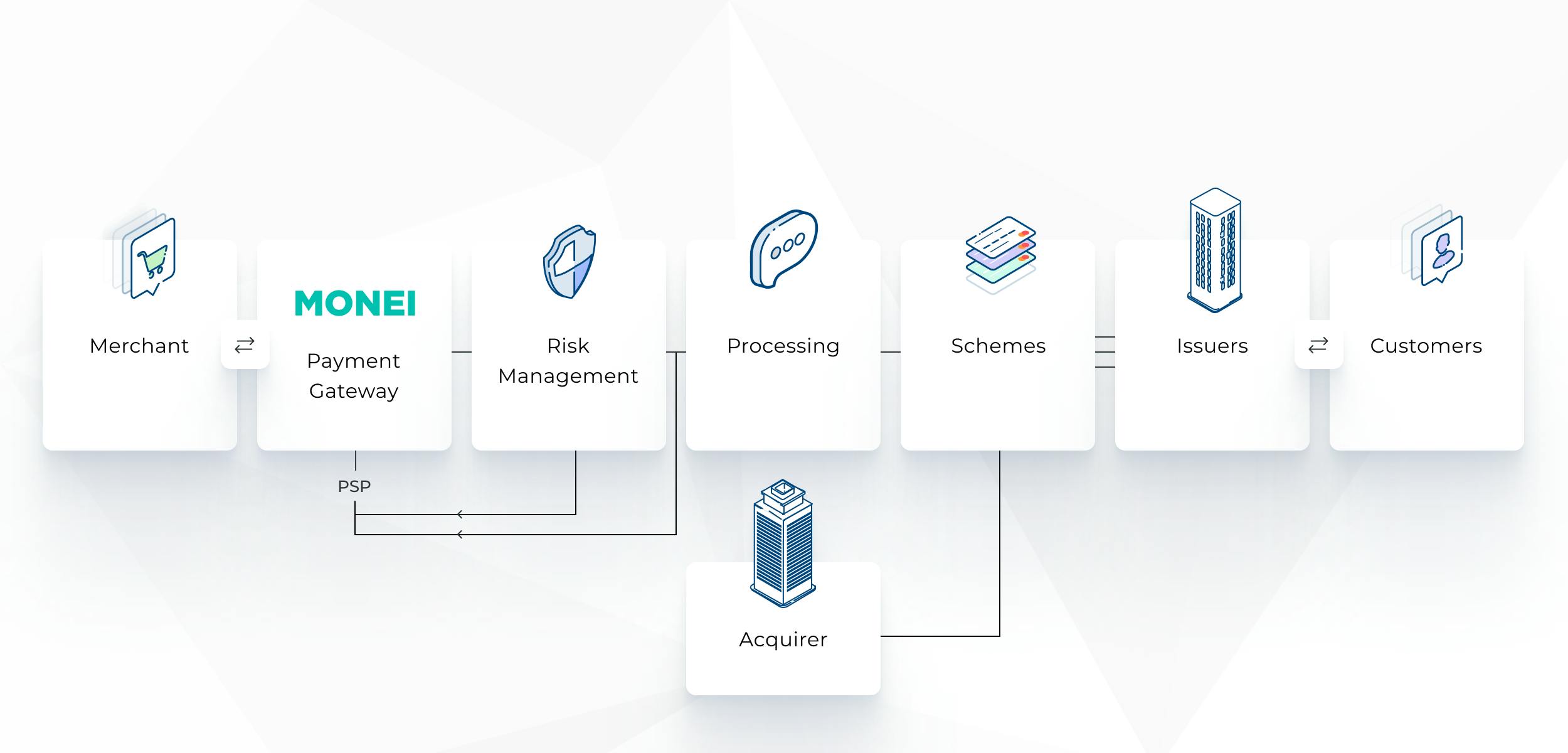

Online payment gateway

Online payment gateways are payment service providers (PSPs) that help e-commerce businesses accept payments through their online stores. They integrate with e-commerce platforms or custom-built websites using a payments API.

Not to be confused with a payment processor, payment gateways work with processors and other key players in online transactions, like the card network, issuer, and acquirer.

Simply put, an online payment gateway is a secure infrastructure that enables merchants to accept customer payments online.

Depending on the payment gateway, features like managing multiple online payment methods from one platform, checkout page customization, emailing payment links, setting up payment routing rules (also known as payments orchestration), and more may also be available.

💡PRO TIP: Use MONEI to manage your omnichannel payment stack from a single platform. Reach more people, improve the payment process, and increase sales by accepting more alternative and local payment methods online and in person.

Mobile payment app

Mobile payment apps make it easy for merchants to accept payments from any location and any mobile device, making them a perfect solution for physical retailers, e-commerce businesses experimenting with omnichannel sales, restaurants, or service providers.

- Physical retailers can use a mobile payment app to easily equip all store staff with a mobile point of sale (mPOS) so customers can check out anywhere in-store (no POS hardware required).

- Online sellers participating in events or pop-up shops can download a mobile payment app to accept physical payments from their smartphones.

- Restaurants can quickly and securely charge customers from any mobile phone or tablet, avoiding the high costs, frequent network outages, and short battery life that come with traditional restaurant POS systems.

- Service providers or freelancers can skip the process of creating and emailing invoices by using a mobile payment app or credit card payment app to collect payments in person as soon as services have been rendered.

Mobile payment apps and other mobile POS devices offer the same functionalities as an electronic point of sale or cash register, but they’re portable and wireless.

💡PRO TIP: MONEI Pay lets you accept payments and manage your business from anywhere. All you need is a smartphone or other mobile device to process contactless MONEI Pay lets you accept payments and manage your business from anywhere. All you need is a smartphone or other mobile device to process contactless lets you accept payments and manage your business from anywhere. All you need is a smartphone or other mobile device to process contactless card, Google Pay, Apple Pay, and Bizum payments on the go. Tap to Pay (iPhone) and , Google Pay, Apple Pay, and Bizum payments on the go. Tap to Pay (iPhone) and Tap to Phone (Android) are now available.

Crypto exchange payments platform

Crypto exchanges also need a secure and scalable way to process payments and help their customers maximize trading opportunities. Integrating with a crypto exchange payments platform can help crypto businesses process large volumes of fiat payments for cryptocurrency purchases. This type of payments platform also helps crypto exchanges improve the user experience by accepting deposits of funds from a wide range of customer-preferred local fiat payment methods.

Financial advice and investment management

Fintech has also made investing more accessible and affordable for a broader audience. Platforms such as Robinhood and eToro allow users to start investing with small amounts and benefit from automated, algorithm-driven insights at a lower cost. While traditional banks continue to serve customers seeking human-led advice for complex financial strategies, fintech platforms have democratized investment management by prioritizing ease of use, digital access, and entry-level investing.

Alternative financing and loans

Fintech has transformed access to credit, particularly for individuals and businesses that have historically faced barriers with traditional banks. By using data-driven models, advanced algorithms, and alternative data sources, platforms like LendingClub and Funding Circle can assess creditworthiness more efficiently and deliver faster lending decisions. Fintech has also expanded financing options through models such as peer-to-peer lending and crowdfunding, offering greater flexibility compared to traditional banks, which typically rely on longer approval cycles and stricter lending requirements.

Fintech vs traditional banks: what’s the difference?

While fintech and traditional banks both aim to provide seamless financial services to consumers, that’s the only similarity between them.

Fintech companies are considered the bank’s biggest competitors. The financial system banks use today is built on traditional, antiquated practices and procedures. It’s more often time-consuming and glitchy than it is frictionless. As consumer demands continue shifting toward faster, easier options, people are looking for a financial solution that meets their needs.

When it comes to innovation and advancement, traditional banks are falling behind, and fintech is stepping up to the plate. Fintech may have a small share in the world banking system, but consumers are increasingly opting to use it as a substitute for banks.

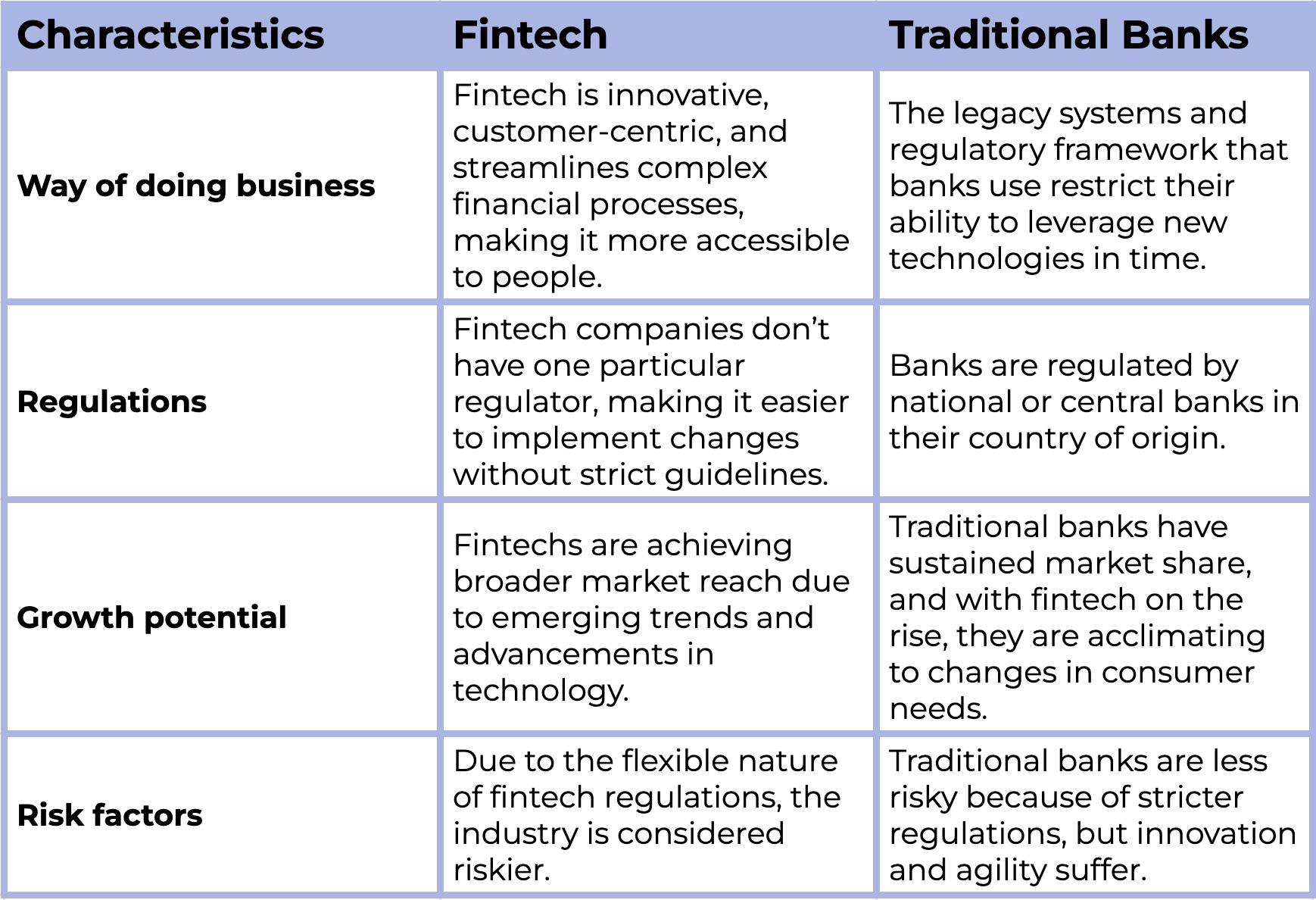

The differences between fintech and traditional banks fall into four categories:

- The way of doing business

- Regulations

- Growth potential

- Risk factors

1. The way of doing business

Traditional banks and fintech companies both provide financial services, but they operate on very different business models.

Structure and function

Fintechs are built on lean, modern infrastructures without the burden of legacy systems, making it easier for them to innovate, adapt, and rebuild processes that no longer work. Their flatter organizational structures and lighter regulatory footprint allow them to move quickly and respond to customer needs in real time. Traditional banks, by contrast, rely on complex legacy infrastructure and rigid processes, which slow change and make innovation more difficult and costly.

Customer experience

These structural differences directly shape the customer experience. Fintech companies are designed to be digital-first and accessible, allowing customers to open accounts, transact, and manage finances remotely, often through a mobile app without visiting a physical location. Services are typically available 24/7, with faster onboarding, better communication, and a stronger focus on usability and convenience. Many traditional banks still require in-person visits for key services and lack the digital identity verification tools needed for fully remote experiences, leading to greater friction for customers.

Technology

Technology is the core enabler behind fintech’s speed and efficiency. By leveraging AI, machine learning, automation, big data, and cloud computing, fintechs can deliver faster, more personalized, and more reliable services with fewer errors. Traditional banks, however, continue to operate on decades-old legacy systems that support everything from account setup to transaction processing. These systems are difficult to integrate or upgrade, limiting banks' ability to roll out new products, adopt emerging technologies, or improve the overall customer experience at the same pace as fintechs.

Operating efficiency and cost

Without the need for extensive physical branches or large workforces, fintechs can run at significantly lower overhead, often offering services at a fraction of the cost of traditional banks. In many cases, these savings are passed directly to customers, making fintech solutions particularly attractive to digital-first and younger generations.

💡Read also:

- What is a Payfac? A Guide for E-commerce and Retail Businesses

- 8 Trends Shaping the Future of Payments & E-commerce

2. Regulations

Every financial institution is regulated in some way to ensure it’s safe for people to use. But fintech is generally more lenient and flexible, and banks are stricter.

Fintech companies don’t have one particular regulator. This is one reason why so many fintech startups have appeared. Without strict regulation, these companies can make changes to their businesses and do what they want without oversight. While this makes it easier for fintech startups to work faster and adapt to their users’ needs, some consider the industry risky. Depending on the country, authorities regulate fintech businesses. And some companies choose to be more regulated or compliant to make their customers feel safer.

Traditional banks are regulated by national or central banks in their country of origin. Regulatory bodies require banks to adhere to legal requirements, restrictions, and guidelines designed to safeguard people’s money. Banking regulations are used to ensure transparency between financial institutions and their customers.

3. Growth potential

When comparing two industries, growth is a key factor. Both traditional banks and fintech companies have growth potential, depending on various factors.

As mentioned earlier, the fintech market is expected to grow more than 25% each year, surpassing $644 billion by 2029. However, this doesn’t mean banks will slip away. Traditional banks have maintained market share, and as fintech rises, they are adapting to changes in consumer needs. This includes adopting fintech features like digital security, mobile payments, and peer-to-peer lending, which lets customers borrow from an individual or group of individuals.

4. Risk factors

Due to the flexible nature of fintech regulations, the industry is considered riskier. But people still use it because it offers a faster, less expensive, more innovative, and highly user-friendly experience. As well as added features that aren’t available at traditional banks.

Stricter regulations, of course, lead to lower risk, which makes traditional banks the less risky option. But if you want to stay competitive, reach more people, and provide a better customer experience, using financial technology is essential. Just make sure you’re using a well-known app or service and, if necessary, that it's compliant. For example, our payment gateway must be PCI DSS-compliant to ensure that both merchant and consumer data are securely handled during credit card processing.

Compliance regulations vary by sector, depending on the fintech's operations.

Will fintech companies and traditional banks work together?

Fintech companies and traditional banks both work as financial intermediaries. Banks have been in business for hundreds of years, but they still need to make radical changes to meet the needs of modern-day customers.

Technologically speaking, fintech offers users more advanced features and almost all the same services as traditional banks. So, what does their relationship look like now? And how will it evolve in the future?

We can’t expect people to switch completely away from banks to fintech. But if fintech and banks collaborate, they’ll both make a bigger impact. There are immediate advantages to both parties if the two can partner.

Traditional banks benefit from the innovation and agility of fintech while boosting confidence in financial technology through decades of customer loyalty, business scale, and an established network.

Here are a few advantages to fintech and traditional banks collaborating:

- Compared to fintech, banks have much larger deposits. Partnering makes it easier for banks to build better financial systems.

- Fintechs that collaborate with banks can be regulated by the same government institutions, helping build trust.

- The overall financial system improves as fintech advances bring new technologies to banking.

To meet the technological demands of today's consumers, banks are embracing fintech features to improve the user experience. As the whole finance system continues to evolve, allocating resources for digital agility is increasingly a priority for banks. A win-win situation for both is long-term partnerships that combine innovation (fintech) and support and trust (banks) to build the sector for the digital future.

You may also like to read:

- Omnichannel Commerce: Benefits, Tips, and Real-Life Examples of Brands Succeeding

- 8 Important Benefits of Mobile Payments

- The Top 4 Digital Wallets to Add to Your Online Store + Benefits for E-commerce

- What are Alternative Payment Methods? [Quickstart Guide]

- Your Guide to Payments Terminology

Sources used:

- Europe’s fintech opportunity - McKinsey

- Payments - Worldwide - Statista

- The Power of FinTech: Boosting Innovation and Growth in the EU Economy - European Fintech Association

- Online Banking Usage Statistics 2026 - CoinLaw

- Digitalisation in Europe – 2025 edition - Eurostat

- Mobile banking trends 2026 and beyond - SBS

- List of Fintech Startup Accelerators and Incubators in Europe - Fintech News

Last sources check: 25/01/2026

Fintech vs traditional banks FAQ

Which is more cost-effective for a merchant: fintech or traditional banks?

Generally, fintech companies tend to be more cost-effective. They have lower overhead costs due to their lack of physical infrastructure, which can translate into lower fees for their services. However, the cost can vary depending on the specific services you're using and the terms of your agreement.

How do the speed and efficiency of services compare between fintech and traditional banks?

Fintechs are often faster and more efficient. Their services are technology-driven and automated, which usually results in faster transaction times, instant payments, and real-time reporting. Traditional banks, while also offering online services, may have slower processing times due to their larger scale and reliance on legacy systems.

Which offers better customer service: fintech or traditional banks?

This can be subjective and varies from one company to another. Fintechs often have more user-friendly interfaces and 24/7 customer support. Traditional banks, on the other hand, may offer personalized service through relationship managers, especially for high-value customers.

Do fintechs or traditional banks provide better security?

Both types of financial institutions prioritize security but may approach it differently. Traditional banks have years of experience handling financial data and comply with established regulations, while fintechs often leverage advanced technologies like encryption and tokenization for secure payments. The level of security can greatly depend on the specific company.

Are fintech services as widely accepted as those from traditional banks?

While fintech companies are growing rapidly, traditional banks still have wider acceptance due to their long-standing reputation and trust. However, fintech solutions are gaining popularity, especially among the younger demographic and in regions with less banking infrastructure.

Can fintechs offer all the services that a traditional bank can for a merchant?

Fintechs offer many, but not all, of the services a traditional bank can. For example, they can handle online transactions, provide loans, or offer payment solutions for business platforms. For more complex services, such as international trade finance or complex wealth management, traditional banks are still the go-to institutions, but they often lean on fintech companies to make these services more efficient.

How do fintechs and traditional banks differ in terms of innovation?

Fintechs are generally more agile and innovative. They leverage technology to provide unique solutions that traditional banks don't offer, like mobile wallets, QR-code payments, or cryptocurrency transactions. Traditional banks, due to their size and regulatory constraints, may be slower to innovate.

How does integration with my business operations compare between fintechs and traditional banks?

Fintech solutions are usually more adaptable and can be more easily integrated into your existing business operations. Many offer APIs that let you integrate their services into your own systems.

Which should I choose as a merchant: a fintech or a traditional bank?

It depends on your specific needs. If you value speed, innovation, and cost-effectiveness, a fintech could be a great choice. If you value a long-standing reputation, personalized service, and a wide range of services, then a traditional bank might be better. Many businesses use a mix of both to get the best of each, and many banks and fintechs partner to offer a holistic solution.

Alexis Damen

Alexis Damen is a former Shopify merchant turned content marketer. Here, she breaks down complex topics about payments, e-commerce, and retail to help you succeed (with MONEI as your payments partner, of course).